奔跑财经-FinaceRun

币圈小白

04-28 17:04

Follow

El Salvador is not afraid of IMF protocol challenges, accelerating its Bitcoin purchase process

Recently, the Central American country is quietly increasing its Bitcoin reserves, despite the International Monetary Fund (IMF) saying that El Salvador is complying with its $1.4 billion low-interest loan agreement and stop accumulating bitcoin in the public sector, according to on-chain data.

Rodrigo Valdes, director of the Western Hemisphere Affairs Department of the IMF, said at a press conference on April 26 that El Salvador is abiding by the agreed policy of not accumulating Bitcoin (BTC), while highlighting the country's positive progress in governance and transparency.

While the fiscal reforms mentioned by the IMF may bring more than $3.5 billion in financial aid to El Salvador, this has not stopped El Salvador from continuing its layout in the cryptocurrency sector.

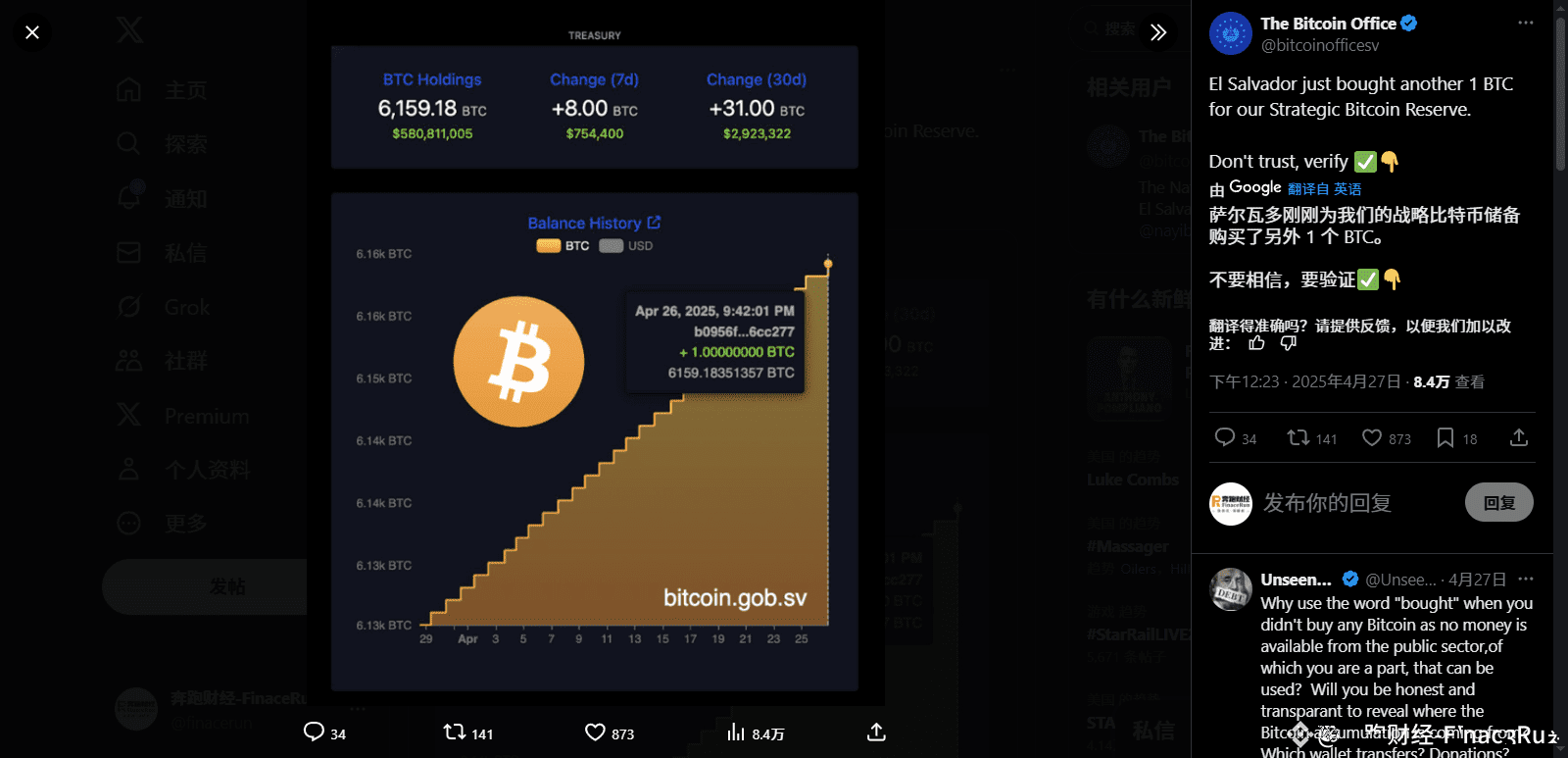

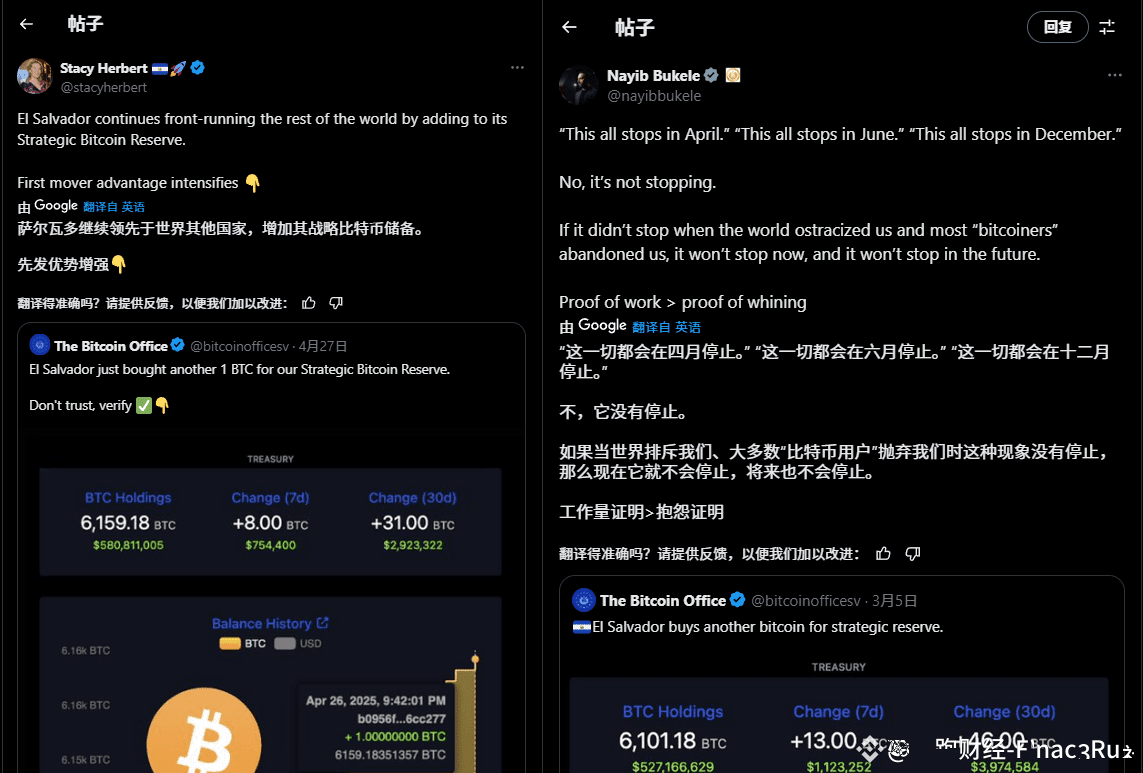

Just over the past month ago, the El Salvador National Bitcoin Office revealed that the government has added 31 bitcoins again and recently purchased 8 pieces, bringing its total holdings to 6,159 pieces and a market value of more than $580 million. All this shows that El Salvador has not suspended its Bitcoin activity.

Interestingly, Stacy Herbert, head of the National Bitcoin Office, stressed that El Salvador is using the technology to stay ahead and continue to expand its strategic Bitcoin reserves. She mentioned that this first-mover advantage is very important to the country's future in the crypto field.

Moreover, this enthusiasm for emerging technologies is attracting international attention, such as stablecoin issuer Tether recently moved its headquarters to El Salvador, praising the country's good regulatory environment.

Not only that, El Salvador has also reached a cooperation intention with Nvidia and plans to develop independent artificial intelligence infrastructure. This further strengthens El Salvador’s position as a hub for emerging innovation in Latin America.

In summary, despite the pressure from the International Monetary Fund, El Salvador is still actively exploring and promoting its own cryptocurrency policy and technological innovation, which also makes us look forward to the future of this small country.

Do you think El Salvador's strategy of "abiding the agreement on the surface and making a secret arrangement behind the scenes" is a smart move or a risky move?

What impact will this continuous purchase strategy have on the global economic landscape and the cryptocurrency market?

#Salvador #Bitcoin #IMF #Cryptocurrency

BTC

-0.85%

Risk and Disclaimer:The content shared by the author represents only their personal views and does not reflect the position of CoinWorld (币界网). CoinWorld does not guarantee the truthfulness, accuracy, or originality of the content. This article does not constitute an offer, solicitation, invitation, recommendation, or advice to buy or sell any investment products or make any investment decisions

0

28

0

46

0

No Comments