Author: Biraajmaan Tamuly, CoinTelegraph; compiled by: Deng Tong,

summary:

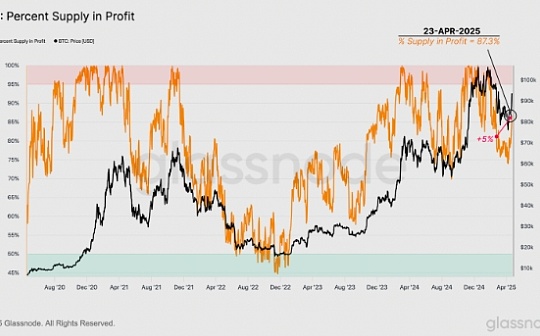

Short-term Bitcoin holders re-profitted, increasing the chances of rising to $100,000.

Long-term holders have increased 363,000 BTC since February, and new buyers injected funds in April.

The risk of Bitcoin selling pressure is at $97,000, at which point 392,000 BTC can be sold.

On April 22, BTC soared above $91,700, making its value higher than the short-term realization price or cost base. This means that most short-term holders (STH) have now returned to profitability.

STH returns to profit after unrealized losses, heralding a bullish outlook and paves the way for a potential $100,000 retest.

Bitcoin short-term on-chain cost basic belt. Source: Glassnode

Historically, in the early stages of stock market rally, profitable STH provides upward momentum by staying firm and attracting new investors. Bitcoin supply chart shows first-time buyers "strong activity" in April, indicating new capital is injected into the market at a higher price.

Long-term holders (holding for more than 155 days) have increased 363,000 BTC since February, while Bitcoin whales have absorbed 300% of the annual issuance.

Despite a breakout this week, Bitcoin researcher Axel Adler Jr. noted that the last strong resistance level is still at $96,100. In an X post, the analyst said,

“At the $96,000 level, the group holding the token for 3-6 months will face the final resistance, after which the next target is $100,000.”

Bitcoin implements price analysis. Source: X.com

Bitcoin price reaches $97,000, potentially triggering a sale

According to Bitcoin’s cost-based distribution data, investors hold about 392,000 BTC with an average cost basis of $97,000, forming a potential resistance zone. This concentration suggests that many investors may sell at break-even prices, which may hinder Bitcoin’s upward momentum.

Bitcoin cost basic distribution map. Source: X.com

However, anonymous trader Ezy Bitcoin stressed that Bitcoin’s price movement during the Wykov re-accumulation phase is “very outstanding.” The chart shows continued strength with three price targets: $131,500 (Target 1), $144,900 (Target 2), and $166,700 (Target 3).

This Wikov model suggests that large players may accumulate, heralding an upward trend in Bitcoin as the market is absorbing supply and preparing for the upward trend.

Ezy Bitcoin’s analysis of Bitcoin Wickoff model. Source: X.com

No comments yet