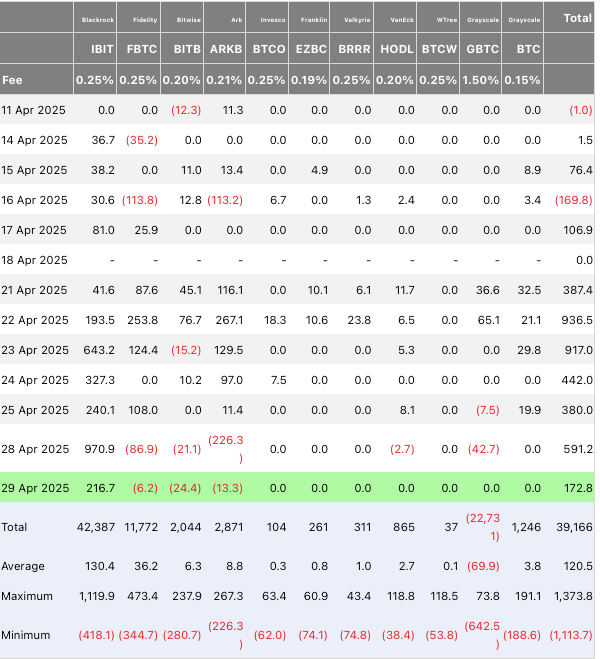

According to Farside Investors, BlackRock’s IBIT Bitcoin (BTC) ETF purchased more than $2.5 billion worth of the cryptocurrency in the last week of April 2025. The world’s largest asset manager purchased $970.9 million worth of the cryptocurrency on Apr. 28. BlackRock’s buying spree coincides with BTC’s recent rally to the $95,000 price level.

Also Read: Dogecoin: How High Can DOGE Rise Once Its ETF Goes Live?

BlackRock Pushes Bitcoin Past $95,000

The latest market rally is most likely due to institutional purchases. Most retail investors are likely sitting this rally out. BlackRock’s over $2.5 billion purchase may have pushed BTC’s price above $95,000 earlier today.

Other bullish developments may have aided in BTC’s rally. The SEC has appointed pro-BTC candidate Paul Atkins as its head. Many anticipate a more relaxed environment for the crypto industry under his watch.

Also Read: Bessent Says Interest Rates, Gas Prices, and Mortgages Are Down – Here’s What That Means for You

There is also a chance that the Federal Reserve will roll out an interest rate cut soon. Inflation in the US is cooling, and the Fed could respond with lower rates.

Can The Original Crypto Reclaim $100,000?

Bitcoin (BTC) faces substantial resistance at the $95,000 level. The asset has struggled to break past this level for the last weeks. The asset may breach the $100,000 mark if it can break its current resistance level.

CoinCodex analysts present a very bullish outlook for BTC. The platform anticipates the asset to hit a new all-time high of $132,727 on May 8. BTC’s price will rally by nearly 40% if it hits the $132,727 target.

Also Read: China Exempts Key U.S. Goods From 125% Tariff—What’s on the List?

There is also a chance that Bitcoin (BTC) will continue moving in a sideways trajectory. The market is holding steady at current price levels. A rate cut could be what triggers the next bullish leg.

No comments yet