#ETH Liquidation Scenario Simulation: Potential "Waterfall" Risk for Trend Research's 530,000-620,000 ETH Leveraged Positions

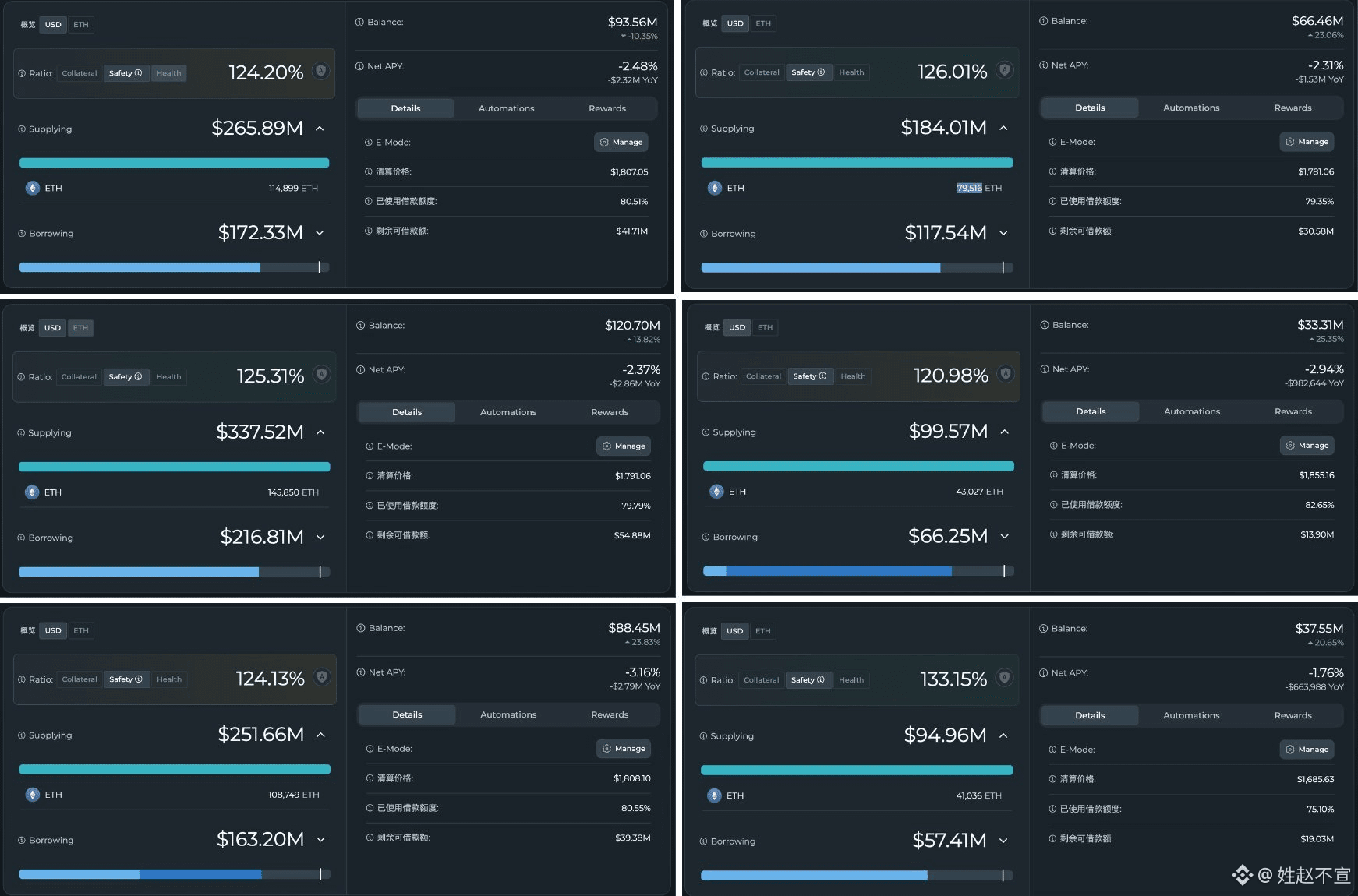

Currently, ETH is approximately $2,350 (fluctuating in real-time). Trend Research's main liquidation price is concentrated in the $1,685-$1,855 range (highest $1,855, lowest $1,685), leaving a buffer of $400-$700 before triggering a liquidation.

Institutions have proactively reduced their positions: Since February 1st, they have cumulatively deposited over 118,000 ETH (approximately $289 million) into Binance, with an additional 45,000 ETH added today, representing 17.9% of their peak holdings. This clearly indicates a move to reduce leverage and mitigate risk.

However, if the market declines rapidly (due to a combination of macroeconomic factors and deleveraging), failure to replenish or reduce positions in time could trigger a chain reaction of liquidations. Total collateral ≈ 530,000-620,000 ETH, stablecoin lending exceeds $790 million. In the event of a crash:

Scenario 1: Classic Waterfall-Style Liquidation (High Probability, Short-Term Dramatic Version)

- ETH breaks 1855 first → triggering 43,000 ETH accounts (liquidation price 1855)

- Protocol automatically sells ETH to repay debts → Instant selling pressure pushes the price down to around 1800

- Chain reaction triggering large accounts at 1808/1807/1791 (cumulative over 400,000 ETH)

- Market panic + other leveraged long positions liquidated, OI drops rapidly

- ETH briefly plunges to 1500-1600 or even lower (similar to the 2022 LUNA/FTX contagion)

- After the bottom is oversold, hunters buy in + short covering, resulting in a rapid rebound of 20-30%, but the trend turns bearish.

Scenario 2: Orderly Liquidation + Buying Absorption (Relatively Mild Version)

- Price slowly grinds to the liquidation zone, institutions continue to reduce positions + protocol liquidates in batches

- DEX/CEX liquidity (especially Binance) absorbed most of the sell orders

- The price stabilized near 1700, without widespread panic

- After the liquidation ended, spot and futures buying (ETFs + whales) entered the market, causing a rebound to 2100-2300, followed by consolidation and recovery.

Scenario 3: Extreme Black Swan (Low Probability)

- Multiple liquidations combined with external events (such as a flash crash in US stocks), triggering a chain reaction of DeFi leverage across the entire market

- ETH plummeted to 1200-1400, releasing nearly one million ETH of selling pressure (including contagion)

- Afterwards, it entered a long bear market to accumulate strength at the bottom.

Currently, institutional active reduction of positions has lowered the probability of a major crash, but leverage is a double-edged sword—a rapid drop may still leave you unable to escape.

The liquidation zone of 1685-1855 is a key area to watch. For those with low risk tolerance, it is recommended to wait for the situation to settle before taking action.