Analyzing trends is relatively simple if you don't obsess over predicting tops and bottoms.

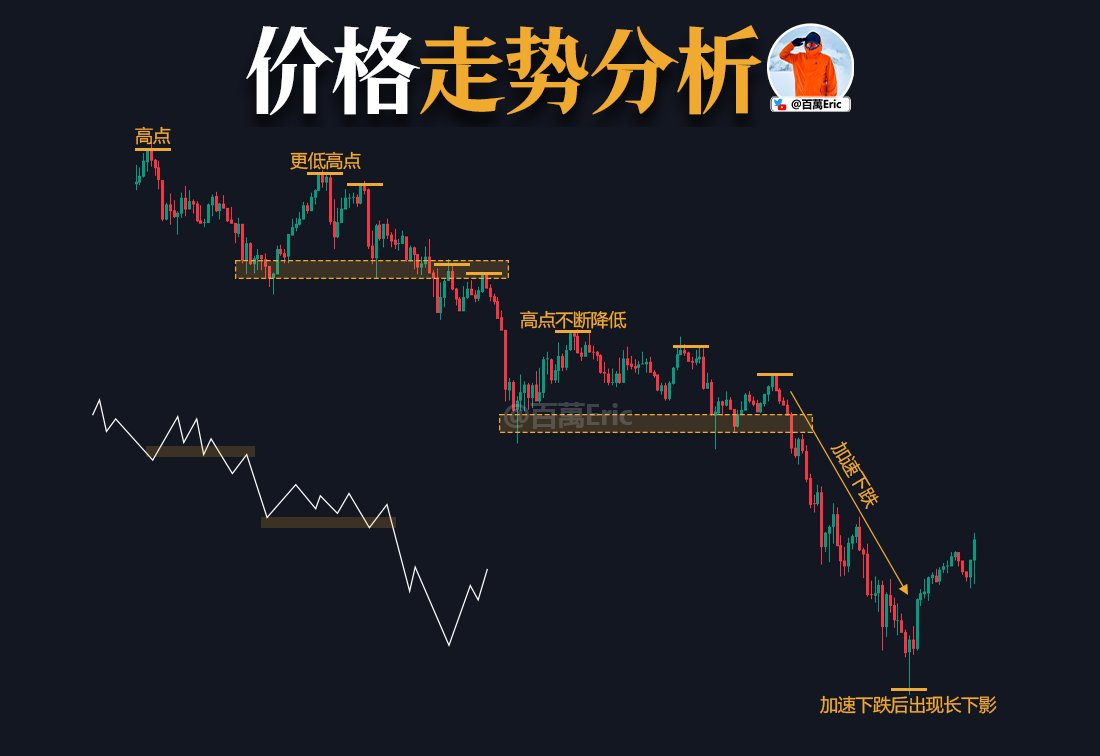

When price highs and lows consistently move upwards (HH, HL), the trend is upward; when highs and lows flatten, the market enters a consolidation phase; when prices break below previous lows (LH, LL) and highs and lows continue to move downwards, a downtrend is established.

Since the logic is clear, why do most people still trade against the trend?

Because "analyzing the market" and "executing trades" are fundamentally different things.

Analysis allows you to take a high-level perspective, overlooking the overall picture—the simplest approach is often the best.

Executing trades, however, requires delving into the details: finding key levels, waiting for high-risk signals, calculating position risk, and managing your mindset. These steps are tedious, counterintuitive, and indispensable (it's not as exciting as gambling!).

Many people don't lack understanding of trends, but rather they can't bear the tedium of following the strict rules step by step within a correct trend.

They always want to skip the calculations, avoid waiting, bypass the mental preparation, and get the results directly...