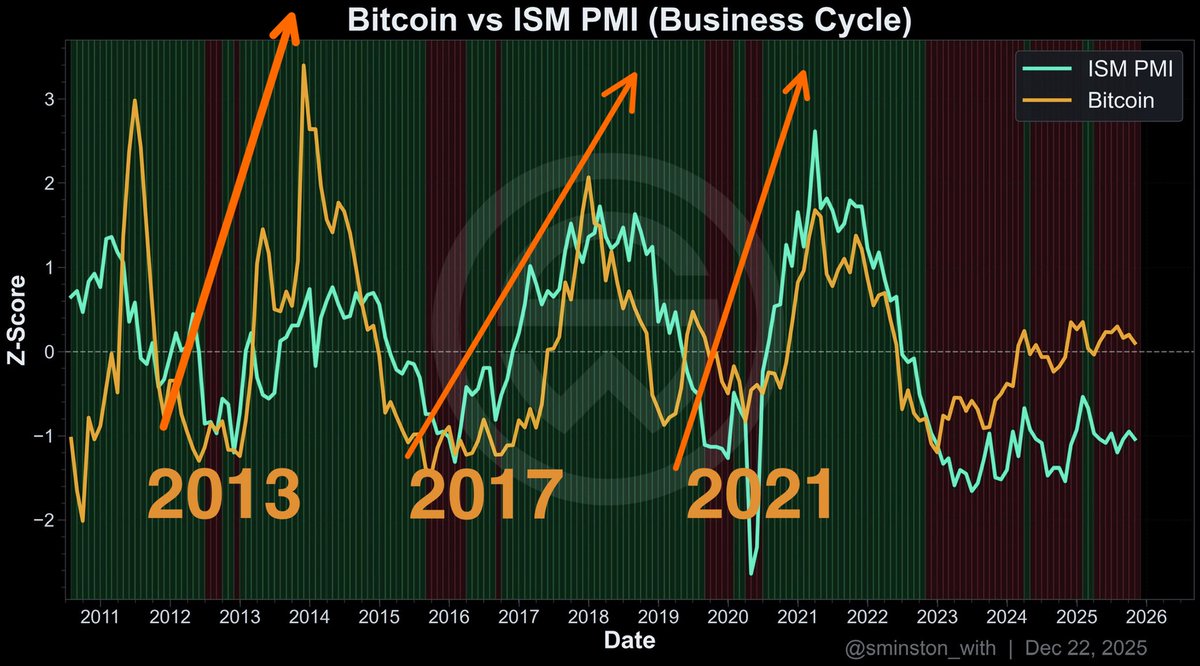

The ISM Manufacturing Index has rebounded strongly, potentially boosting Bitcoin's prospects.

The ISM Manufacturing Index just recorded 52.6, far exceeding the expected 48.5.

This is a huge surprise.

Reasons why the ISM Index is expected to continue rising until 2026:

New Orders Pace:

The new orders index surged to 57.1 in January, the highest level since early 2022. This leading indicator suggests strong market demand sufficient to support production levels for the next few quarters.

AI Agents Boosting Productivity:

Manufacturers are increasingly moving from pilot projects to full-scale deployment of autonomous AI agents to manage supply chains and shift changes. This "supercycle" of technology investment is improving operational flexibility and freeing up previously idle production capacity.

Supportive Industrial Policies:

New tax incentives and the continued repatriation of semiconductor and green energy hardware are driving a long-term capital expenditure boom, enabling the industrial sector to maintain structural growth.

The ISM PMI index has been steadily climbing for nearly three years and has just decisively jumped into expansion territory.

December: 47.9

January: 52.6

This marks a strong economic return to growth after 26 consecutive months below the neutral threshold of 50.0.

Historically, when the PMI index jumps from a deep contraction to above 52.5, the growth momentum tends to continue.

Research by @sminston_with indicates that the last time such a significant recovery occurred, the Bitcoin bull market peaked approximately 10 to 11 months later.

Closely monitor the continued economic expansion in 2026 and the trend of Bitcoin's "liquidity-driven" price action being highly correlated with historical data.

For more ISM/Bitcoin charts, follow @sminston_with.