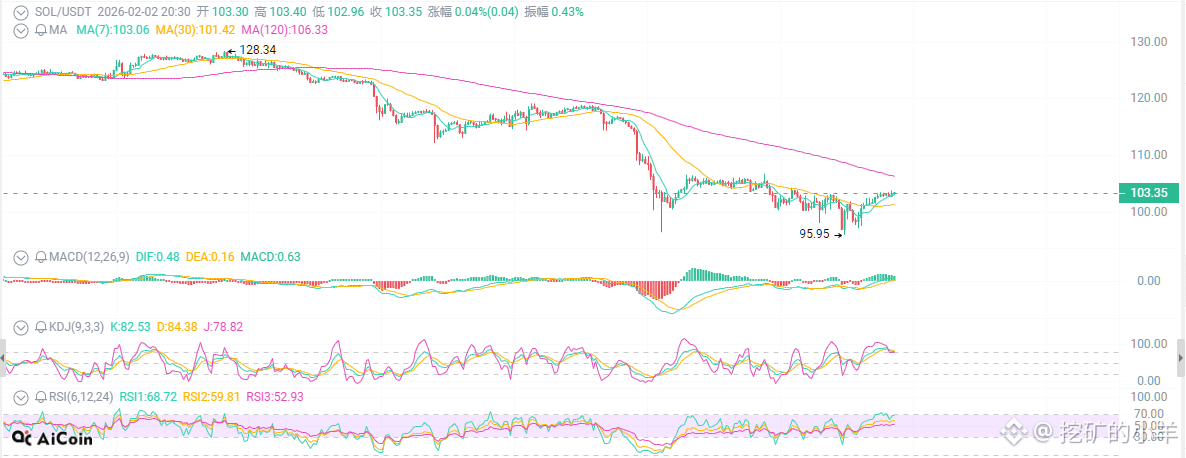

Looking at the $SOL chart, it plummeted from $116 to $103 in three days, a drop of 11%. The market seems strangely volatile.

On the surface, everything looks terrible. Step Finance was hacked for $27 million. 38 million SOL were unlocked this week. The entire crypto market is plunging.

But in January, Solana's DEX trading volume reached $117 billion, far surpassing Ethereum and all L2 exchanges. Polymarket's monthly trading volume reached $7.66 billion.

I remember back in 2021, everyone was cursing the SOL network for outages, calling it a garbage chain. And what happened? It rose from $8 to $260.

Now it's a similar scenario. Hacking, unlocking and dumping, market panic. Everyone's running away.

The technical picture is indeed ugly. The MACD is below the zero line, and the $96.40 low is precarious. But this extreme pessimism excites me.

SOL is currently at $103. If the price falls to a low of $95.95, consider buying only after a valid rebound signal appears.

If the price rebounds to around $106, gradually reduce your short position, with a strict stop-loss order placed at $110.

{future}(SOLUSDT)