@LexSokolin and Artemis are the first to put key performance indicators (KPIs) for fintech and cryptocurrency on the same platform.

- @aave ($22 billion) has more outstanding loans than all Buy Now Pay Later (BNPL) platforms ($21 billion).

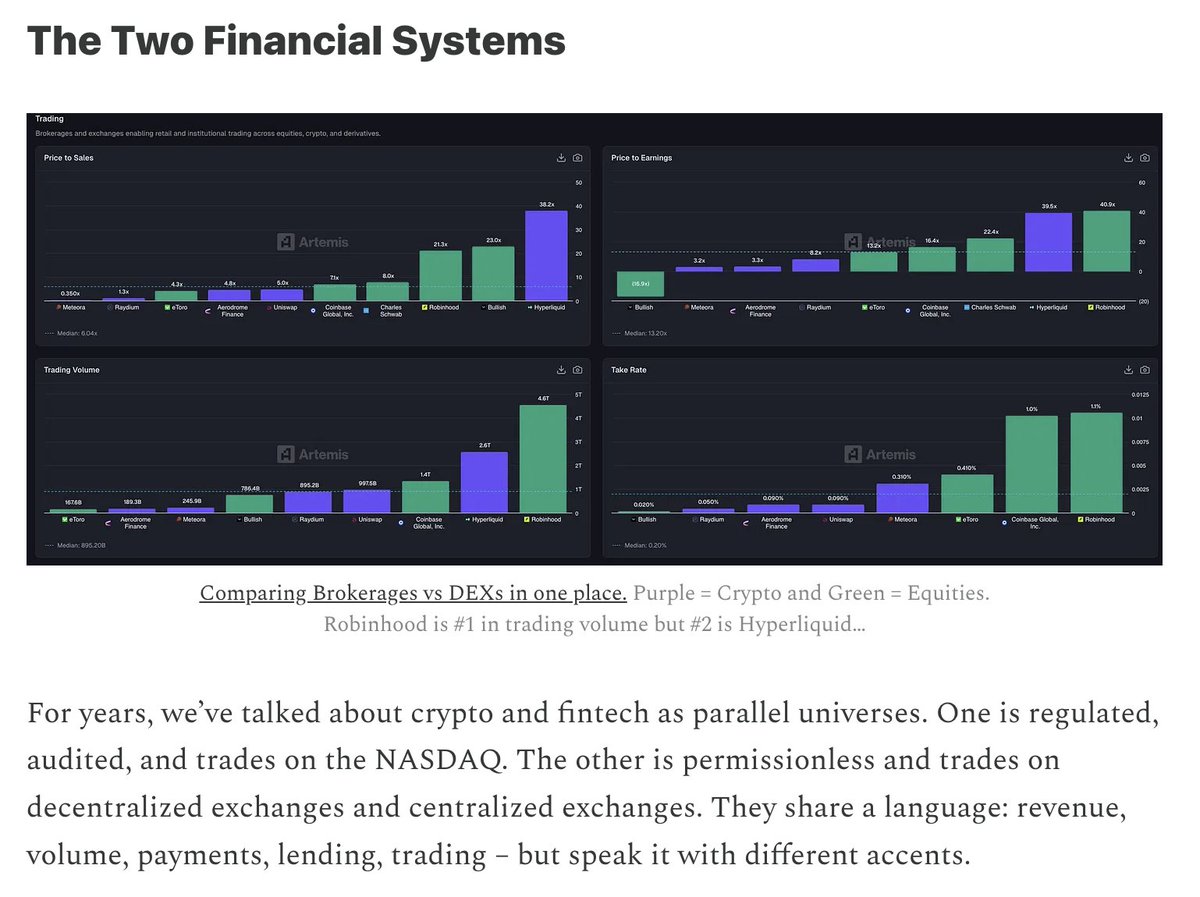

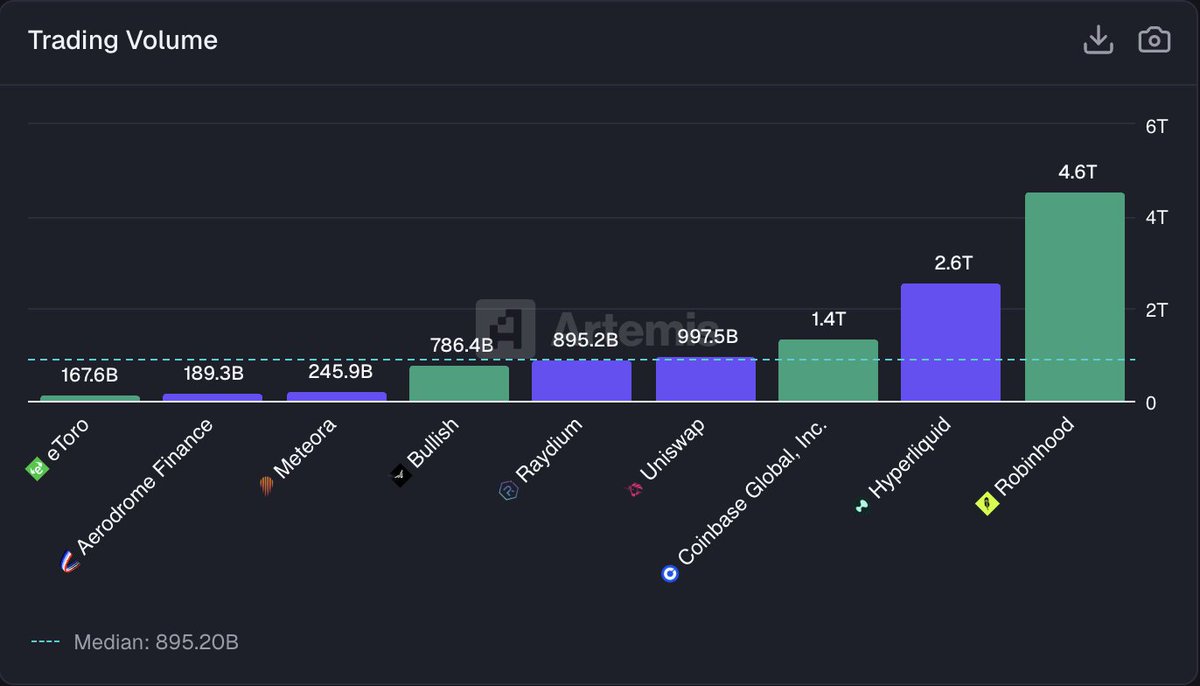

- @HyperliquidX ($2.6 trillion) has over 50% of Robinhood ($4.6 trillion) in trading volume.

- @Polymarket ($25 billion) has approximately 50% of DraftKings ($52 billion) in trading volume.

Here's an analysis of who's winning in the fintech vs. cryptocurrency space 🧵

For years, cryptocurrency and fintech have operated independently.

One is regulated, public, and auditable.

The other is permissionless, on-chain, and globally accessible.

They share the same basic functionalities—payments, transactions, lending—but have never been measured in the same way.

Therefore, we addressed this issue by expanding the comparison across the digital finance sector, allowing for a truly fair comparison between fintech and cryptocurrencies.

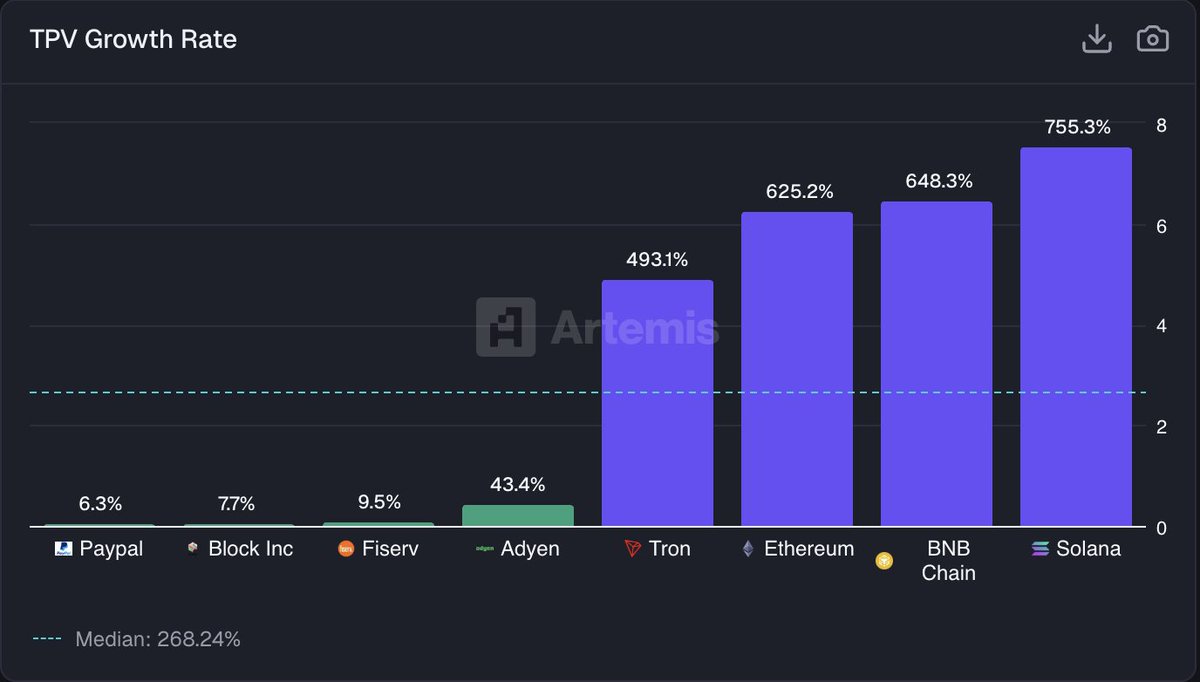

The payments sector presents the biggest gap between the two.

Fintech giants handle trillions of dollars in transactions.

Stablecoin trading platforms remain small in absolute terms.

However, their growth rates are drastically different.

Block, PayPal, and Adyen are all experiencing single-digit to low double-digit growth rates.

Mainstream blockchains' B2B payments business is growing by 500% to 700% year-over-year.

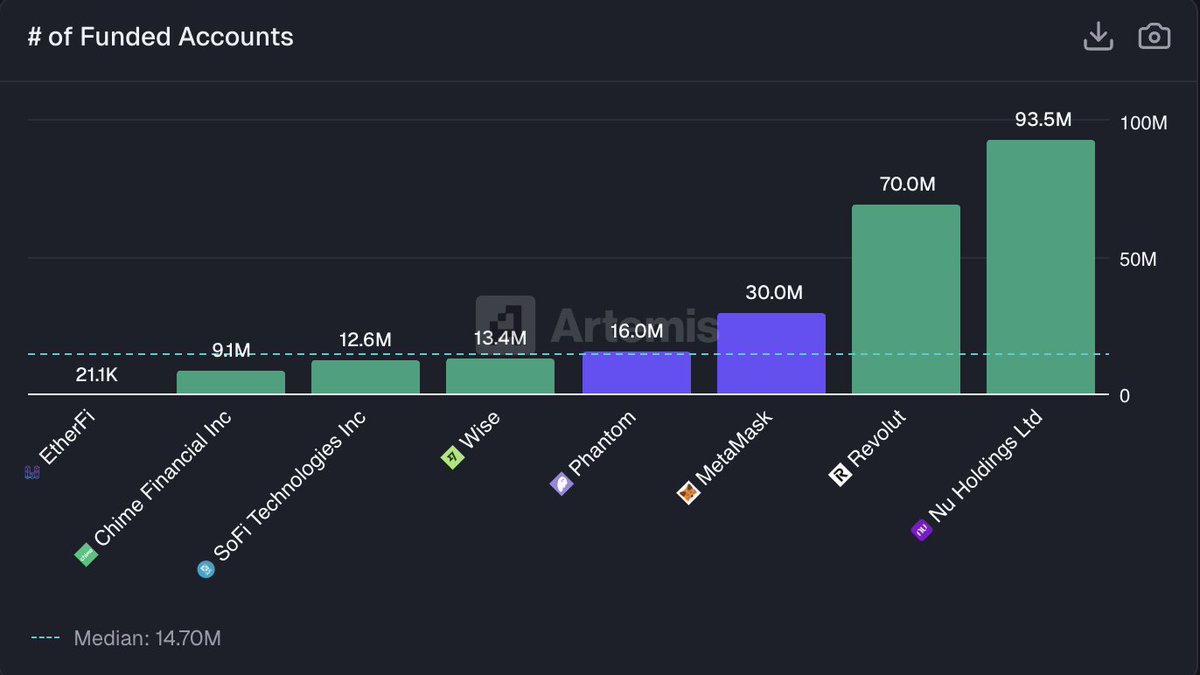

Wallets are increasingly resembling new types of banks.

MetaMask boasts 30 million users.

Phantom has 16 million users.

This is comparable to, and even surpasses, traditional new banks like Wise, SoFi, and Chime in some aspects.

Transaction volume is the biggest surprise.

Robinhood remains firmly at the top.

However, trading volume in highly liquid markets (spot trading volume + spot trading volume) has exceeded 50% of Robinhood's total trading volume, and even surpasses Coinbase's total trading volume.

Highly liquid markets.

Lending and prediction markets exhibit the same trend.

Aave's outstanding loans exceed the combined total of Klarna and Affirm.

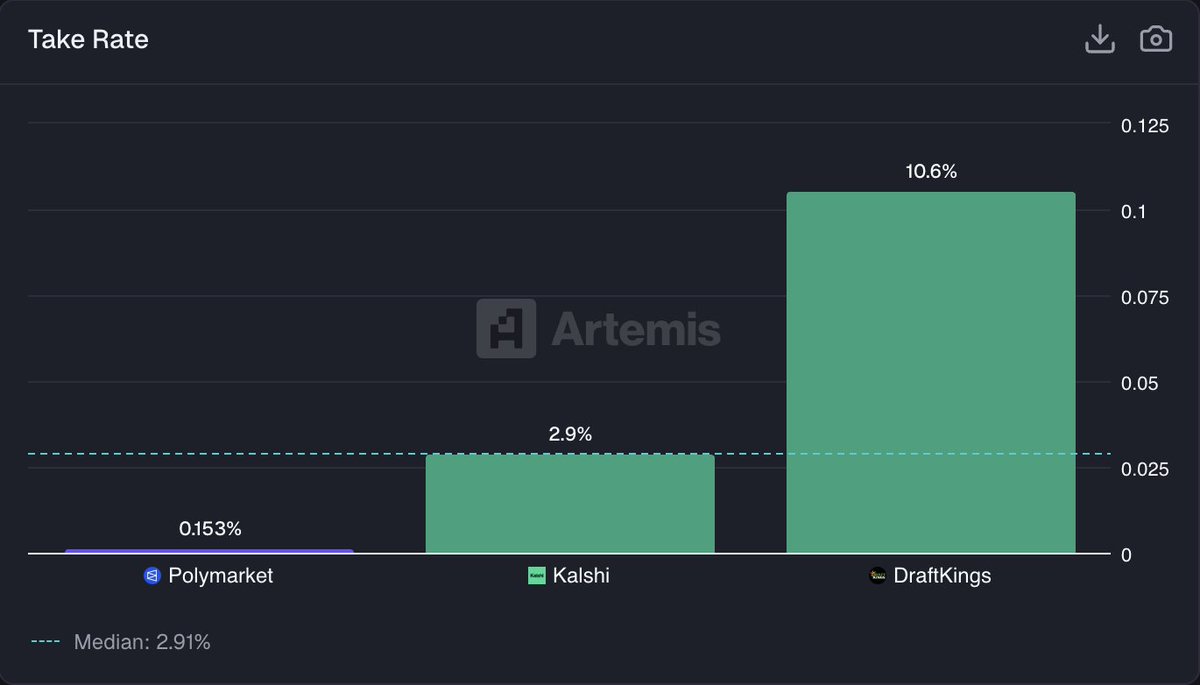

Polymarket's trading volume is only half that of DraftKings.

Cryptocurrency usage is on par with, or even higher than, fintech.

However, due to lower fees, the value derived from cryptocurrencies is far less than that from fintech.

Trading volume ≠ revenue.

This is the convergence of digital finance.

Cryptocurrencies have built the most efficient financial infrastructure.

Fintech, on the other hand, has captured the economic benefits.

Unresolved questions for the next decade:

• Can cryptocurrencies learn to build tollbooths and extract value from them?

• Or, can fintech learn from cryptocurrency infrastructure and extract value from it? The full analysis report has been published in @LexSokolin's "Fintech Blueprint":

You can access the Fintech/Cryptocurrency comparison data here: