Someone has created a comprehensive data website for Crypto Card, a blockchain-based U-card 🔽

U-cards have been growing at an astonishing rate since 2025. In terms of overall scale, as of now, the cumulative spending on crypto payment cards has reached nearly $840 million, with over 7.5 million transactions and approximately 150,000 active users. Looking at a longer timeframe, growth was relatively slow before 2024, but the real turning point occurred in Q4 2024 – 2025, with monthly transaction volume accelerating significantly and the curve becoming steeper.

Even more interesting is the card data from the Solana ecosystem. Solana cards have accumulated approximately $152 million in spending, with 280,000 transactions and nearly 13,000 users. While not the largest in scale, the growth rate is remarkably clean: in the mid-to-late 2025, Solana's monthly card spending stabilized in the $5-6 million range, and the structure shifted from a single product driving volume to multiple cards simultaneously releasing volume. If the AI Agent x Payment x x402 model is rolled out across multiple fronts, we can expect to see many AI-powered Solana products/U-cards capable of invoking payments.

Looking at the monthly breakdown from November 2025, products such as @solayer_labs, @MetaMask, @useTria, and Cypher collectively contributed approximately $5.74 million in Solana card transaction volume. This simultaneous increase in transaction volume also signifies that users are truly beginning to use on-chain assets as a daily payment tool.

Three trends are clearly emerging:

First, payment frequency is increasing.

The growth rate of transaction volume is starting to outpace user growth, indicating that existing users are continuously reusing the service, rather than engaging in one-off experiences.

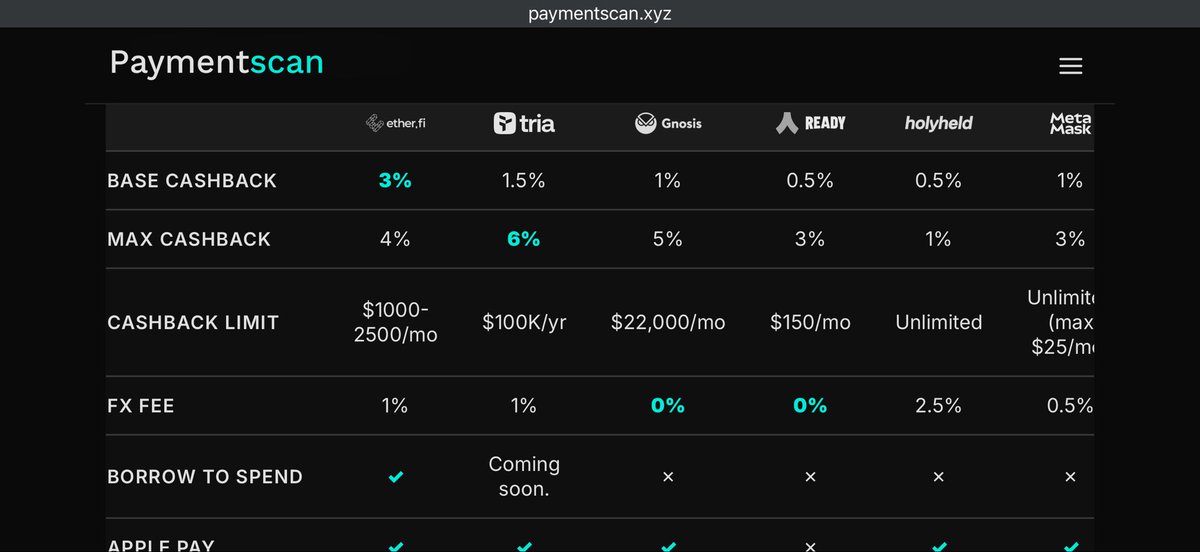

Second, fee and cashback structures are beginning to influence choices.

Low FX Fees and clear cashback rules are becoming core reasons for user migration, not just brand recognition.

Third, functional boundaries are expanding.

From simply "swiping a card to exchange for fiat currency," the focus has shifted towards designs that are closer to everyday financial experiences, such as Apple Pay, direct loan payments, and cross-chain settlements.

It is precisely during this phase that card solutions like Tria, which are more "infrastructure-oriented," have begun to gain a stronger presence. Instead of relying on extreme subsidies to boost volume, they integrate cross-chain payments, higher cashback caps, and a sustainable user experience, making them more likely to retain long-term users during the overall growth phase.

If 2023–2024 was the "validation period" for Crypto Cards, then 2025 is likely to be the year of truly testing Proof-of-Failure (PMF), improving retention, and focusing on product details. The competition going forward will no longer be about who issues cards first, but about who can truly transform on-chain assets into "usable balances" in users' wallets.