How Low Lending Costs Profoundly Reshaped the Entire BNB Chain DeFi Ecosystem

Looking back from early 2026, the development trajectory of Lista DAO is itself a condensed history of BNB Chain DeFi. From its frenzied peak of $4.5 billion in TVL to the "new normal" of $1.5-1.6 billion after the promotional frenzy subsided, it didn't collapse; instead, it demonstrated the true resilience of a protocol.

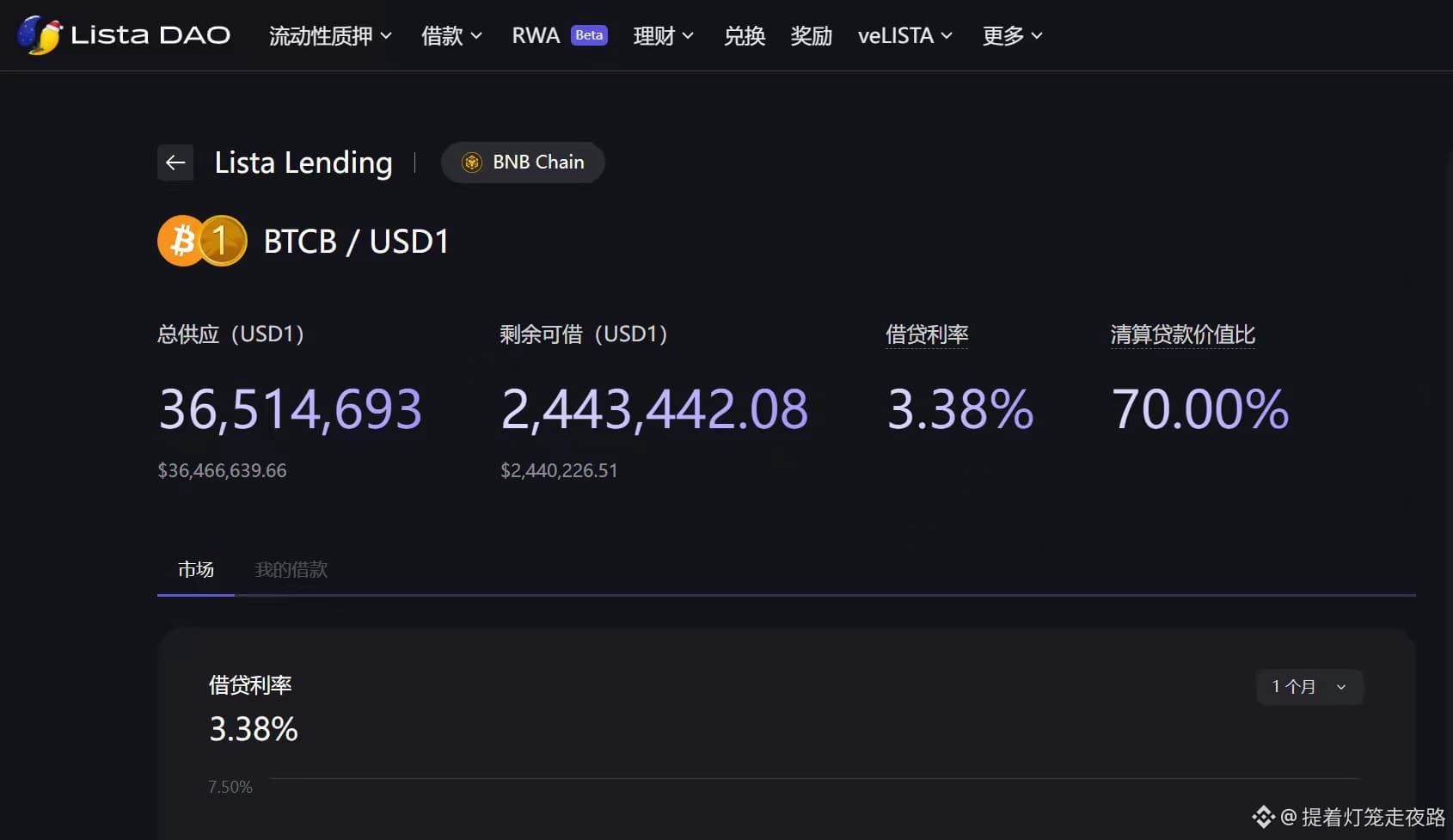

Its core driving force has never changed: providing the most competitive low lending costs in the entire market. This is precisely what acts as a powerful magnet, attracting almost all arbitrageurs, leveraged traders, and stablecoin seekers on the BNB chain.

Its innovative products all revolve around this core:

1. slisBNB/slisBNBx: Seamlessly combining BNB liquidity staking and lending, creating a "staking equals credit" paradigm, locking in the most core assets and users of the BNB chain.

2. Smart Lending & Fixed Rates: Providing more refined and stable fund management tools to meet the diverse needs of everyone from farmers to institutions.

3. RWA Integration: Directs low-cost crypto funds towards robust returns in the traditional world, providing a crucial "yield ballast" during bear markets or volatile markets.

4. Multi-Chain Expansion: Attempts to replicate the "Lista interest rate" output model on other chains, expanding its influence.

How Will It Reshape the Ecosystem?

· For ordinary users: Accustomed to acquiring USD stablecoins at a cost of 2-4%, participating in other high-yield activities has become the norm.

· For DEXs and project teams: Sufficiently high incentives are needed to attract liquidity from Lista, this "reservoir of funds."

· For BNB holders: A powerful financial tool that allows for efficient asset utilization without ever selling their tokens.

The future challenges for Lista are: How to maintain its interest rate advantage in multi-chain competition? How to enable lisUSD/USD1 to break through the ecosystem and achieve wider adoption?

In any case, Lista has proven that a successful DeFi protocol doesn't rely on temporary subsidies, but on providing core value that cannot be easily replaced—in Lista's case, continuous, reliable, low-cost funding. In 2026, DeFi players on the BNB chain will still be unable to bypass Lista. #bestUSD1investmentstrategylistadao $LISTA

#bestUSD1investmentstrategyListaDAO

@lista_dao