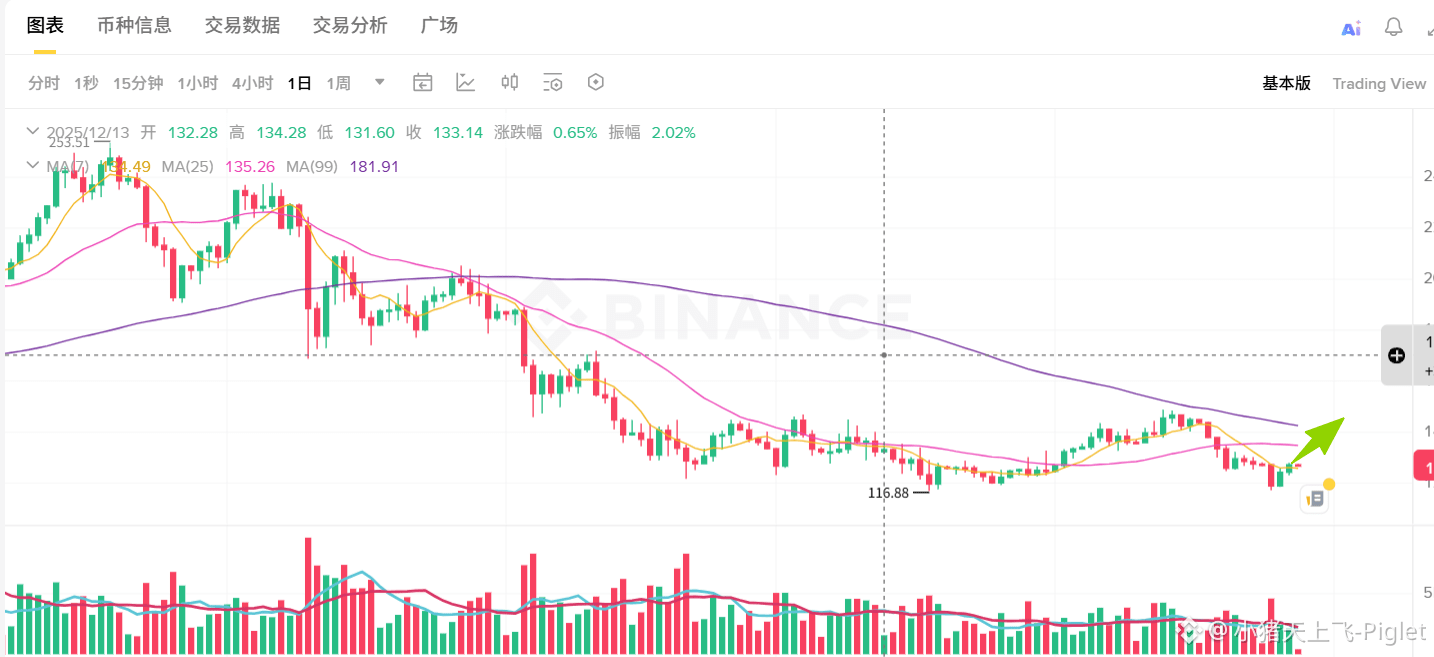

SOL is currently trading at $127.15, up 2.37% in the last 24 hours and slightly up 1.07% in the last 7 days. Technically, it's weak: the 1-day RSI is 44.45 (weak zone), the MACD histogram is -1.35 (bearish dominance), and the price is below the Bollinger Middle Band at $134. Support is at $119, and resistance is at $150. A break above $130 is needed to reverse the downward trend in the short term.

Core Driving Logic: A divergence exists between fundamentals and market sentiment: 1) Positive factors: Solana's on-chain active users are approaching 5 million, RWA's scale has exceeded $1 billion, Ondo Finance launched tokenized stocks, and Coinbase completed its full DEX integration; 2) Negative sentiment: Analyst Beastlorion called SOL the "worst technically performing coin," predicting a possible drop to $30-40, causing community FUD; 3) Ecosystem development: Despite price pressure, the network staking volume is nearly 70 billion (70%), showing confidence among long-term holders.

Chip Game and Derivatives Dynamics

Derivatives open interest is $15 billion, funding rate is 0.044% (nearly zero), and 24-hour liquidations totaled $6.86 million (short positions accounted for 76%), indicating a stalemate between bulls and bears. Social media sentiment is "extremely bearish," but on-chain data is healthy, suggesting a discrepancy between expectations and reality.

Trading Execution Recommendations

Entry Point: $119-$125 (Lower Bollinger Band + Previous Low Support) Phased entry. Key Support: $119 (Technical Support) → $110 (Psychological Level) Key Resistance: $150 (Upper Bollinger Band) → $160 (Breakthrough Target) Stop-Loss Rationale: Daily closing price below $110 (Technical Breakdown) Target Narrative: Retest of $150 by the end of Q1 (Ecosystem Activity and Price Mismatch Correction) $SOL

{future}(SOLUSDT)