For short-term trading, the Greed & Fear Index and the Liquidation Map offer some reference value.

Generally speaking,

a low Greed & Fear Index indicates that short positions far outweigh long positions—a rebound is likely at any time.

a high Greed & Fear Index indicates that long positions far outweigh short positions—a pullback is likely at any time.

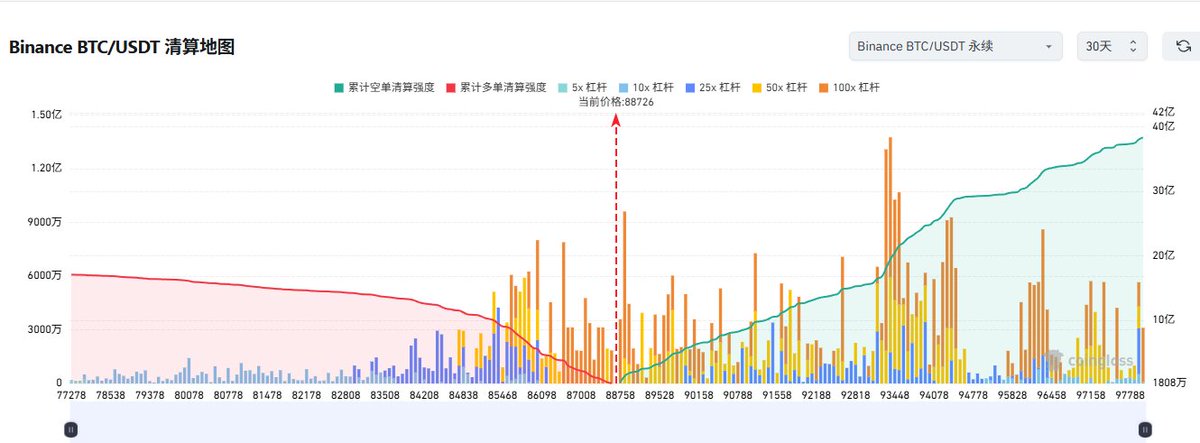

In recent market movements, market manipulators have been targeting the Liquidation Map to trigger double-sided liquidations in both long and short positions. The current market hasn't formed a clear trend; it's just localized back-and-forth trading. It's far better to stay out of the market than to participate actively.