When we've made a fortune in a bull market and want to cash out, dumping shares on the market is a major no-no for large investors. @lista_dao provides an elegant exit strategy.

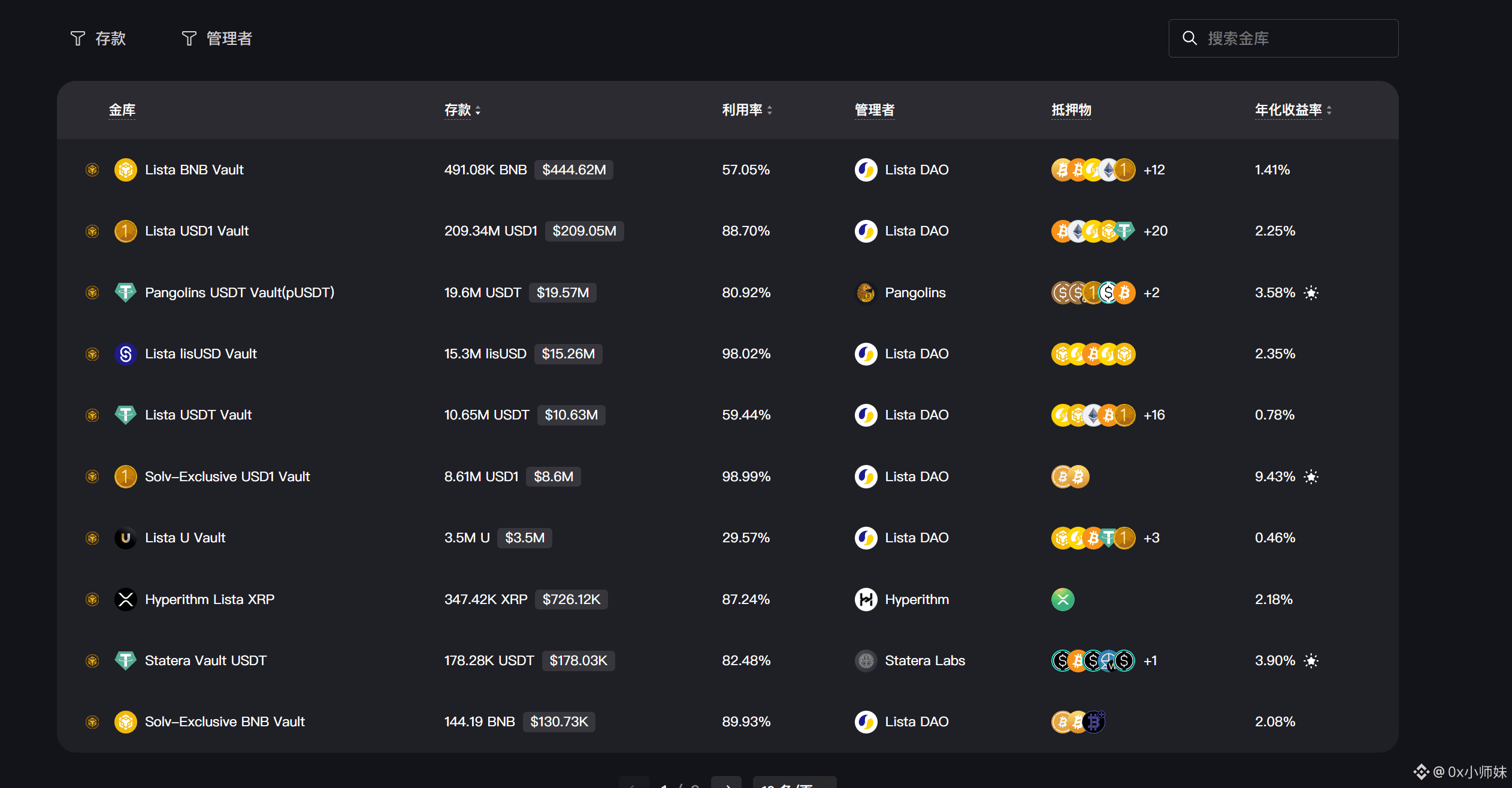

If you have a large position, selling directly can cause significant slippage, even driving down the price and reducing your actual profits. In this situation, you can deposit your assets into LISTA and borrow lisUSD.

After borrowing the stablecoin, you can gradually realize the cash through OTC channels or process it in batches on a DEX. This method effectively spreads your selling pressure over a long period.

You get much-needed cash, lock in profits, and avoid impacting the market. If the price continues to rise during your borrowing period, you can still enjoy that increase;

If the price falls, the borrowed money is already secured, essentially hedging at a high price. Combined with LISTA's incentives, this "borrow and exit" strategy is actually an extremely clever market capitalization management technique.

For whales, LISTA is not just a leverage tool, but also a liquidity management buffer, allowing you to maneuver freely between entry and exit points.

#USD1 Best Investment Strategy ListaDAO