Does anyone remember Bitcoin ATMs?

These things are quite interesting; they act as a "physical gateway" connecting the real world to the crypto world—you can deposit money to buy cryptocurrencies, and you can also exchange cryptocurrencies for cash and withdraw them.

Now, many people online are making videos of "withdrawing cash with Bitcoin," which looks quite magical, as if the coins magically turn into banknotes.

But nobody mentions how high the fees are! These fees are generally between 5% and 20%, averaging 7 to 10%. Compared to the thousands of dollars in fees charged by exchanges, this is practically a "fee assassin"!

Why are they so high?

Operators also need to break even—the machines cost money, the premises cost money, maintenance costs money, compliance costs money… so they probably think the price is "not expensive."

But users aren't buying it!

There are nearly 30,000 Bitcoin ATMs worldwide, but the average daily transaction volume is less than $5,000. That works out to about $250 per machine per day, and that's considered "good operation."

In short, this business falls into a "user paradox":

1. Who would be willing to pay an extra 5% to 20% to buy Bitcoin? Why not use an exchange instead of coming here to be ripped off?

2. To withdraw cash, you need to have the cryptocurrency, right? But most people with cryptocurrency will use exchanges or DEXs; who would come here to exchange it?

3. There are also transaction limits—many machines only allow a few thousand dollars per transaction, and those who want to do larger transactions have to go through KYC, which is inconvenient.

4. It only serves "emergency scenarios"—for example, digital nomads suddenly need cash, but if you have a mobile phone, why not just use mobile payment? Moreover, why would HODLers be willing to sell their cryptocurrency at a loss in transaction fees?

So, this machine ultimately becomes a "curious child's experience device," with an extremely low repurchase rate; nobody uses it frequently.

In Web3, many people always want to build infrastructure and "collect taxes passively." Bitcoin ATMs, like many public chains—the more people build them, the more likely they are to fail. The industry changes too fast. Many times, what you perceive as an innovative model has already been explored and rendered obsolete by others.

So, for business owners considering entering the Web3 space, before you act, do some research: the products you don't see aren't necessarily new; they might simply be outdated. $BTC

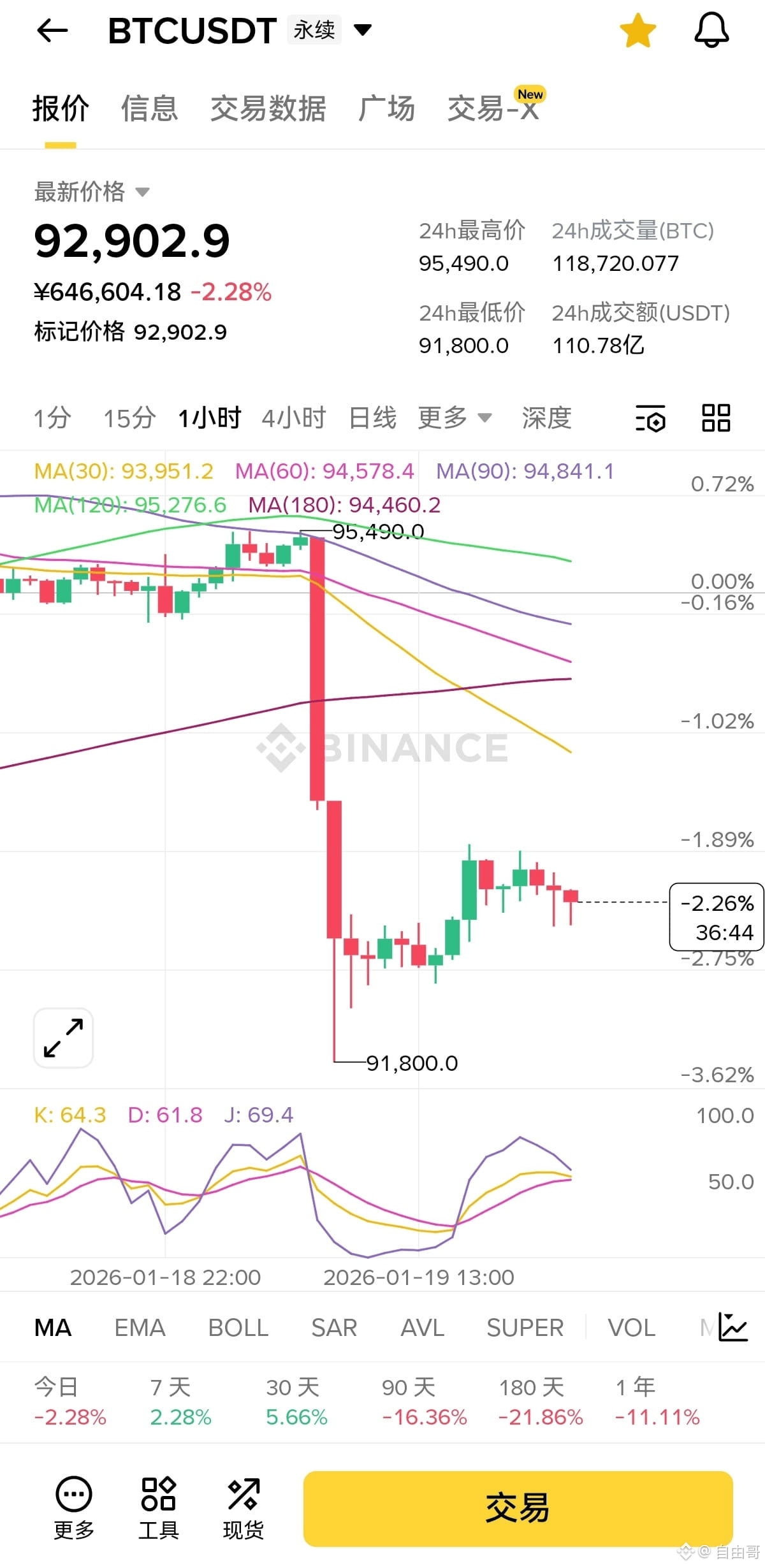

{future}(BTCUSDT)