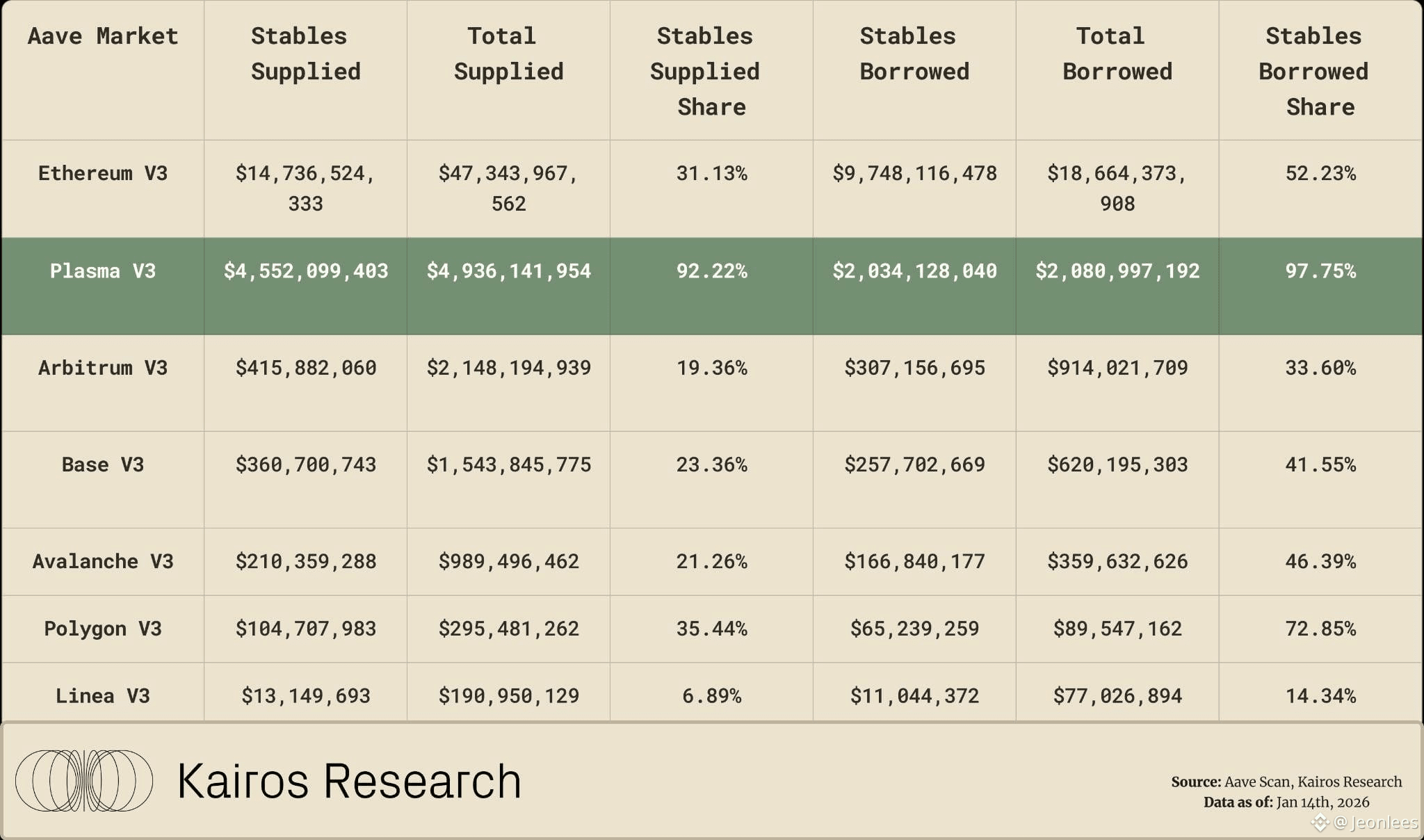

When I look at Plasma, I mainly focus on three aspects: the stablecoin asset structure, the transaction execution path, and the rigid role of XPL in the network. From the outset, Plasma has treated stablecoins as core assets in its chain-layer design. This means that its performance optimizations, fee models, and application priorities should theoretically serve needs like "high-frequency stablecoin transfers + large-value settlements + low-slippage DeFi trading," rather than pursuing a general-purpose chain approach that tries to do everything but doesn't delve deeply into anything.

On-chain observation involves first examining changes in the on-chain stablecoin supply, net inflows and outflows, and the actual number and failure rate of stablecoin-related transactions. If Plasma truly aims to be a stablecoin infrastructure, its biggest fear is that funds will simply remain stagnant, or that short-term inflows based on incentives will lack sustained usage. Secondly, I look at DEX depth and the slippage performance of stablecoin trading pairs: if a stablecoin chain experiences poor slippage during large transactions, it indicates that market making and liquidity routing haven't been established, and users will ultimately return to exchanges or other chains.

Only then do I consider $XPL itself. I'm more concerned with whether it truly binds to network resources: node participation, staking thresholds, ranking rights/resource allocation, and how protocol fees or revenue are handled. If XPL's demand primarily stems from network operation (e.g., staking participation for security and resource scheduling), then its pricing has a "usage anchor"; if demand is more driven by short-term trading activity, then more activity will only exacerbate volatility.

My assessment of Plasma will be straightforward: whether the stablecoin supply is steadily increasing, whether transfers and transactions are continuous, whether on-chain depth is improving, and whether XPL is gradually returning to a functional pricing model. Only when these metrics align can Plasma truly live up to its "stablecoin chain" positioning.

@Plasma $XPL #plasma