The relative shifts in the DeFi space cannot be ignored 👀

Just a year and a half ago, DeFi applications generated roughly twice the fee revenue of blockchain. Today, that figure is nearly five times higher. (See chart)

While I've always believed in the network effects of blockchain to create a premium, it's more reasonable to assume that the value currently attributed should flow more towards the front end—wallets, DeFi applications, and protocols closest to the user.

However, users of open-source software are often profit-driven. Liquidity flows rapidly. Examples abound, but this cycle is particularly pronounced.

Moats do exist (Aave is an example), but they are few and far between, so a discount to DeFi relative to traditional financial technologies may be reasonable.

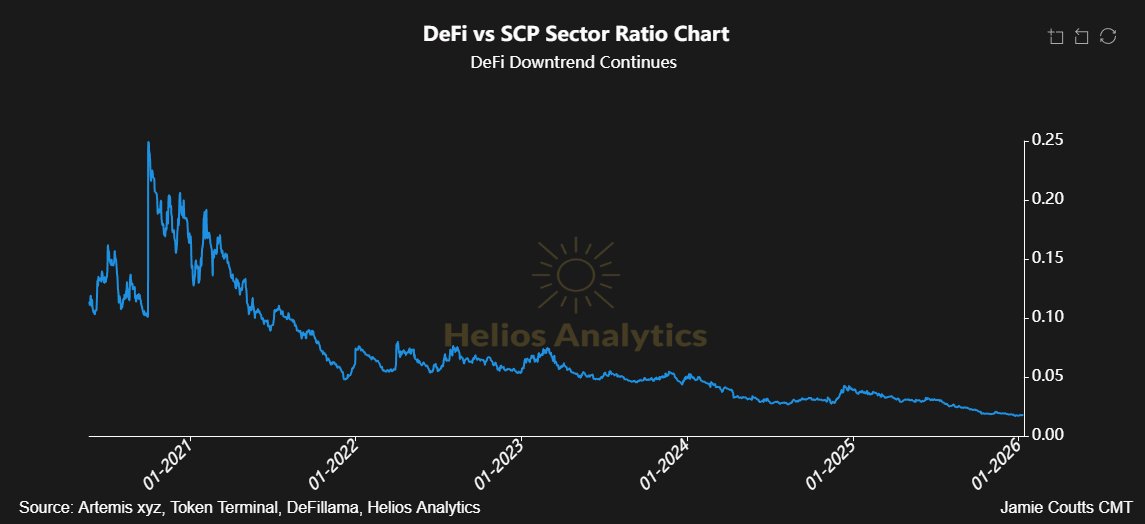

Returning to the argument of relative value, while the DeFi application case seems plausible, relative trends are crucial—DeFi's value relative to SCP is still in a structurally declining trend (see chart).

That said, I've slightly increased my risk appetite this week and am now thinking more seriously about when the market will shift.

True contrarian trading opportunities for certain applications will eventually emerge—but may require the following conditions:

• Accelerated liquidity

• Business cycle confirmation

• A genuine shift in on-chain activity (with price still leading)

• RWA funding core DeFi (lending)—potentially in the next cycle

These are initial thoughts; much more work needs to be done.