Liquidity dried up; beware of another round of volatile price movements!

The Federal Reserve meeting minutes released last night confirmed previous assessments.

Fed officials generally believe that inflation is unlikely to return to the 2% target quickly in the short term. In particular, the impact of the previously discussed tariffs remains uncertain, which could keep prices high for longer than expected.

While Q3 GDP data was good, the labor market showed signs of weakness, such as an increase in continuing jobless claims. This contradictory situation of a "good economy but weak employment" has led to significant disagreement within the Fed regarding the timing and magnitude of the next interest rate cut.

The expectation of a rate cut next year remains, but patience is needed in the short term: the market generally believes that the Fed will continue to cut rates in 2026. However, due to the above uncertainties, the January meeting is likely to keep rates unchanged, and the next important observation window may not be until March. The general direction is easing, but more data and time are needed for confirmation.

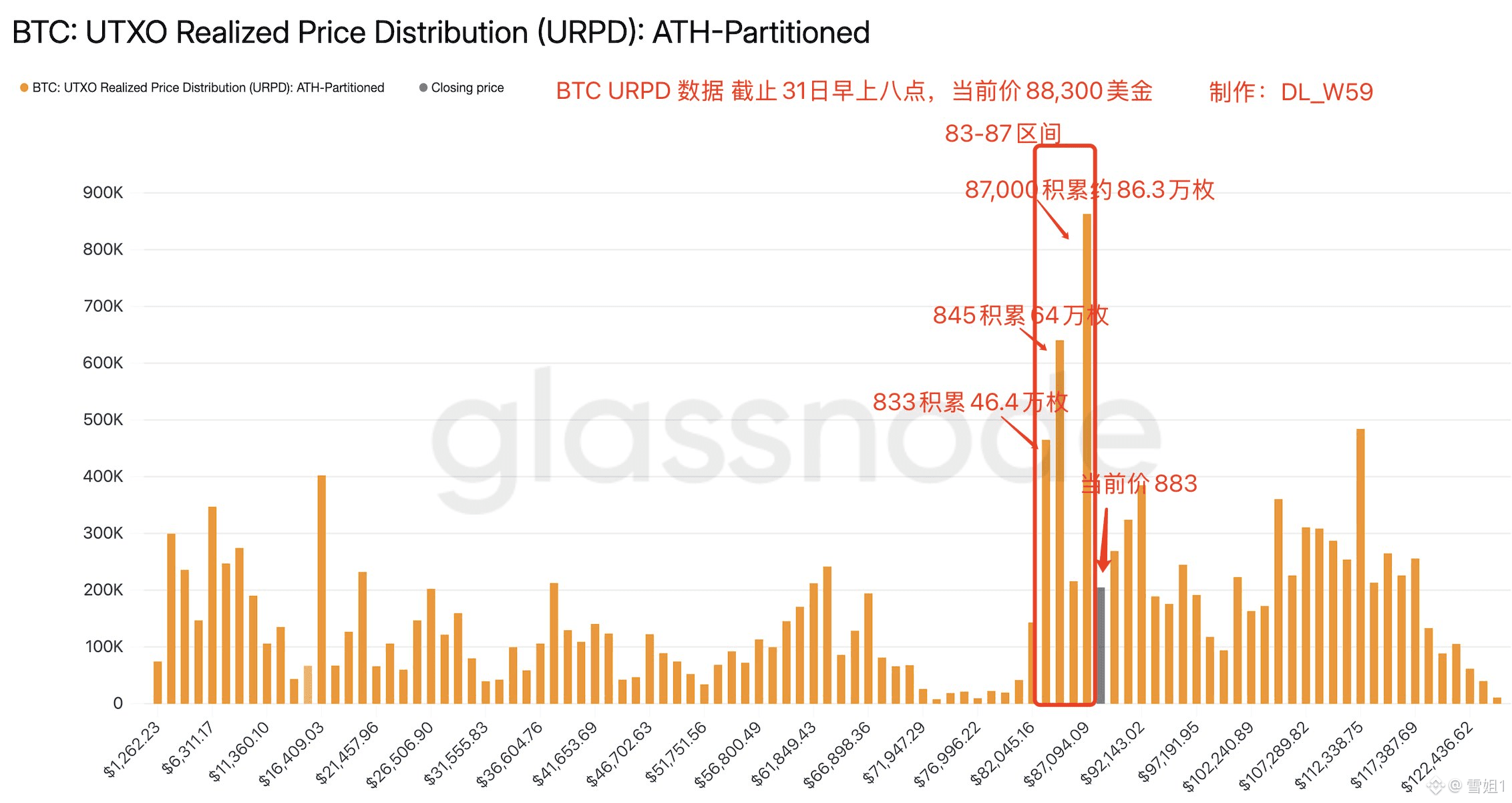

Returning to Bitcoin itself, the current market situation is very clear. A very large amount of capital has accumulated around $87,000, forming an important support zone. Meanwhile, over 1.7 million Bitcoins have accumulated in the $84,500 to $87,000 range, indicating strong buying pressure in this area. The market has reached a temporary equilibrium here, but it's fragile and lacks a strong catalyst to break the deadlock.

Looking at a longer timeframe, the current sideways consolidation does bear similarities to some historical periods of accumulation. This consolidation may continue for some time before the market chooses a direction.

Given the extremely low liquidity during the New Year's holiday, significant market movement is unlikely. Maintaining consolidation above the $83,000 to $87,000 range would be a positive outcome.

$87,000 is a key support level in the near term, while strong resistance lies around $90,000. A significant breakout above these key levels with substantial volume is needed to initiate a new trend.

#StrategyIncreasesBitcoinHoldings #TokenizationBoom Top news, top strategies, same opportunities, same gains, follow along and reap the rewards. The strategy continues. [Come to my chat room](https://app.binance.com/uni-qr/cpos/15606889063778?l=zh-CN&r=HGV4CH2I&uc=web_square_share_link&uco=sGrEFA04_L803jygSOTfxQ&us=copylink).