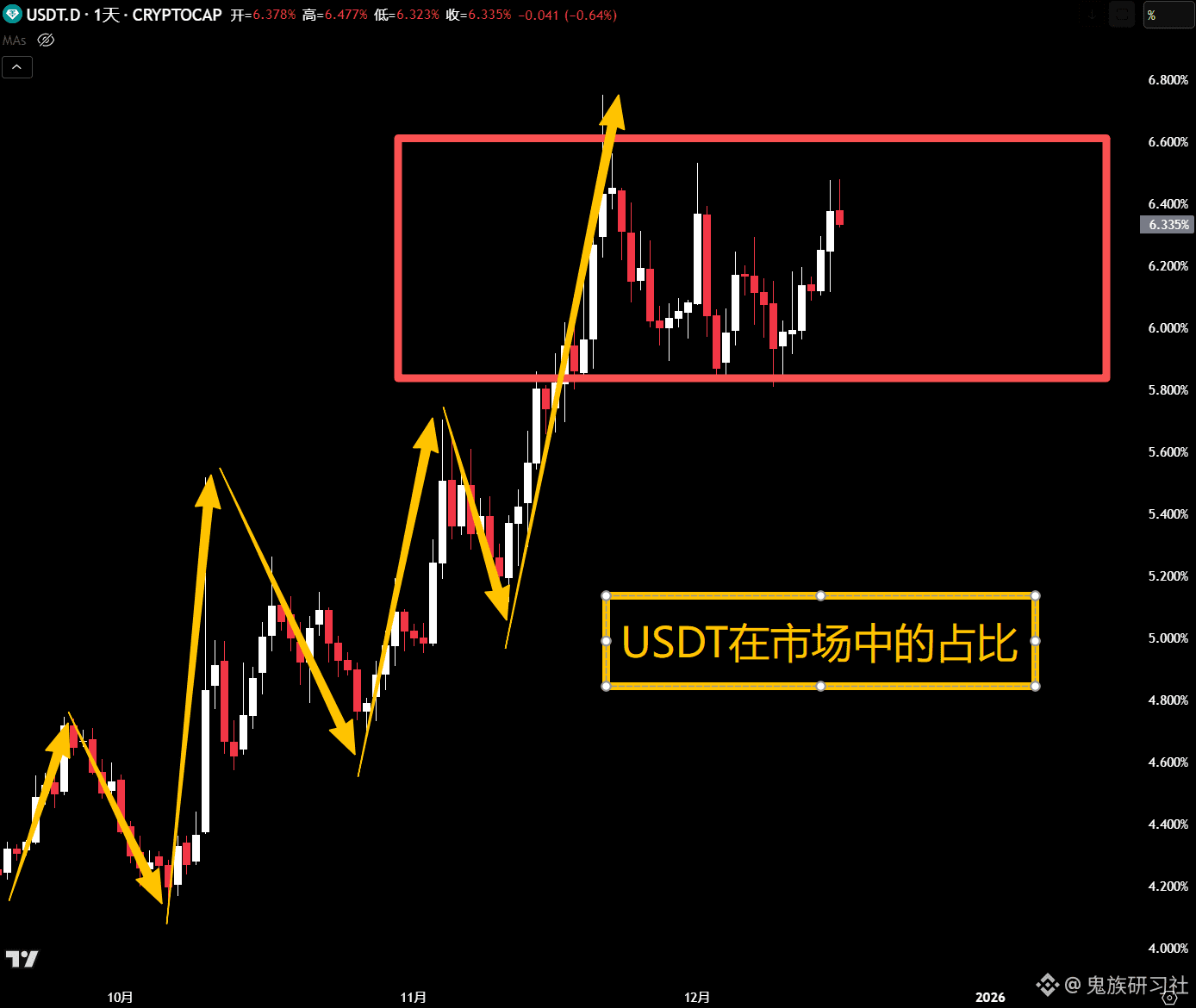

The continuously rising market share of the stablecoin USDT reflects a current market situation of more USDT than cryptocurrencies. However, the USDT share is fluctuating sideways at a high level, subtly suggesting a potential top formation. Normally, a decrease in USDT's share indicates that investors are exchanging USDT for various tokens, a sign of increased buying pressure. Conversely, an increase indicates a decrease.

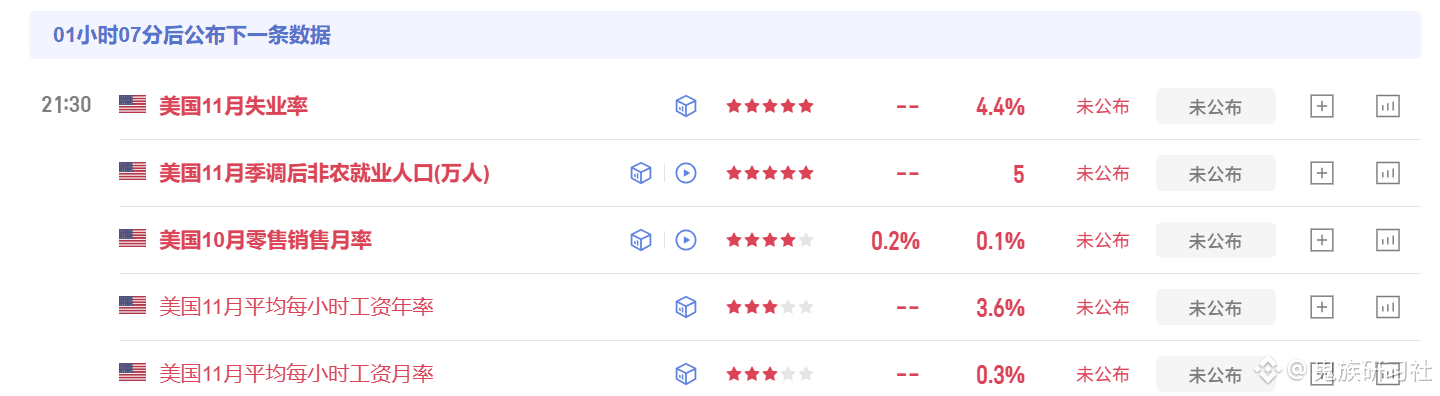

Additionally, the non-farm payroll data will be released at 9:30 PM tonight, likely causing significant market volatility. However, this volatility is temporary and will not directly change the market direction. The 18th brings important data on Japan's interest rate hike and the US CPI data, which I anticipate will have a downward impact on prices.

Today, let's see how high this rebound goes. If it rebounds, pay attention to the news the day after tomorrow, which could impact prices and cause another sharp drop. Of course, this is largely speculation based on current price action. Focus on these key pieces of information. #WhaleMovement #FedRateCut #CryptoMarketWatch