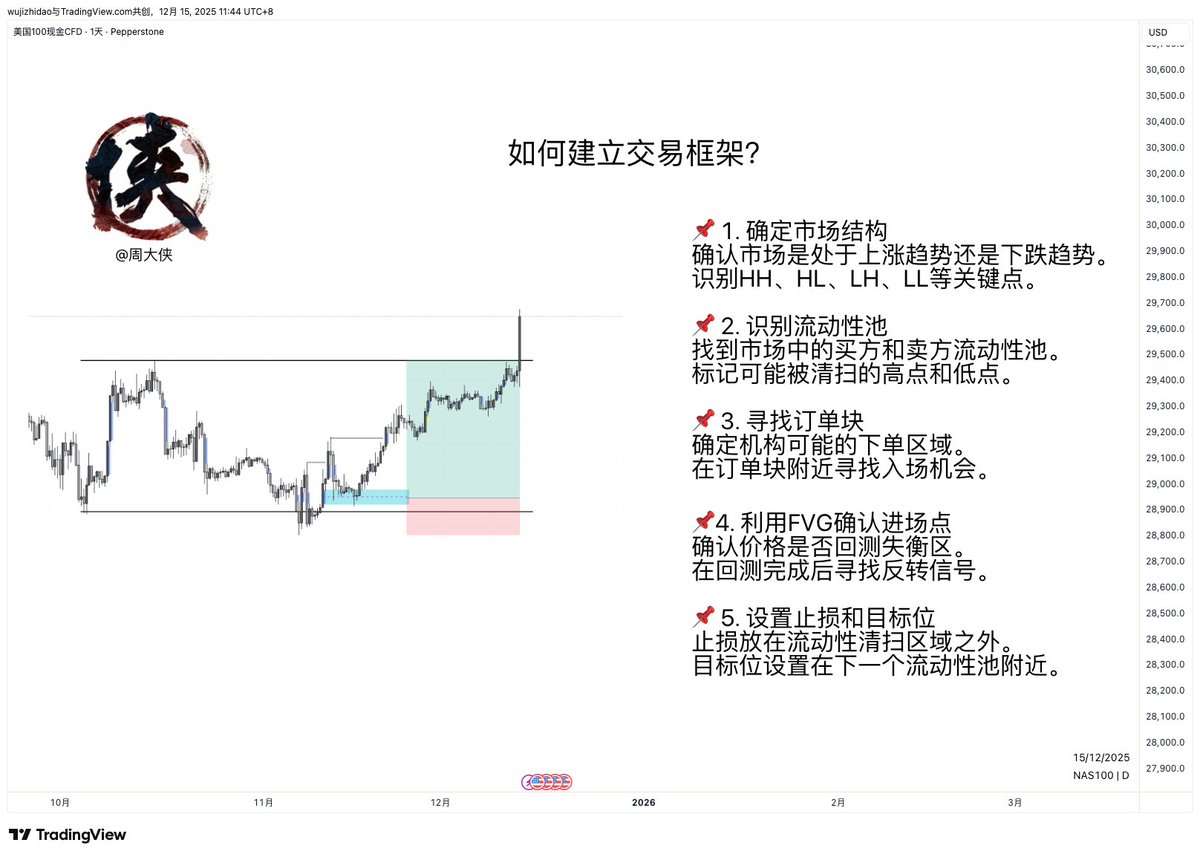

How to Build a Trading Framework?

📌 1. Determine Market Structure

Identify whether the market is in an uptrend or downtrend.

Identify key levels such as HH, HL, LH, LL, etc.

📌 2. Identify Liquidity Pools

Find the buy and sell liquidity pools in the market.

Mark potential highs and lows that may be cleared.

📌 3. Find Order Blocks

Identify potential institutional order placement areas.

Look for entry opportunities near order blocks.

📌 4. Confirm Entry Points Using FVG

Confirm whether the price retraces to the imbalance zone.

Look for reversal signals after the retracement is complete.

📌 5. Set Stop Loss and Target Price

Place the stop loss outside the liquidity clearing zone.

Set the target price near the next liquidity pool.