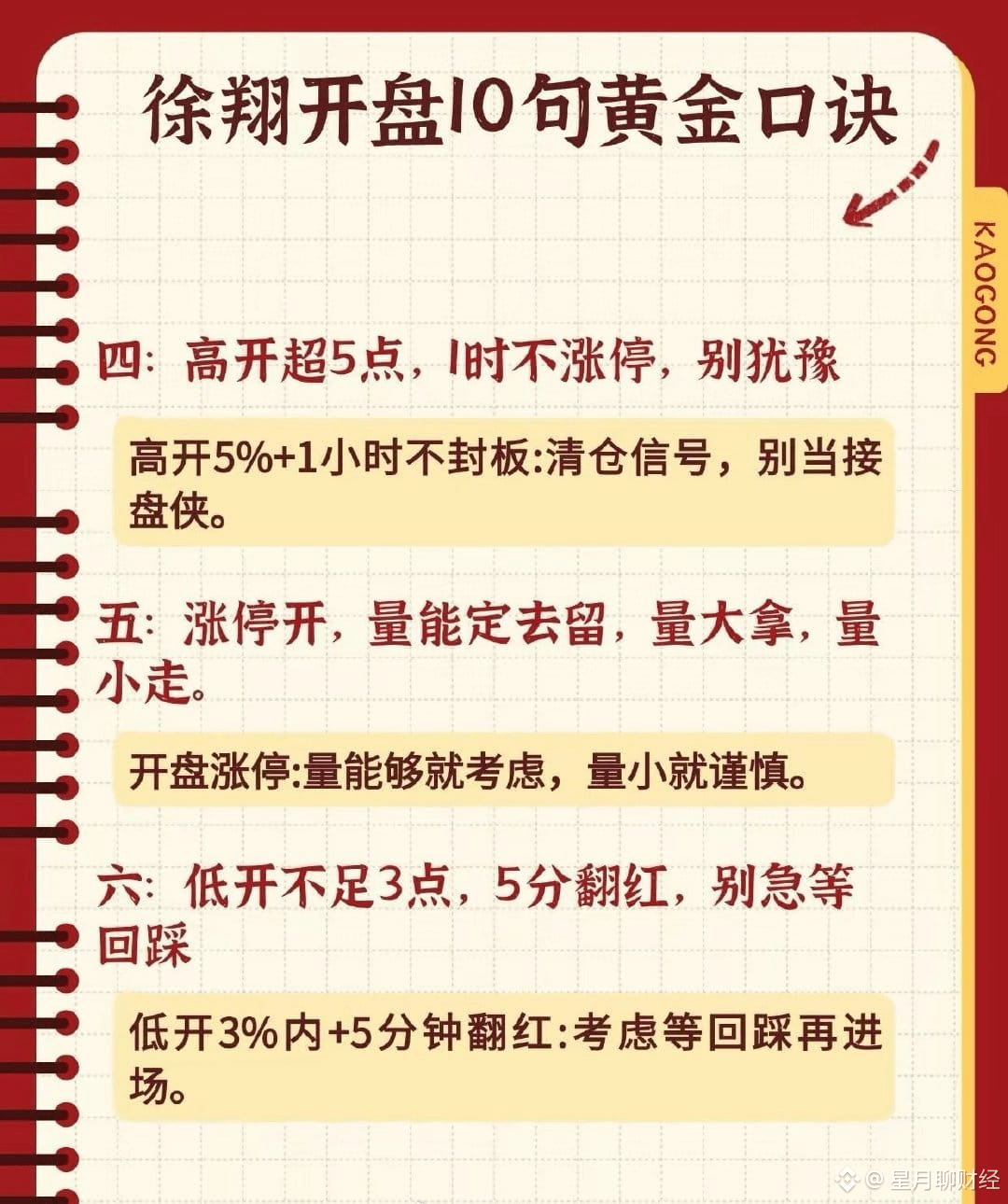

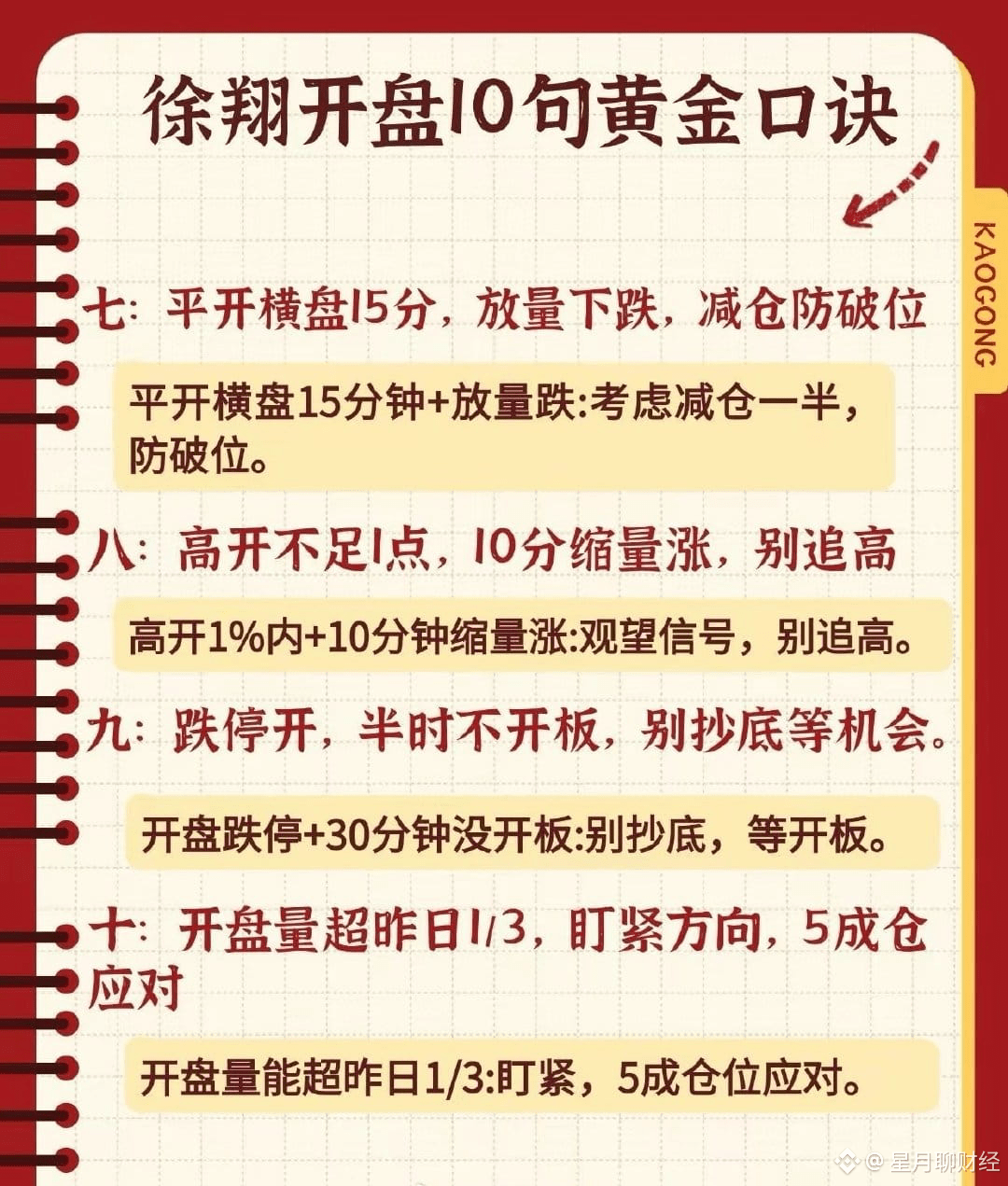

Xu Xiang famously said, "The opening bell determines life or death; the most crucial minutes in stock trading are those first few minutes!"

In the world of short-term trading in the A-share market, the saying "The opening bell determines life or death; the most crucial minutes in stock trading are those first few minutes" has always been widely circulated and is often linked to the trading logic of legendary trader Xu Xiang. It accurately pinpoints the core pain point of short-term trading, becoming a practical maxim revered by countless traders. The first few minutes of trading are like the dawn on a battlefield, holding the key to the entire day's market movements and determining the fate of a single trade.

The essence of the opening bell is the concentrated release of overnight information and market sentiment. All information—including the previous trading day's closing price action, overnight domestic and international policy changes, sudden positive or negative industry news, and individual stock earnings announcements—will be "priced" within the first few minutes through price fluctuations and changes in trading volume. For short-term traders, these few minutes are a golden window to judge market strength and the movements of major players—strong stocks often open high, accompanied by huge buy orders that lock in the daily limit, demonstrating the firm confidence of funds; while weak stocks may open low and continue to decline, with sluggish trading volume, indicating downward pressure throughout the day. The core of the short-term trading system represented by Xu Xiang is to capture this "certain signal" at the opening, avoid the ambiguity, and use accurate early morning judgment to lock in profits or avoid risks.