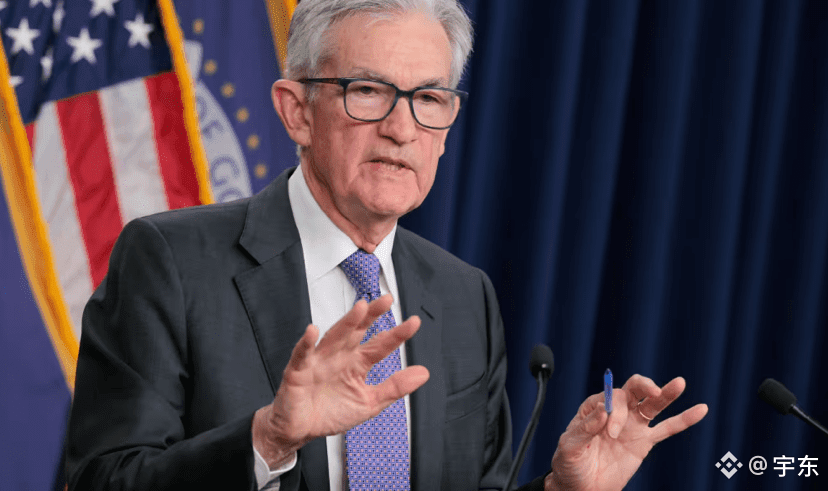

As expected! The Fed cut interest rates as anticipated, and Bitcoin continued to fall!

As mentioned yesterday, the Fed announced a 25 basis point rate cut to 3.50%–3.75%, the third rate cut this year, and a result widely anticipated by the market. Although this is a signal of interest rate easing, the market and funds had already priced in the rate cut. Before the rate cut, Bitcoin attempted to break through the $94,000 resistance level, but subsequently faced pressure and fell back.

Many may ask, why didn't the rate cut support the market? Several reasons: 1. Expectations already priced in: The market had already priced in the rate cut, and traders positioned themselves in advance, making the positive news "realized beforehand." 2. Structural risks remain: BTC has experienced significant volatility this year, and bullish momentum at higher levels is insufficient. 3. Funds are more sensitive to macroeconomic trends: The positive impact of a rate cut does not equate to an immediate recovery in risk appetite.

Therefore, this rate cut did not bring sustained upward momentum; instead, it may have become a trigger for short-term profit-taking. In other words—expectations opened with a rise, but the actual rate cut failed to materialize or even continued to fall. Risks remain, so the direction is still uncertain.

Our advice: conservative investors should wait and see; aggressive investors should be aware of the risks! Risk, risk!

#Fed Rate Cut #CryptoMarket Watch #CryptoMarket Rebound

$BTC

{spot}(BTCUSDT)