Solana DEX's shift from Meme-based trading structures at the beginning of the year to SOL-Stablecoins as its core trading pair is one of the key conditions for the rapid development of Prop AMMs. Currently, SOL-Stablecoins account for 60%-70% of Solana DEX's daily trading volume, providing greater room for active market making.

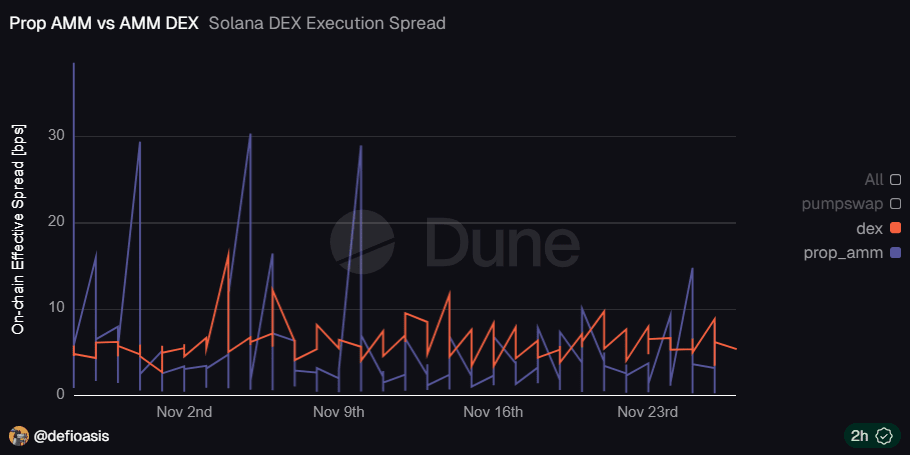

It's generally believed that private market-making strategies like Prop AMMs will have smaller spreads when trading broad asset classes. However, reviewing SOL-USDC trading data from the past month reveals that while conventional DEXs (Meteora, Raydium, and Orca) have higher average spreads, they are also more stable; while Prop AMMs have lower average spreads, but higher tail risk.

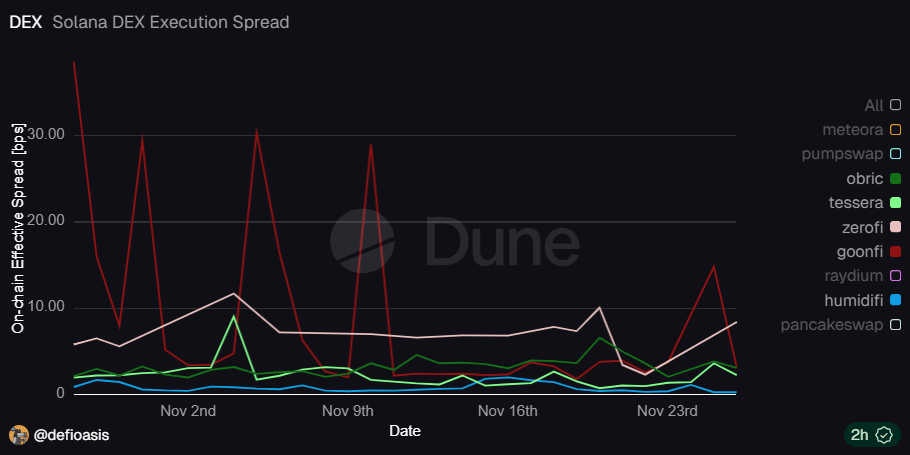

Within Prop AMMs, the difference in strength is quite significant. GoonFi is most prone to wild price swings, frequently surging to 30bps; ZeroFi has the highest average spread; in comparison, Tessera V and HumidiFi are the most stable, with HumidiFi almost always keeping the spread below 1bps, no wonder it's the leader...

In short, the core competitiveness of Prop AMMs lies in the proprietary strategies of the teams behind them and the effectiveness of the closed-loop curve; the key is how small the spread can be.