The underlying logic of moving average strategies is the resonance across time dimensions.

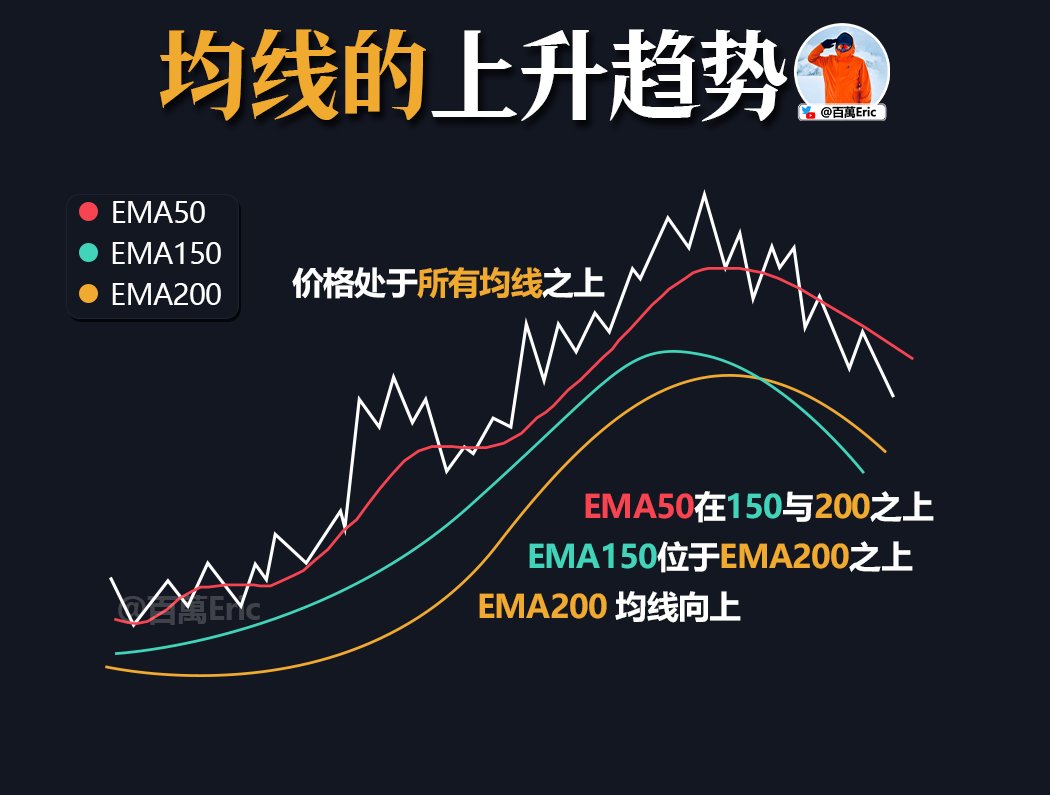

When the price is above all moving averages, it signifies that short-, medium-, and long-term market consensus is accumulating momentum in the same direction.

When the short-term moving average (EMA50) crosses above the medium- and long-term moving averages, it indicates that buying pressure is beginning to take the lead in shorter timeframes.

When the medium-term moving average (EMA150) is above the long-term moving average (EMA200), it indicates that the trend has been structurally confirmed.

And when the EMA200 itself begins to turn upwards, this is not a short-term rebound, but the mature start of a new trend.

When the price consistently trades above all moving averages, any pullback, as long as it doesn't break below key medium- and long-term moving averages, should not be considered a topping signal, but rather a "normal adjustment" within the trend.