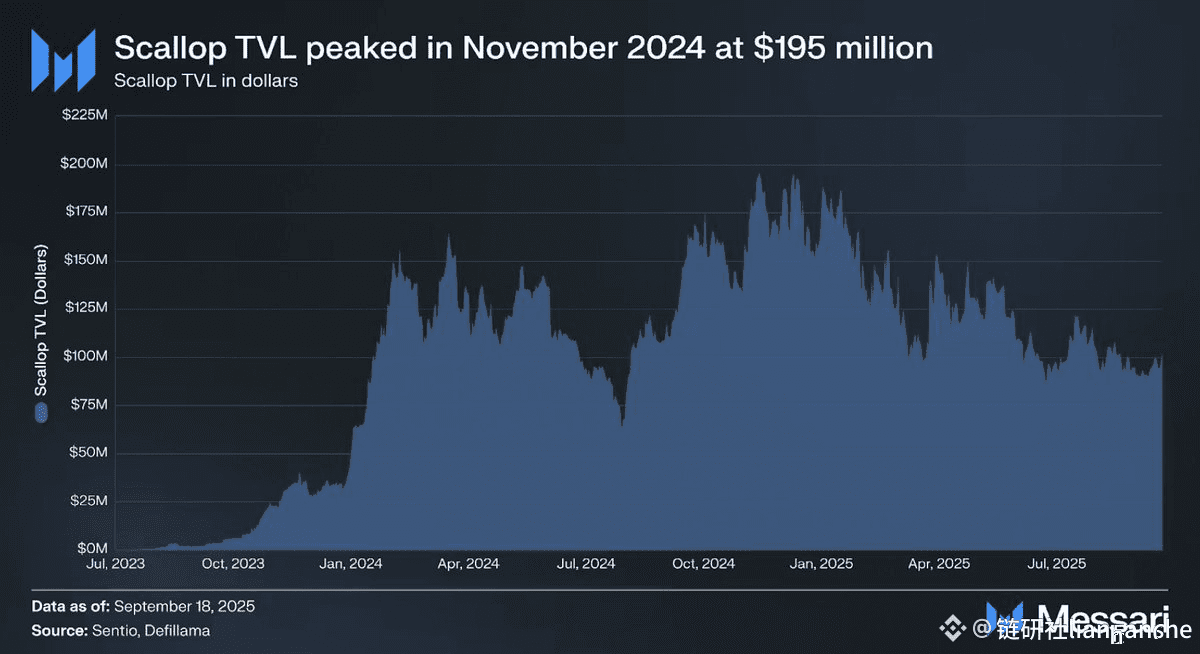

The $19 billion market crash on October 11th dealt a significant blow to the subsequent cryptocurrency market. However, within the SUI ecosystem, Scallop @Scallop_io, as the leading lending platform, maintains strong fundamentals and consistently generates positive cash flow—its TVL has long surpassed $100 million, generating $6 million in revenue.

The full economic model is now revealed through @MessariCrypto's report.

The report mentions 50 million SCA tokens locked up.

What does that mean? That's 20% of the total supply, and more importantly, 40% of the circulating supply!

This means that nearly half of all circulating SCA tokens are locked up for an extended period.

And the average lockup period is a whopping 3.71 years! Folks, the maximum is four years. This data suggests that the vast majority of Scallop holders are determined to max out their holdings! They're simply locked up. These are all "diamond hands" voting with real money, betting on Scallop's long-term value.

The reason they dare to play this game is the $veSCA model.

For DeFi veterans, the 4x lending yield bonus from locking up their staking is a steal. Short-term market fluctuations are far less important than long-term, stable, and high in-protocol returns. For long-term DeFi players, this is true "maximization of benefits."

This impressive economic model perfectly aligns user interests (high returns) with protocol security (reduced selling pressure). It empowers players on Sui to navigate cycles.