Trading Card Games

The Pokémon Trading Card Game (TCG) has moved beyond nostalgia, with on-chain trading of physical cards gaining momentum.

Now, every card can be on-chain and backed by the physical card itself.

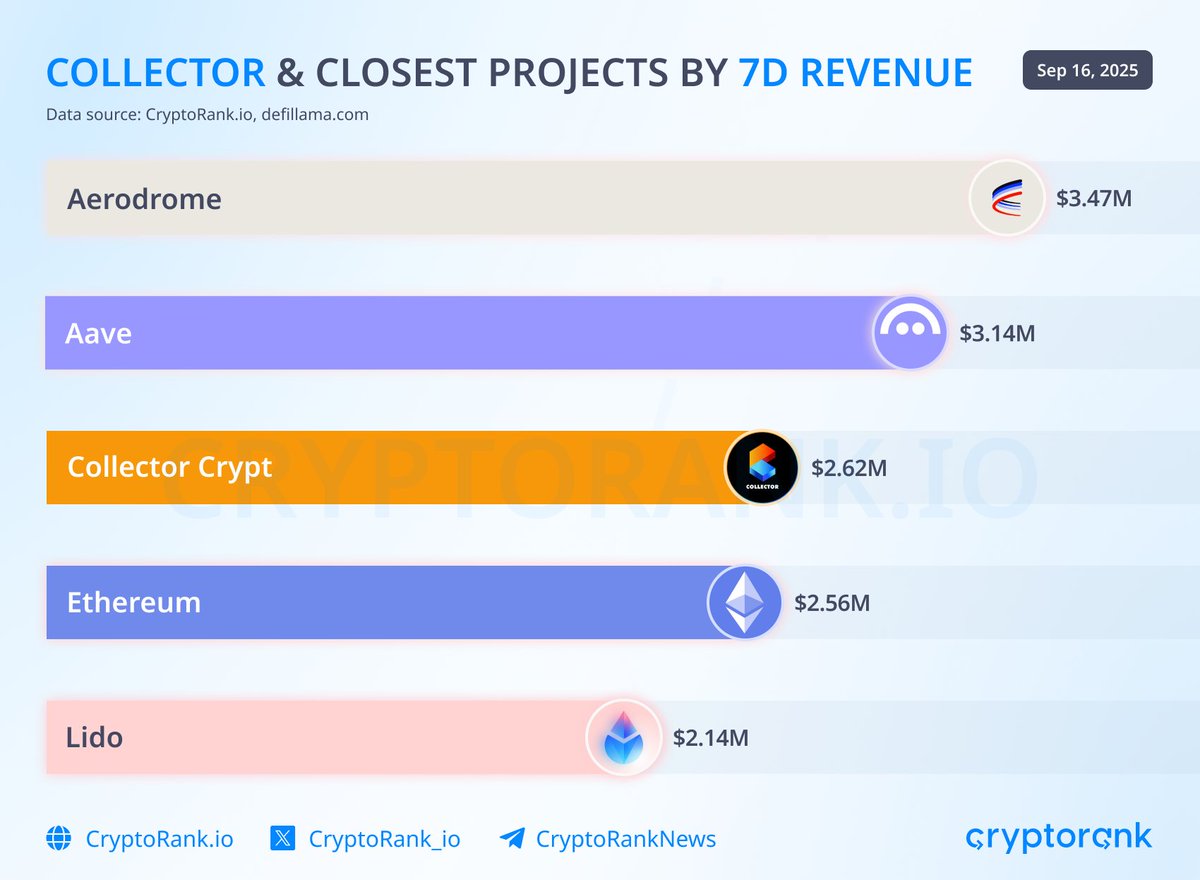

Leading platform @Collector_Crypt's seven-day revenue just surpassed both ETH and Lido.

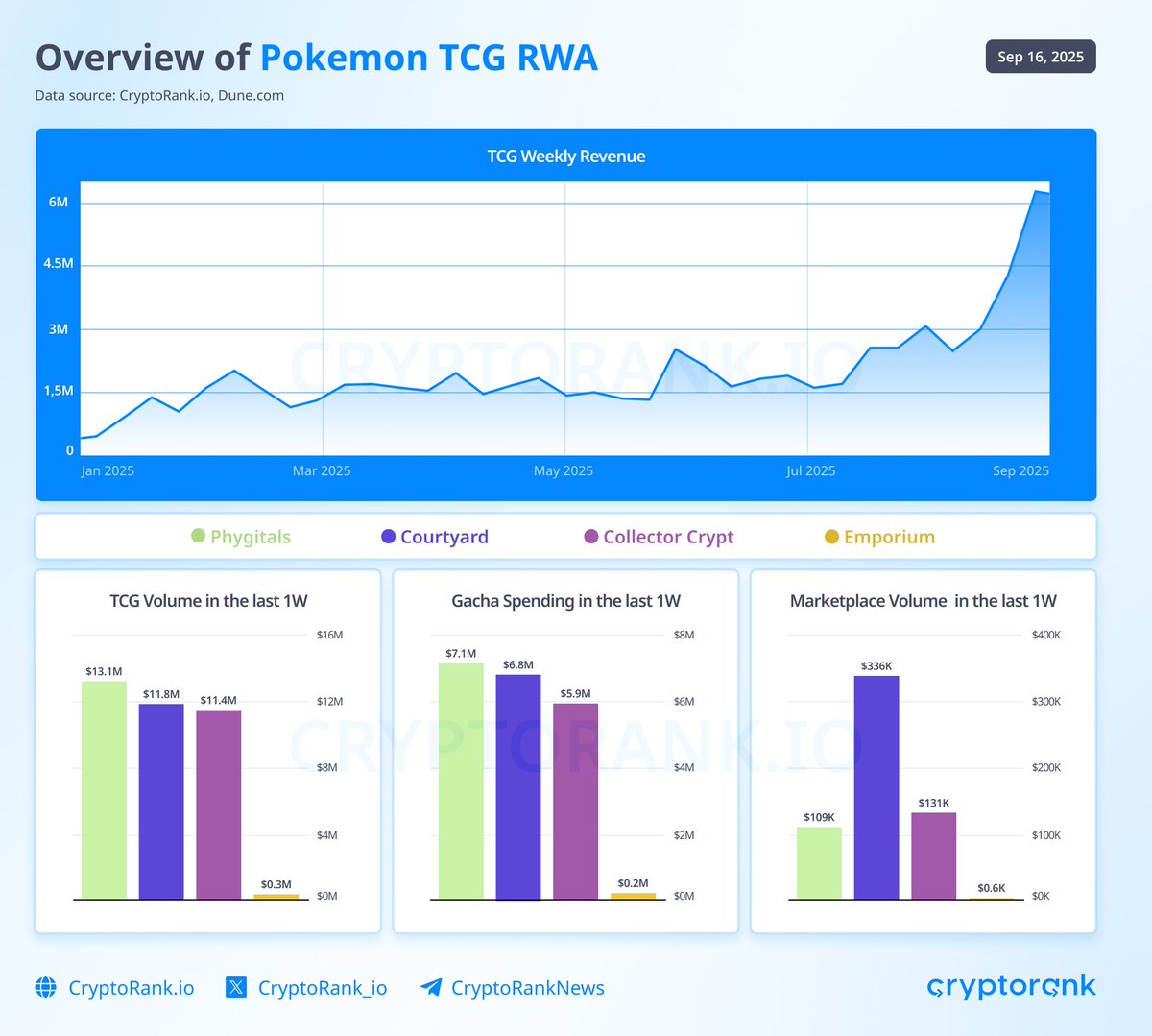

The platform acquires Pokémon packs in bulk at a discount, generating profits from both wholesale and retail sales.

Distribution occurs in two ways: through on-chain Gacha machines or the secondary market.

Gacha drives the majority of activity, as users pay for random spins for a chance to win rare cards.

This model converts the price difference from bulk purchases and the constant demand for spins into revenue, while secondary market trading and guaranteed buybacks on some platforms support liquidity.

Key Players:

@Courtyard_io – Infrastructure, vault storage, redemption options.

@Collector_Crypt – Tiered cards, Gacha mechanics, buyback guarantees. @phygitals – Novel mechanics and fun drops.

@TCG_Emporium – Niche community and hybrid physical/digital format.

Other players: @ripdotfun, @beezie_io, @tocatcg, @dripshop_live

Looks like this is more than just nostalgia.

Physical asset backing, gacha-driven revenue, and on-chain liquidity create a strong product-market fit.

Venture capital firms such as GCR, GVB Capital, and Big Brain participated in Collector Crypt's seed round.

As always, get an early look at CryptoRank's IDO/ICO rounds 👇