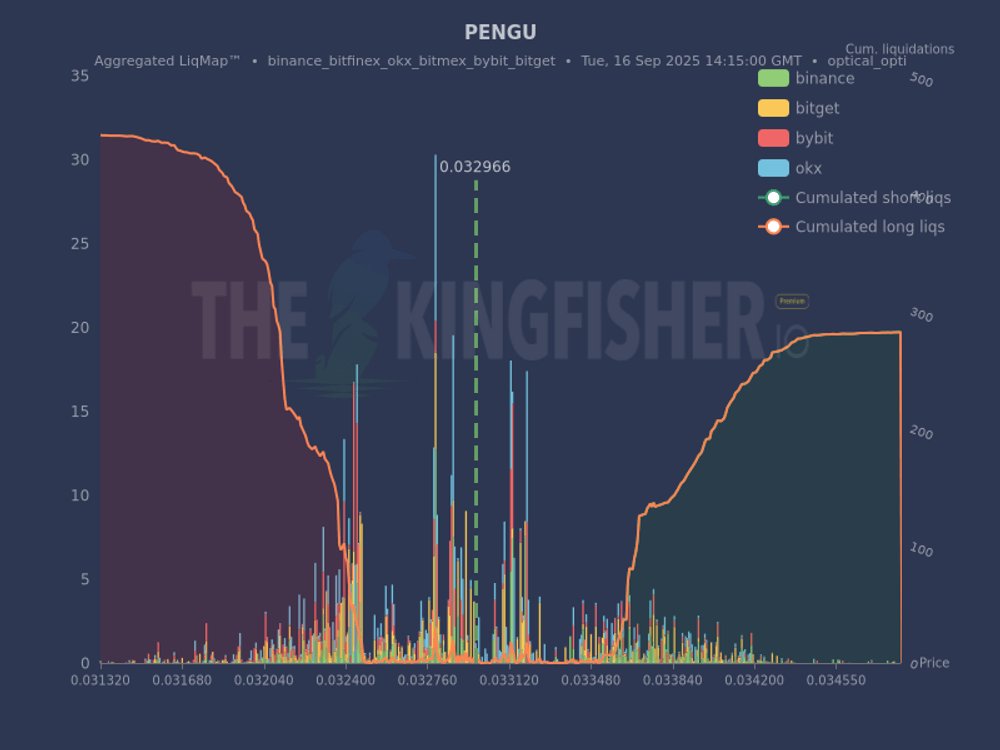

This chart of Kingfisher's PENGU optical options liquidations illustrates a key dynamic.

The current price is 0.032966.

A significant cluster of long liquidations is forming below, particularly around 0.03240 and lower. This suggests that if the market shifts, the price could aggressively target these levels.

There is a significant imbalance. Cumulative long liquidations (orange line) are significantly higher than cumulative short liquidations (green line). If prices fall, many long positions will be exposed. This suggests a potential downtrend or trend continuation.

The timeframe is optical options, meaning these are short-term setups that could be liquidated within a few days to a week.

Potential price magnets are areas of concentrated long liquidations. If prices fall, these areas will become targets for cascading liquidations. If prices aggressively approach these areas, traders may seek to partially take profits or tighten their stops.

This is not a crystal ball. It shows the exposure of leveraged funds. Smart investors use this to predict volatility and potential price declines, not necessarily an exact reversal. Be sure to manage your risk.

$PENGU.