The recently released US PCE data for June wasn't very good. The most important annualized core PCE figure, after a revision to the previous figure, was in line with the previous reading and below market expectations. However, since it was a revised figure, the impact shouldn't be significant. The monthly core PCE figure, in line with market expectations, was above the previous reading.

Both the annual and monthly PCE rates are rising, indicating that inflation is currently not favorable. At the very least, a downward trend isn't visible, especially with tariffs expected in two months. The figure could be even higher then.

While the weak inflation data reduces the probability of a Fed rate cut, the market isn't focused on this data, but rather on when Trump will announce Powell's successor. After all, whether the current data is good or bad, it's all a game of tactical play between Trump and Powell. Once a replacement is announced, market expectations will rise.

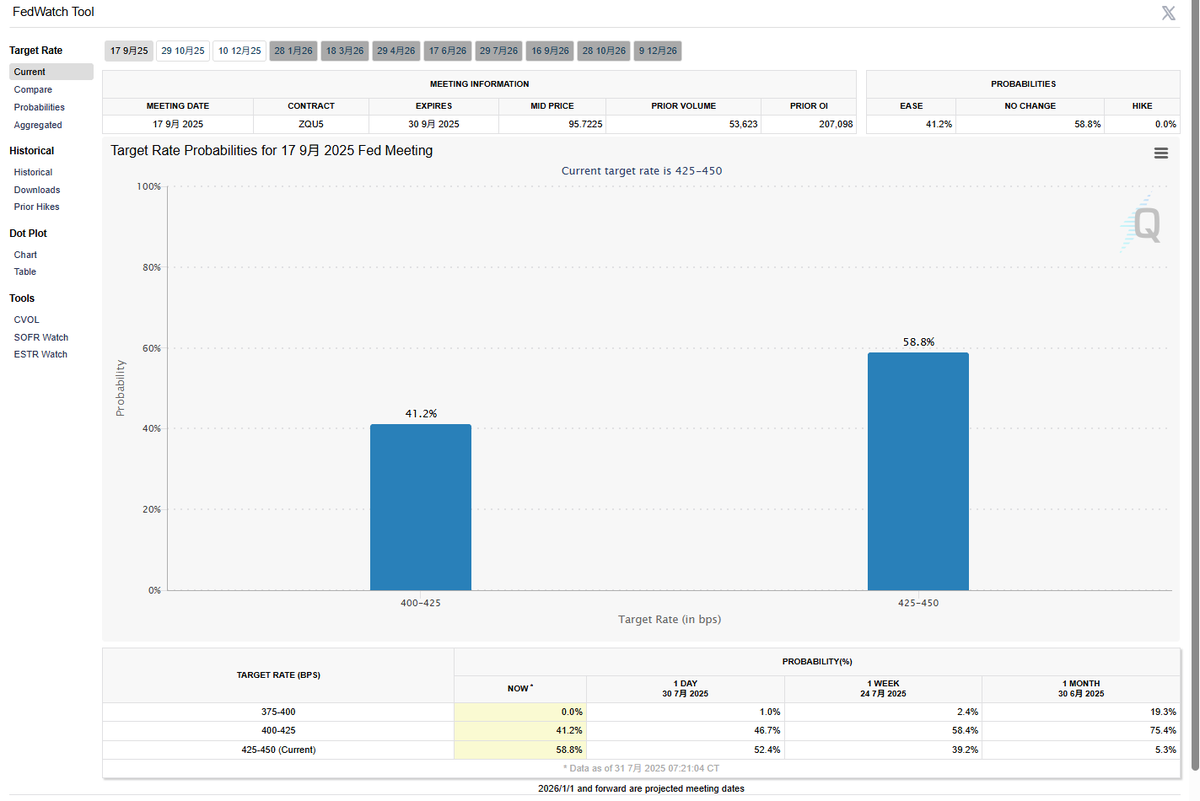

After the PCE data was released, the CME's probability of no rate cut in September rose again, from 55% yesterday to 58.8% now. It remains to be seen how the market reacts.

I personally believe that if the current macroeconomic data is positive, it will help market sentiment, but if it is negative, the market reaction should be minimal. After all, it's no longer the time when data is the driving force.

This article is sponsored by #Bitget | @Bitget_zh