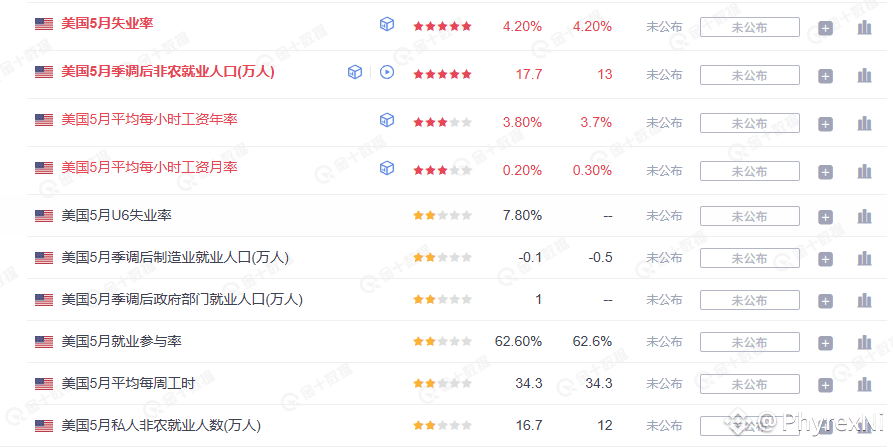

Written before today's non-agricultural data, employment and unemployment data should be the key data of each month, but before the tariffs are officially implemented, unless the unemployment rate rises sharply, it should not have any impact on the Fed's monetary policy. In the past week, many Fed officials have made it very clear that if the official tariffs (reciprocal) are not implemented, the Fed may be more cautious.

Therefore, the market has no hope for a rate cut before the third quarter, especially after the release of GDP data, the probability of the United States entering a recession has been reduced again, and no analysts will talk about recession in the short term.

So now the unemployment rate data has returned to the time when both good and bad data are good data. A slight increase in the unemployment rate can increase some expectations of the Fed's rate cut, and will not overly stimulate the topic of recession. The decline in the unemployment rate shows that the US economic situation is still good, and the Fed itself has no intention of cutting interest rates in advance, so a good economy can also promote investors' risk appetite.

Then there is the employment population. The more this data is, the better. However, the impact should not be great, as long as it is not significantly lower than expected. Another thing is the change in wages. Wage increase is definitely a good economic benefit. According to current market expectations, if it can meet expectations, it can still boost investor sentiment.

Especially Tesla is almost back to $300 before the market opens. The market needs some positive news to calm down. Of course, if the non-agricultural data explodes, this weekend will be difficult.

This tweet is sponsored by @ApeXProtocolCN|Dex With ApeX