Although the US stock futures rose well due to the positive news of Nvidia's financial report and the suspension of Trump's tariffs, the Nasdaq futures have risen by 2%, and the S&P futures have risen by more than 1.6%, but the reaction of $BTC was not very friendly. After breaking through 108,500 in the morning, it began to fall. Some friends questioned whether it would not follow the US stock market.

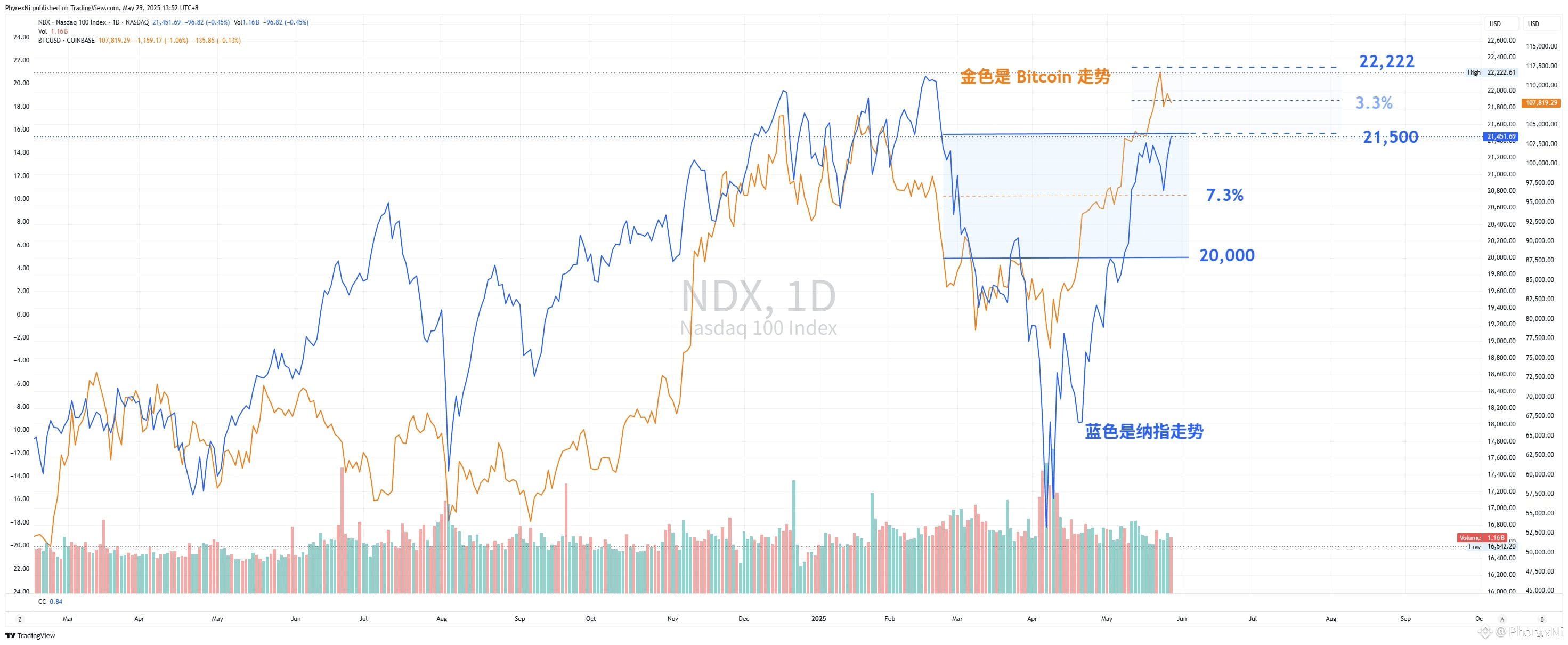

In fact, from a general perspective, the trends of Bitcoin and US stocks are still highly overlapped. BTC's leading rise some time ago was already good. Compared with US stocks, it not only returned to the historical high before the tariff, but also broke the historical high. It has already led the US stock market in terms of the increase.

Even now, the US stock market has just returned to the level before the tariff on February 25, so compared with BTC, the US stock market has more room, so the current situation of BTC is also normal, and it is also the main trading time in Asia. Yesterday we also analyzed that BTC's main trading time is from 21:00 every weekday.

So I still think that the rise of US stocks will be good for Bitcoin. As long as there are no unexpected events, if the US stocks continue to rise after opening today, BTC will not be too bad.

This tweet is sponsored by @ApeXProtocolCN|Dex With ApeX