On Sui, another lending protocol I am familiar with is NAVI.

Its trading volume has always been the first in the Sui chain in Alpha, although it has been surpassed by $BLUE in the past two days.

However, the two are not on the same track. Let's talk about my expectations for it!

➤ From the perspective of trading volume:

If trading volume is the key path for Alpha tokens to climb the ladder, then $NAVX is undoubtedly worthy of special attention.

This is not groundless. Trading volume often reflects user activity, and these users and trading volume are important resources for Binance to empower and what Binance needs.

Of course, we know that Alpha's trading volume is driven by the points system, but Sui Chain does not have a double trading volume bonus like BNB Chain. Therefore, there must be a reason behind NAVX's ability to achieve such a trading volume.

From the perspective of "minimum wear and tear" of users brushing points, this is most likely because NAVX's trading loss is extremely low.

Many friends may have mentioned this, but the low loss tested in practice often has certain requirements for the timing of buying and selling.

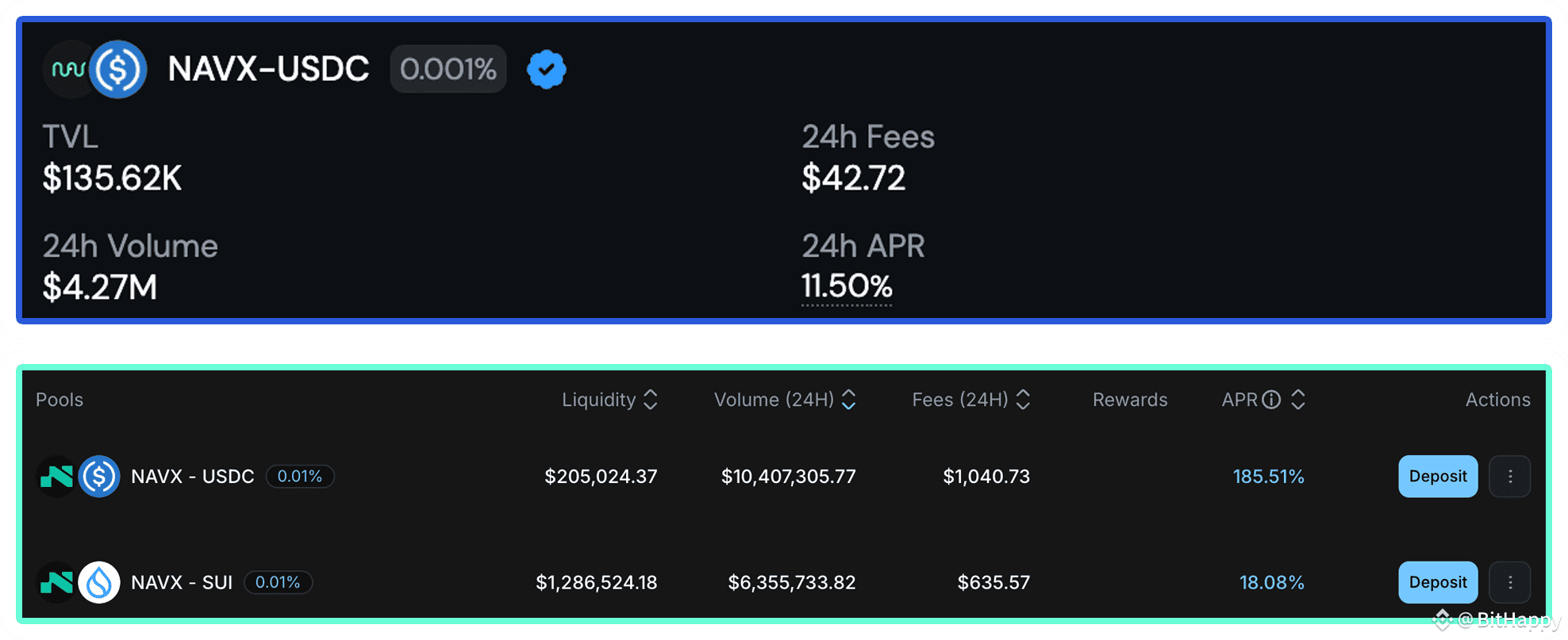

According to the liquidity pool data of Sui Chain DEX Cetus: NAVX provides pools with a fee rate of 0.01% for SUI-NAVX and USDC-NAVX.

What's more exaggerated is that NAVX also provides a pool with a fee rate of 0.001% for USDC-NAVX on Bluefin, which wiped out the idea of making money for my LP group.

These are the fundamental reasons for low trading losses.

However, the income of these pools in 24 hours is only more than one thousand US dollars. Obviously, NAVX's goal is not this meager profit.

The real intention of NAVX should be to take advantage of Alpha's momentum, improve its own popularity through low wear and tear, and then enrich its own ecological layout.

➤ From the perspective of ecology:

NAVX also includes Sui's liquidity pledge agreement Volo, and the Perp DEX aggregation trading platform Astros under development.

It can be seen that its ambition is not small!

From my observation, the two tracks of liquidity pledge and Perp DEX are gradually forming the infrastructure of public chain DeFi together with DEX, stablecoins, and lending protocols.

In summary, NAVX is indeed worthy of our attention. Can it launch contract trading or even spot trading in the future? Let us wait and see!

______________________

Circulating market value: $38,611,655

Fully diluted market value: $67,031,000

DeFi enthusiast: BitHappy