As of now, the Nasdaq and S&P 500 have recovered the space for yesterday's decline. The market is gradually "disenchanting" about Trump. During yesterday's decline, investors distrust caused by Trump's fierce criticism of Powell. Today, 24 hours later, no factors that can reverse the market have occurred.

The rebound of US stocks is likely to be because they have fallen too much, and the market panic has been corrected, but at present, it is really about the market entering a reversal. I still think it is unlikely that it will still rebound. In addition, this week and next week are financial reports seasons, and there may be a temporary possibility of breaking through macro sentiment in the financial report season.

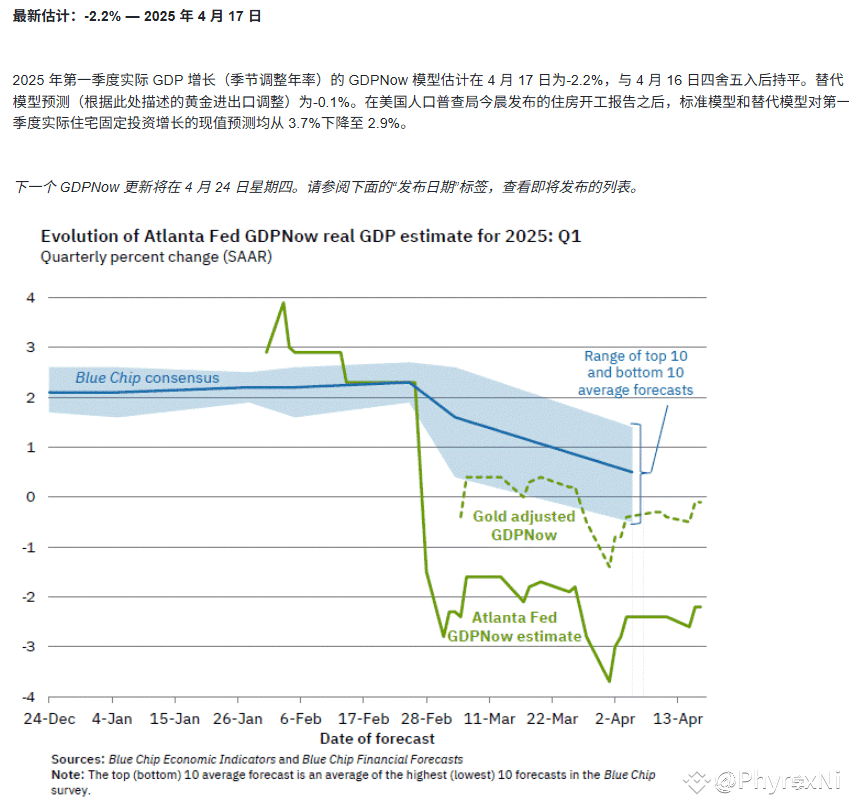

However, the GDP data at the end of the month is still the watershed of May's trend. If GDP is positive, it proves that the United States has not reached a recession. Although it will not strengthen the expectation of interest rate cuts, the economy can relax. However, if GDP is negative and it is -2.2% given by GDPNow, then the expectation of interest rate cuts will be greater than the positive.

This tweet is sponsored by @ApeXProtocolCN|Dex With ApeX