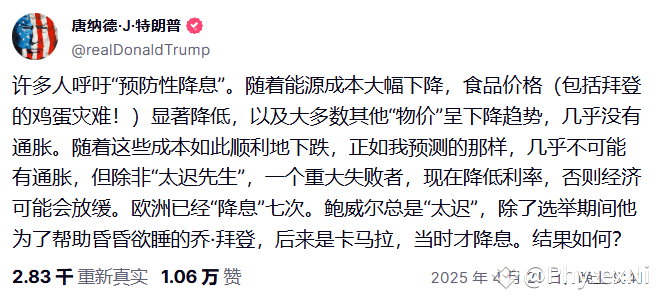

Although I still don’t know the logic of the independent rise of $BTC, the logic of the decline of US stocks is quite clear. One is pessimistic about economic expectations, and the other is the conflict between the political and economic management of the United States. Today, Trump issued another article to criticize Powell, believing that Powell was always too late, and he completely forgot that he personally praised the Federal Reserve for not cutting interest rates in January.

March voluntarily praised the Fed for not cutting interest rates in advance, and now it has begun to say that Powell is too late, and said that the United States should lower interest rates to prevent economic weak expectations due to tariffs. Uncertainty is what everyone is most panicking. As of now, the S&P 500 has fallen 2.74%, Bitcoin and gold continue to rise, and trading volume is also rising.

In 10 years, 20 years and 30 years, U.S. bonds rose by more than 1%. Maybe I'm wrong, but I won't do much in this position, which doesn't fit my understanding.

This tweet is sponsored by @ApeXProtocolCN|Dex With ApeX