DEX contract platforms like Hyperliquid may cause ETH to collapse!

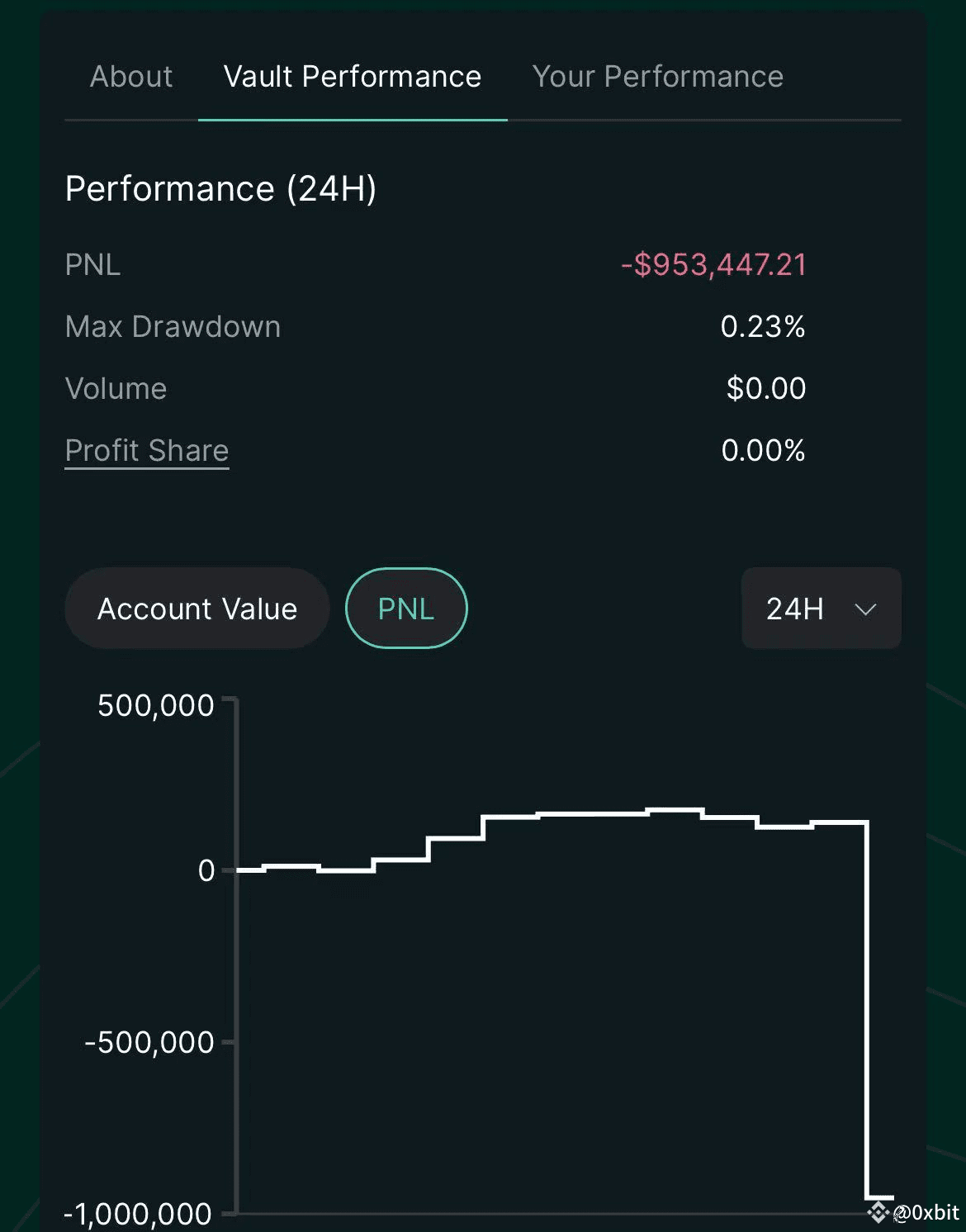

Recently, Hperliquid's liquidity pool has been reduced by 1 million U.S. because a whale that is long ETH is insufficient. Due to the lack of liquidity of the opponent, his long position cannot be closed through the form of a liquidity, so he directly chose to withdraw margin and force closing the position.

During this cycle, ETH performed poorly. Many whales held a large amount of ETH but had little returns or even lost losses, so they chose to open a contract with Hyperliquid.

This great master's technique, even if the whale that opens a lot of ETH makes a profit, it still cannot make a profit due to insufficient liquidity of its opponent. The whale is worried that it will lose money later, so it chooses to withdraw margin to force its orders. (Once ETH falls later, there may be greater losses)

In this case, since the whale's position is too large for ETH, which is a strong market price, the transaction price will be much lower than the current ETH price.

In the end, he left the market with a loss and also reduced the price of ETH!

The master who makes whale opponents is really awesome!

It is difficult for ETH to achieve good monetization in this cycle!

#ETH🔥🔥🔥🔥🔥🔥🔥🔥🔥