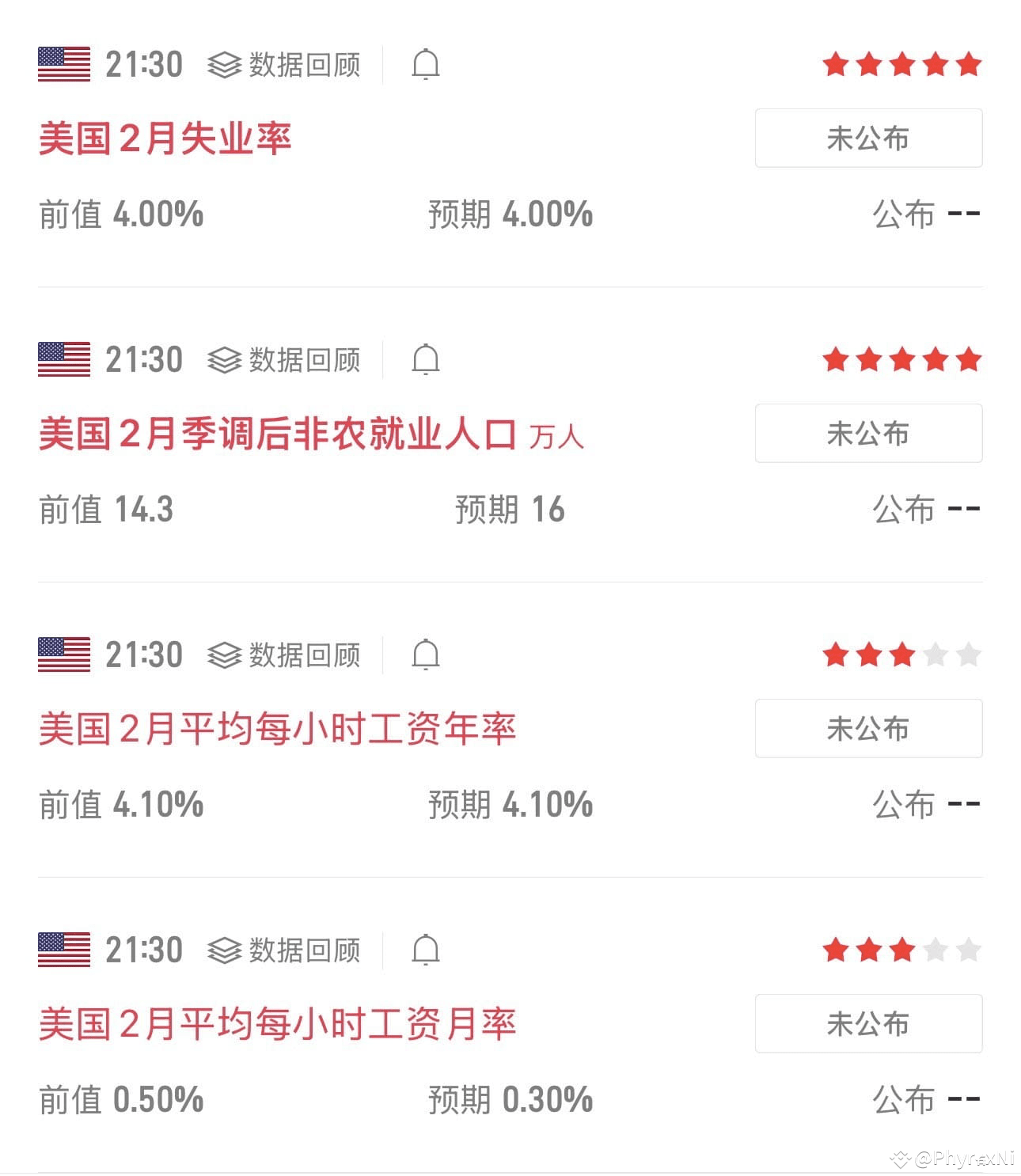

Before writing non-agricultural data, non-agricultural data are always very tangled, and it cannot even be ruled out that the pullback from the day is a risk aversion, but in fact, the current non-agricultural data does not have much to do with the Federal Reserve's resolution in March. But the market will still serve as a basis for measuring the Fed's March dot chart, which is correct.

In general, if it is to increase the number of interest rate cuts, the rise in the unemployment rate is a good thing. The unemployment rate has reached at most 4.2% in the past six months. The Federal Reserve believes that the neutral unemployment rate is 4.3%, so the higher the unemployment rate, the greater the probability of increasing the number of interest rate cuts. This is a fact.

But the sharp rise in the unemployment rate will make the United States enter into recession expectations. Recession is more terrible than inflation. If it really enters recession, it will be the last drop.

If the unemployment rate continues to decline, it means that the US economy continues to be strong, which may not be a bad thing. After all, the focus of reducing inflation is inflation data, so essentially, it is a good thing that the unemployment rate will increase slightly or remain unchanged.

Then there is non-agricultural employment. The higher the data, the better the US economy. The end of the month means that the economy is not very prosperous. DOGE's layoffs are actually a reduced data. So from the current point of view, the higher the non-agricultural employment, the better the market, after all, the economy is stable.

Finally, there is salary. There is nothing to say about this. The higher the more it is, the more it is beneficial to the economy, and the lower the less it is, the less it is not conducive to the economy. So in general, the current market expectations are good data, and it will be good if it meets expectations.

This tweet is sponsored by @ApeXProtocolCN|Dex With ApeX