Let me talk about my personal views on the market, not investment advice.

The current market is either controlled by the Federal Reserve's monetary policy or controlled by Trump's big stick. When bulls and bears are fooling each other, it seems that tariffs are needed, and market sentiment plummeted, and then Trump's big stick comes out.

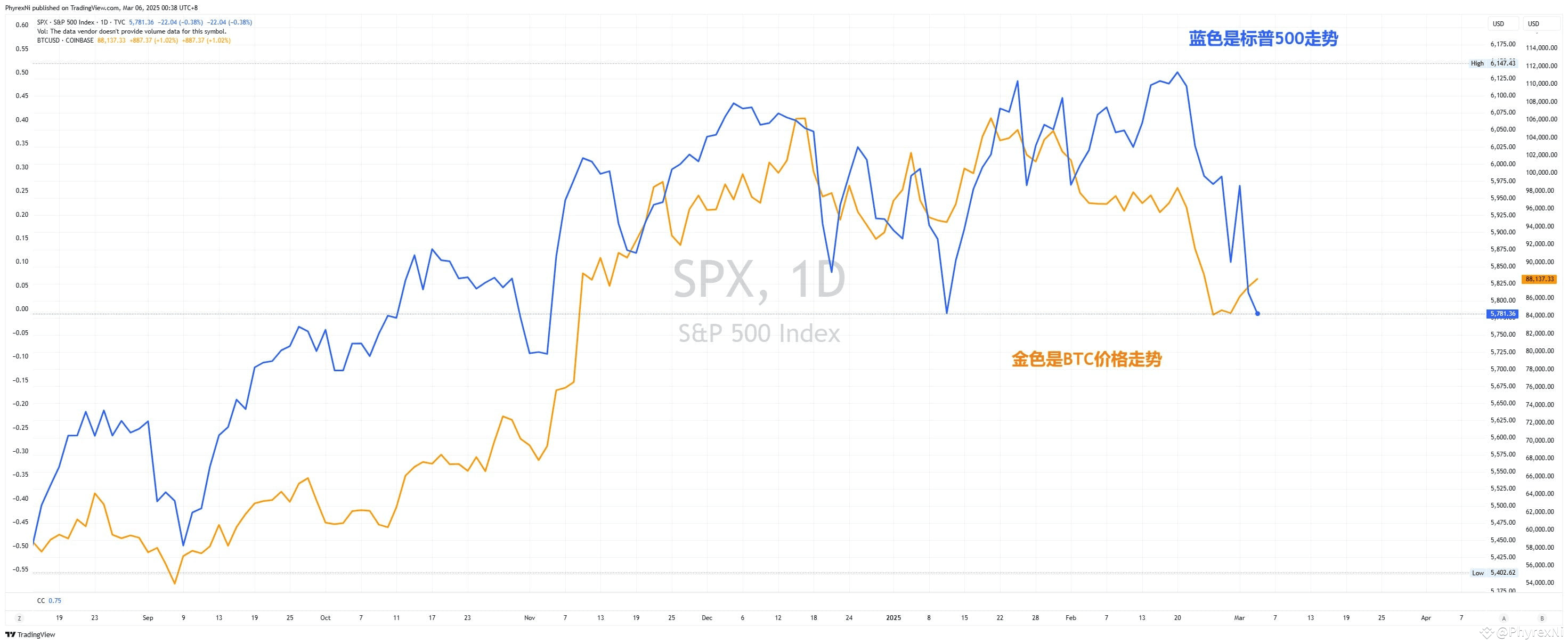

It was obvious that the Russian-Ukraine war had signs of a halt and the market was about to recover. At this time, Trump's stick appeared. But in general, U.S. investors in U.S. stocks and cryptocurrencies are not in good mood right now, which is a fact.

The main reason for $BTC to rebound is the cryptocurrency summit held by Trump at the White House. From 2:30 am to 6:30 am on March 8, Beijing time, it should be divided into two sessions, one of which is about 20 people, including Michael of $MSTR and Brian of $COIN, and some government officials in the White House.

The symposium ended with an open summit. It is not clear whether it was at the symposium or at the summit that Trump announced some details of Bitcoin’s strategic reserves. This should be what investors expect, but don’t expect too much. Trump’s original words at the 2024 Consensus Conference are:

“The United States will not sell any more $BTC and use these BTC as a strategic reserve.”

So in fact, Trump’s original intention is not to buy BTC, but not to sell. This is the biggest probability. If there is really a chance to buy it, it may be the national sovereign fund mentioned last month. This part of the funds comes from taxation. It is not impossible to buy a part of it through this fund, but the total amount will not be too large. So the impact on emotions may be limited.

What can really drive some liquidity is tariffs, the end of the Russian-Ukrainian war, Ukraine's rare earth mineral development, and the United States' macro data. This part of the data will be more important and the impact will be longer. Therefore, if it is a direction, it must be based on the macro-political situation.

Without clear data, such as the dot chart, it is indeed possible to have long and short directions, and the danger of betting on a single direction will be greater. There are really experts who can make money in repeated bands, which is really amazing. If you don’t have this ability, it may not be wrong to wait and see during this period.

Data to follow:

1. Ukraine and the United States sign a rare earth mineral development agreement, which is considered as a condition for the end of the war.

2. Trump's tariff policies on Canada and Mexico weaken or slow down, or give up.

3. The Fed's dot map on March 20 and Powell's speech, the previous macro data were actually for dot maps.

I don't know if there is anything to add to the above.

PS: I think Q1 is purely a personal behavior. I have said it logically, but the risks are not gone, so I don’t recommend that everyone place blind bets. It is best to have enough understanding, especially now, long and short may be in the hands of one person or in the mouth. The risk is actually quite high.

This tweet is sponsored by @ApeXProtocolCN|Dex With ApeX