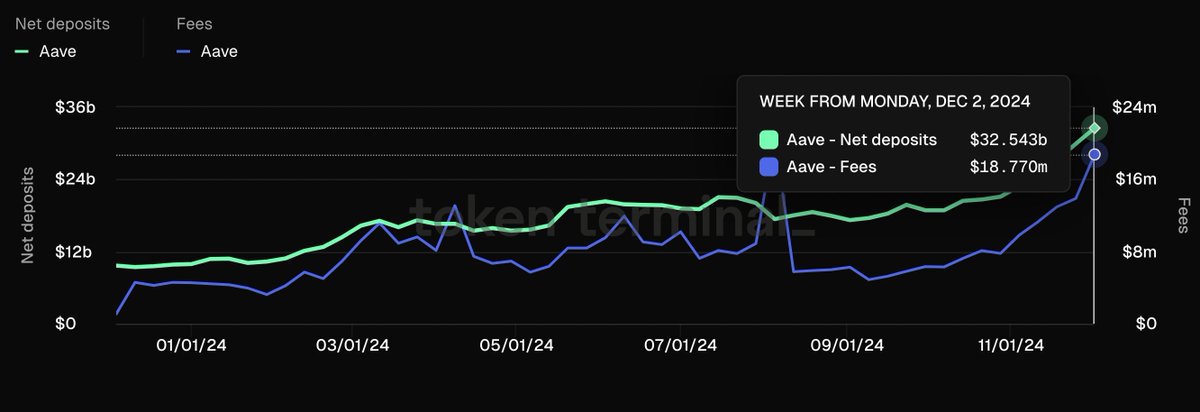

Is it because the price of the currency has risen and there are great scholars to defend me, or is it really a new perspective of undervaluation?I just saw a KOL in the UK who compared AAVE with traditional bank valuations to analyze potential appreciation potential, and my eyes lit up instantly.His logic is simple: HDFC, India's largest private bank, has a deposit of $300B, a market value of $171B, and a valuation of 57%. However, Aave has a deposit of $34B, but its market value is only 13% of the deposit. According to him, if $Aave can reach the valuation ratio of traditional banks, the price of $AAVE should easily break through $1000.However, speaking of which, Aave deposits have indeed tripled in the past year, and this trend is indeed like this. In traditional finance, it is quite difficult to see such a growth rate, and the advantages of on chain self custody, on chain transparency, and combined returns are too much compared to traditional banksOnce regulation is implemented, more TradFi funds will wake up and the deposit volume will increase by 10-20 times, which doesn't seem too outrageous. By then, the estimated price of the loan agreement led by $Aave will definitely not be this number anymoreFrom this perspective, it seems quite difficult to refute.What do you all think? Is it because the price of the currency has been inflated, or is it indeed undervalued from a new perspective?