作者:链上巫师

Original | Odaily Planet Daily@OdailyChina)

Author | Asher@Asher_ 0210)

Another "major crash" has occurred.

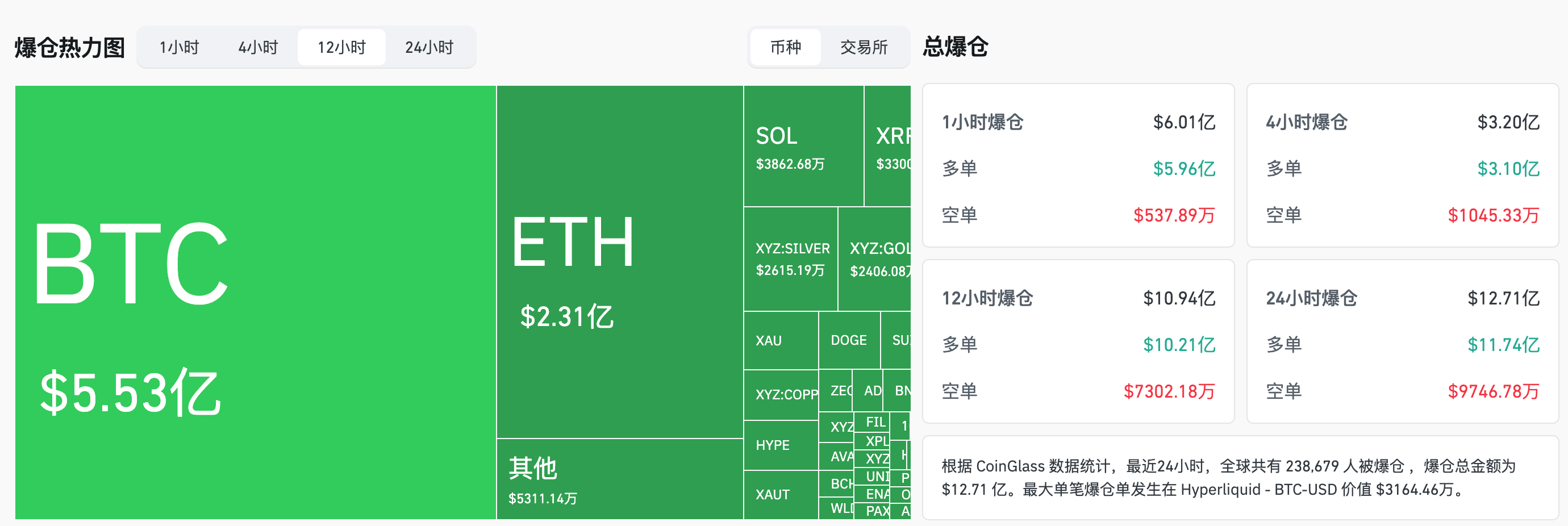

OKX market data shows that from last night to this morning Beijing time, BTC fell rapidly from around $88,000, briefly dropping below $81,200, a 24-hour drop of over 7%; ETH fell from $2,940 to a low of $2,690, a 24-hour drop of nearly 10%; SOL fell from $123 to around $112, a 24-hour drop of over 8%.Coinglass dataData shows that $1.094 billion in market liquidations occurred in the past 12 hours, of which $1.021 billion were long positions; nearly 240,000 people were liquidated in the past 24 hours.

This decline was not triggered by a single negative factor, but rather by the simultaneous release of multiple factors at the same time.

Tensions in the Middle East have escalated sharply, and geopolitical risks have resurfaced in the market.

The sudden escalation of geopolitical risks was one of the earliest and most significant background factors factored into last night's market decline.

Latest reports indicate that the USS Abraham Lincoln aircraft carrier and its strike group have entered a state of "all lights out and communications cut off." This move is typically considered standard operating procedure before major military operations, leading the market to speculate that actions against Iran are entering a highly sensitive phase.

Meanwhile, Iran's stance has clearly shifted to a posture of military preparedness. Iranian First Vice President Aref, speaking about the regional situation, stated that Iran has maintained a state of military readiness since the current government took office and will not initiate war. However, if conflict is triggered, Iran will take a firm stance in self-defense, emphasizing that "the outcome of the war will not be decided by the enemy." He pointed out that preparations for a state of war must be made now.

Although the situation has not yet escalated into a substantial conflict,This state of being "highly opaque, unverifiable, and difficult to predict" is itself sufficient to influence market behavior.Against the backdrop of already tight liquidity and declining risk appetite, geopolitical uncertainties are being quickly priced in, prompting funds to reduce directional exposure rather than continue betting on highly volatile assets.

The FOMC's hawkish stance has been implemented, and liquidity expectations have been repriced.

The decline in the cryptocurrency market is still inextricably linked to the Federal Reserve.

At its January FOMC meeting, the Federal Reserve maintained its benchmark interest rate at 3.50% to 3.75%, and emphasized in its statement that the unemployment rate had stabilized and inflation remained at a relatively high level. While the statement itself did not significantly exceed market expectations, it effectively completed a "predictive conclusion" on a sentiment level.The market's previous vague hopes for short-term interest rate cuts or even a policy shift have been officially compressed or even eliminated.

For risky assets, such moments often don't manifest as new negative news, but rather as a situation where positive news can no longer be over-consumed. Since 2025, the multiple FOMC meetings that have led to Bitcoin pullbacks are a recurring example of this mechanism: it's not that policy has suddenly turned hawkish, but rather that the market has to acknowledge that liquidity won't arrive as expected.

When positions have already accumulated and leverage has already increased, this confirmation of the "shoe dropping" is enough to trigger risk release—it's not the first blow that topples the dominoes, but rather it causes all the already shaky structures to lose their support at the same time.

It's not just the cryptocurrency market that's declining; US stocks and precious metals are also experiencing a simultaneous reversal.

What is even more alarming is that this decline is not a "one-man show" for the crypto market.

In the US stock market, the decline in stock indices was a significant signal of weakening market risk appetite. The Nasdaq 100 fell by about 1.6%, the S&P 500 fell by about 0.75%, and the Dow Jones Industrial Average also fell by about 0.2%. All three major indices were under pressure, with the technology sector performing particularly poorly, dragging down overall market risk appetite.

Meanwhile, the precious metals market, traditionally considered a "safe haven asset," also experienced significant volatility. After its recent strong rally, gold prices saw a sharp pullback last night, with clear profit-taking occurring in the market; silver also retreated rapidly from its highs, with a significant decline. This indicates that funds are not simply shifting from risky assets to safe haven assets, but rather reducing overall risk exposure in a highly volatile environment.

When stocks fall, crypto assets come under pressure, and precious metals also pull back, the market signals are quite clear. Funds are simultaneously reducing exposure across multiple asset classes, and overall risk appetite is contracting rapidly.

In such an environment, Bitcoin naturally cannot remain unaffected.It has never been truly regarded as a safe-haven asset by the market, and due to its high volatility, it often becomes the first target for selling when sentiment turns to risk aversion.

Continued outflows from ETFs have significantly reduced the crypto market's ability to absorb new capital.

Changes in the money supply provided the final piece of the puzzle for this round of decline.

Data from Bitcoin spot ETFs shows that funds are continuously withdrawing.Data shows that in the past week alone, BTC spot ETFs have experienced continuous net outflows, with several days recording outflows exceeding $100 million.The cumulative net outflow has reached over US$1 billion.

More importantly, the withdrawal of ETF funds was not a one-time event, but rather...Continuous, multi-day, trend-driven reduction in holdingsThis means that institutional funds did not choose to "buy low and hold" during the pullback, but rather preferred to reduce overall risk exposure and wait for clearer macroeconomic and market signals.

In this funding environment, the market lacked a "buffer." When prices declined, ETFs failed to provide sustained buying power, and the market relied more on existing funds to absorb selling pressure. Once key price levels were breached, selling quickly took over, while buying was noticeably delayed, forcing prices to find new equilibrium through rapid declines.

It's not a black swan event, but rather a concentrated release of "forced risk reduction".

The recent decline in BTC was not triggered by a single sudden negative event, but rather by a comprehensive repricing of risk assets by the market due to the convergence of multiple risk factors. Escalating geopolitical uncertainty, revised macro liquidity expectations, and the lack of stable structural support in the crypto market amid continued net outflows from ETFs ultimately triggered a proactive "braking" action by the market.

When long-term funds and passive buying are absent, the market often forces trend-following strategies and leveraged funds to exit the market by breaking through key trend levels, thus completing the first stage of risk clearing. In this process, Bitcoin broke below the highly watched 100-week moving average (around $85,000), a level that has served as a "safety net" during corrections many times since last year and is also the default defense line for many trend models and leveraged positions.

In retrospect, the market has completed the first round of rapid deleveraging and sentiment clearing, but true stabilization still depends on two conditions: first, whether key technical levels can be recaptured and held; and second, whether risk capital is willing to return to the market and participate in pricing. Until then, high volatility and low confidence may remain the dominant themes for the foreseeable future.

No Comments