Author:Coin Gabbar

Arthur Hayes Buy ENA, PENDLE, and ETHFI Amid Crypto Market Volatility

Have you noticed a major crypto figure doing some big moves again? Arthur Hayes, one of the co-founders of BitMEX, bought huge amounts of Ethena tokens in addition to PENDLE and ETHFI

This Arthur Hayes buy ENA update, comes just weeks after he sold them, attracting the attention of traders and investors. Such moves often serve as signals to potential market trends, most especially in the highly volatile DeFi space.

Recent Token Purchases by Arthur Hayes

According to Onchain Data, Hayes withdrew 873,671 Ethena tokens worth $245,000 from Binance on November 26. He had earlier pulled over $1.4 million in tokens, including $572,000 in ENA, $590,000 in PENDLE, and $331,000 in ETHFI. Additional PENDLE tokens were received from Wintermute.

Source: X (formerly Twitter)

In just the past 30 minutes, he received 2.01M ENA ($571.6K), 218K PENDLE ($589.8K), and 330.99K ETHFI ($257.4K). These purchases highlight his focus on Ethereum-linked DeFi projects during shifting market conditions.

What This Means for the Defi Tokens

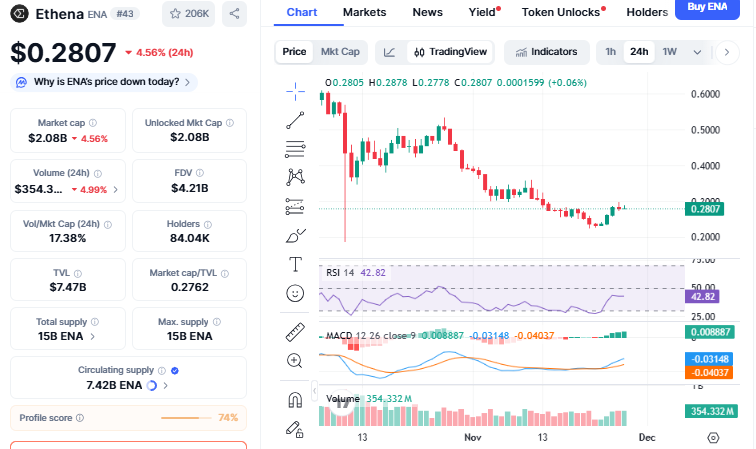

As per CMC Ethena's ENA token has been experiencing high volatality recently. The crypto has fallen 3.6% in the last 24 hours against the gain recorded across the broader cryptocurrency market.

Source: CMC

The decline could be traced to a whale sell-off amounting to 100M ENA ($28M) amid technical weakness shown by a bearish RSI divergence. $0.24 is crucial for support as it needs it to firm up and not decline further.

Pendle rallied 9.96% over the last 24 hours, driven by a $536K buy by Arthur. The protocol leverages yield tokenization, where traders can speculate on future yields.

ETHFI rose 3.24%, on the back of buybacks and institutional integrations, which gives viability to Ethereum-focused projects.

ENA Price Prediction

Looking at the above chart, the price might find some short-term support around $0.275–$0.280.

A push by bulls above $0.283 (resistance of 78.6% Fib) could see a recovery toward $0.30–$0.31.

On the downside, a break below $0.24 may trigger further declines because technical momentum remains mixed.

Traders should pay close attention to these levels for potential buying opportunities or risk management.

Lessons from Arthur Hayes’ Strategy

Arthur Hayes Buy ENA and other tokens is a clear indication of the necessity of monitoring more than active whale moves. The moves of Hayes are usually those that give one a glimpse into the areas of DeFi that can potentially grow. Investing in the Defi tokens at the same time shows that there is a concrete strategy that is focused on Ethereum projects.

Retail investors can definitely learn a lot from the movements of the big players in their market research and understanding, though this is not a sure way to make money.

Conclusion

Arthur Hayes purchase is a clear sign that there is still interest in Ethereum-based DeFi projects.

The actions of the whale can either change people's opinions and create short-term volatility or provide direction for the market. Investors must scrutinize these moves, as the risk/reward ratio in the crypto space is ever-changing.

Disclaimer: This article is for information purposes only, kindly do your own research before investing in crypto markets.

No Comments