Author:Wall Street CN

2026 may be the turning point when AI inference workloads surpass training workloads.

According to a recent research report released by the Vivek Arya analyst team at Bank of America, as reported by the trading platform TrendFin.Despite concerns about funding, valuations, and interest rate volatility, continued growth in AI capital expenditures is driving strong performance in the chip sector, while the industry focus is shifting from training to inference, which can truly deliver returns on investment.Bank of America stated thatOf the projected $1.2 trillion in AI capital expenditures by 2030, inference may eventually account for the majority, or up to 75%.

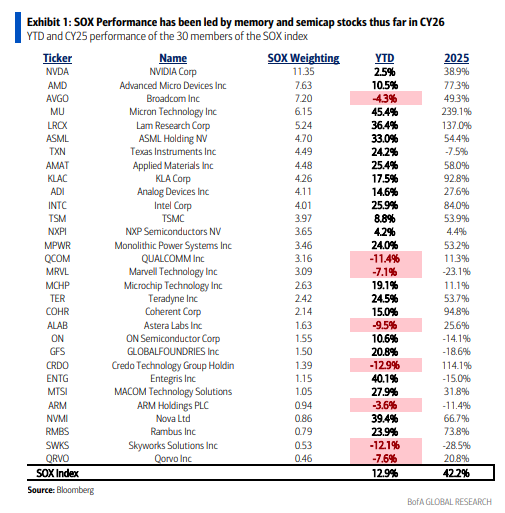

Despite numerous concerns about AI funding, valuations, and interest rate volatility, chip stocks have had a solid start to the year. The Philadelphia Semiconductor Index (SOX) is up about 13% year-to-date, marking its second-best January performance in the past 20 years, far exceeding the S&P 500's mere 1% gain. Notably, this rally is not driven by computing giants Nvidia and Broadcom, but rather by memory chip, semiconductor equipment, and analog chip manufacturers.

The AI capital expenditure statements from hyperscale cloud service providers have injected confidence into the market. These companies emphasized three points: AI investment is crucial to maintaining double-digit growth; sales growth could have been even higher without supply constraints; and there is no evidence of a "bubble." Bank of America Securities expects computing stocks to regain momentum based on these positive signals.

This narrative shift will create differentiating opportunities for various types of chip suppliers, with a range of silicon solutions, from GPUs and CPUs to ASICs, finding their place in the inference market, while also having a lasting impact on storage and semiconductor device suppliers.

Inference workloads are entering a turning point.

Inference is a crucial step in realizing the return on investment in AI, requiring a range of chip solutions optimized for both cost and performance. According to Bank of America Securities analysis,While training remains important, 2026 may mark the year that inference becomes a much larger workload, ultimately accounting for the majority, or 75%, of the $1.2 trillion AI capital expenditure projected by 2030.

In this transformation, Nvidia maintains its leading position with the broadest product pipeline, covering training (Blackwell, Vera Rubin) and inference (Rubin CPX, Groq, Vera CPU), and possesses a supply guarantee advantage. Broadcom maintains strong partnerships with Google and Anthropic and has gained new opportunities with OpenAI, Apple, and xAI. Bank of America Securities believes that market concerns about the risks of Google's in-house technology (COT) have been exaggerated, leading to an excessive decline in Broadcom's stock price.

AMD, a reliable second supplier of general-purpose chips for Nvidia, saw its stock price fall on Friday due to excessive market concerns about TSMC's 2nm process, but Bank of America Securities believes the process is still on track. Opportunities persist for memory and semiconductor equipment suppliers, although volatility may increase after the recent surge.

The demand for optical connectivity is real, but the increase is excessive.

Optical transceiver and component suppliers were the strongest performers in the chip sector, second only to memory chips.

As AI clusters grow in size and bandwidth demands, the necessity of increasing optical connectivity is undeniable. NVIDIA's upcoming photonic switches (a webinar will be held on February 3rd alongside LITE's earnings release this week, with COHR also announcing its results at the same time) are potential catalysts, while Marvell's acquisition of Celestial AI has further amplified market interest in new optical architectures.

However, it's worth noting that, aside from Meta, there is limited evidence of interest from hyperscale cloud service providers in co-packaged optics (CPO) due to its higher operational complexity and the shift of more bill of materials control to Nvidia and Broadcom. According to leading industry analysis firm Lightcounting, CPO sales are projected to account for only about 1% (approximately $500 million) of the $46 billion Ethernet transceiver market in 2026/27. Copper cabling remains relevant, and a buy recommendation is given for CRDO, a leader in active cable.

~~~~~~~~~~~~~~~~~~~~~~~~

The above exciting content comes from

For more detailed analysis, including real-time updates and firsthand research, please join [the group/group].

No Comments