Author:Wall Street CN

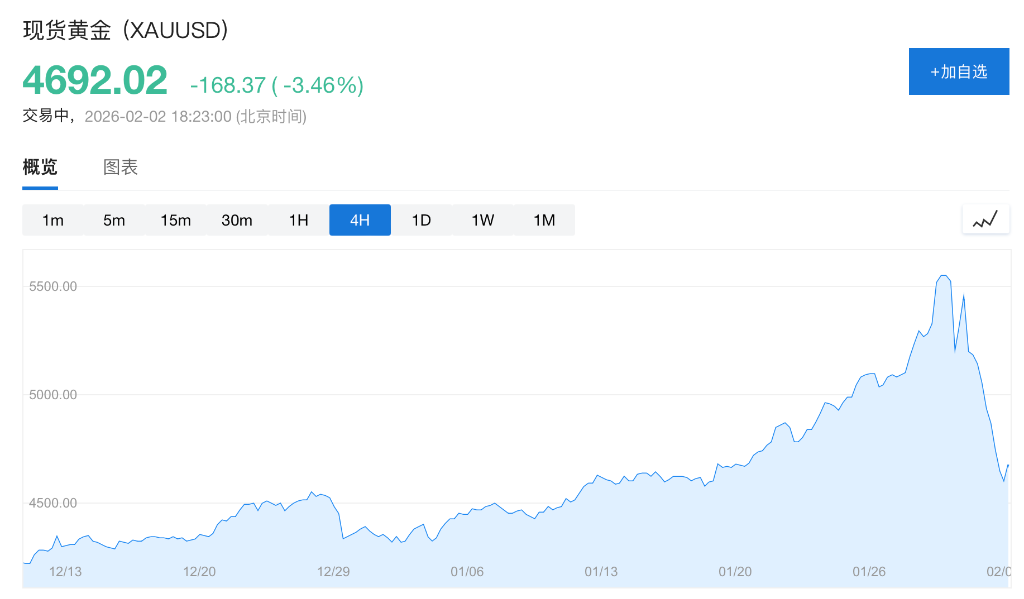

Despite a more than 20% pullback in gold prices from last week's record high, retail investors' enthusiasm for buying gold has bucked the trend and increased.

According to media reports on February 2, the gold trading lounge at the headquarters of United Overseas Bank in Singapore was packed with people.Many investors lined up at the counter to buy physical gold.This bank is the only financial institution in Singapore that offers physical gold products to retail customers. Ng Beng Choo, a 70-year-old retiree, had been waiting for over six hours after taking her number at 9:30 AM. She stated:

"Gold prices fell today, so I'm buying."

The sell-off that lasted until Monday pushed gold prices down to around $4,400 an ounce, but there was no panic selling at the retail level. Instead, there was a significant "buying on dips" trend.Analysis indicates that this reflects continued long-term confidence in gold in the retail market, with investors generally believing that the core logic driving gold prices upward remains unchanged:On the one hand, policy uncertainty under the Trump administration in the United States persists; on the other hand, investors are still seeking assets to hedge against currency devaluation and sovereign bond risks, and gold's "safe-haven" properties remain favored.

Physical gold stores are experiencing a buying frenzy.

According to media reports, the gold trading area at the headquarters of United Overseas Bank (UOB) in Singapore experienced unprecedented crowding. Due to a surge in customer demand, the entire product line of MKS PAMP SA, a globally renowned gold bar brand, sold out that day, with some latecomers unable to purchase physical gold. Notices have been posted around the bank stating:

"Due to overwhelming demand, all queue numbers for today's purchase have been issued. Thank you for your patience."

The report states that similar scenes were playing out simultaneously in Sydney. Outside the ABC Bullion store near Martin Place, queues stretched from inside the store onto the street. A male investor in his early twenties, who identified himself only as Alex, said that despite "significant losses" in the market last Friday, he chose to continue buying gold bars, adding, "Tomorrow will be a new day." Even during periods of sharp gold price fluctuations, some retail investors still view physical gold as a long-term asset rather than a short-term trading instrument.

Market Logic Behind the Plunge

Driven by macroeconomic factors such as the Trump administration's restructuring of the geopolitical landscape and pressure on the Federal Reserve, gold's long-term upward trend accelerated significantly last month. However, the market experienced a sharp reversal last Friday, with selling pressure continuing into Monday, and gold prices falling more than 20% from their previous historical highs.

Bloomberg data shows thatThis sharp drop was mainly triggered by institutional traders liquidating previously crowded bullish positions.In stark contrast, retail investors generally view price pullbacks as buying opportunities, and demand for physical gold has bucked the trend and increased in several markets.

In a report released on Monday, Deutsche Bank reiterated its long-term target of $6,000 per ounce for gold, emphasizing that the core logic driving the current gold price increase, including policy uncertainty, sovereign credit risk, and currency revaluation, has not changed substantially. This assessment also supports the continued bullish sentiment in the retail sector.

No Comments