hoeem

币圈小白

14h ago

Follow

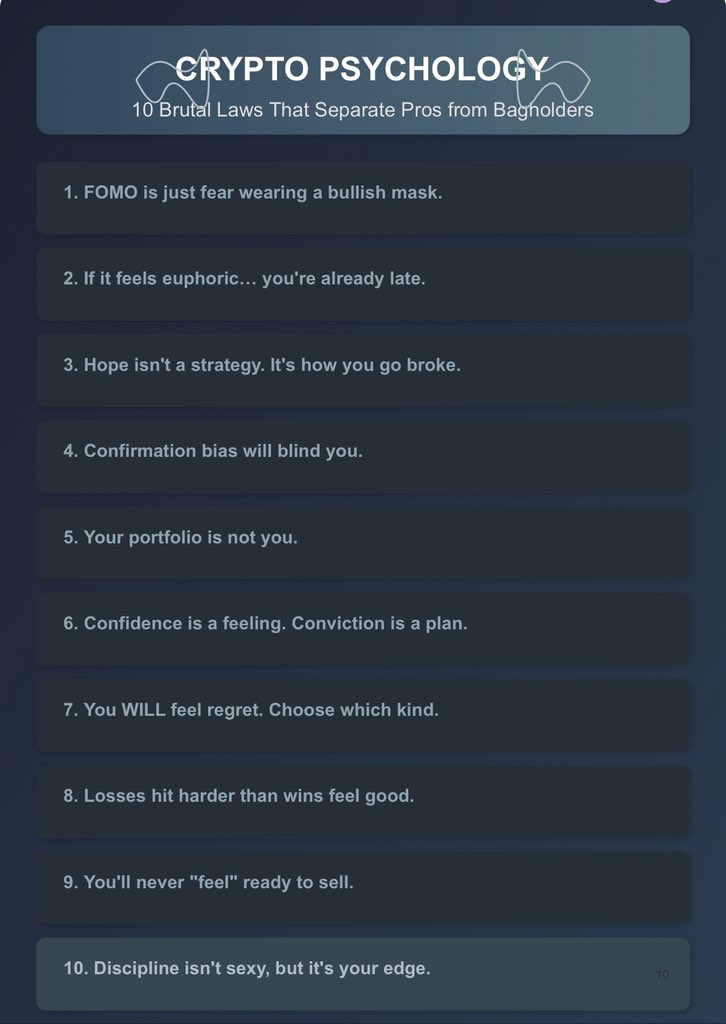

Crypto Psychology: Ten Cruel Laws to Separate Professionals from Baggage Holders

If you don't master your mind, the market will tear it apart.

Save this and read it before APE. ↓

1: FOMO is just afraid to wear a bullish mask.

You are not optimistic, but you are afraid to miss the next pump.

Example: Bitcoin is close to $100,000 in the second half of 2024. Retail chase.

advantage? They've already spinned.

FOMO keeps you late. Discipline keeps you rich.

2: If people feel happy... you are already late.

When everyone agrees to be higher, probably not.

During the "Trump Meme Pump," it goes from $7 to $90, and then people say it will flip Mano and Melania will flip wet.

Retail is in a hurry. Sold to them the smart money.

Course: Euphoria = Exit.

3: Hope is not a strategy. How it went bankrupt.

“I only hold it for a longer time…”

That's not belief - emotional paralysis.

There are multiple guys who forwarded $500→$10K.

Hold "Only One Run".

Lost most of it.

4: Confirmation bias will turn a blind eye to you.

If you are just looking for bullish tweets about bags, then you are not a trader, then you worship.

Many people overlooked the $luna red flag in 2022, and many did the same with other cryptocurrencies in 2025.

Be blinded by hope.

Find the truth, not the comfort.

5: Your portfolio is not you.

If your identity is associated with your net worth...

You will make desperate, emotional decisions.

This can cause the helical spiral to fall off and zero it all.

It's hard to write it down because it's the most extreme case, but it's a sad reality.

I saw a member trader taking his life in his livelihood and now bothering me.

He lives in pain and I hope some kind of intervention can save him.

His portfolio became his identity and I'm sure he's struggling elsewhere in his life, and it's his only option.

Please, if you have this way to seek professional help even if you may feel the only option is absolutely not.

6: Faith is a feeling. Conviction is a plan.

If you can’t explain your position without emotions, you won’t be convicted. You are gambling.

Most lost traders show high confidence and low clarity.

Reminder: Strong opinions require a stronger system.

7: You will regret it. Which one to choose.

Unfortunately, it sold too early...

Or regret it for too long.

You won't skip regrets.

But you can choose which version to use with.

The cycle after the cycle is the fork on the road, allowing people to stabilize steadily until the right portfolio is with a highly volatile portfolio.

8: Loss is more difficult than victory.

A 40% shrinkage feels great than a 10x damage.

How its brain connects.

Traders holding 100x coins to -90% drop never recovered emotionally.

Don't chase high, but fix the bag.

9: You will never “feel” for sale.

You'll think: "Only one leg."

You will tell yourself, “I will know when.”

You won't.

Winners exit through the program.

The loser panicked.

10: Discipline is not sexy, but its advantages.

There is nothing to replace it.

Best performers in 2025

BTC

0%

APE

+1.64%

Risk and Disclaimer:The content shared by the author represents only their personal views and does not reflect the position of CoinWorld (币界网). CoinWorld does not guarantee the truthfulness, accuracy, or originality of the content. This article does not constitute an offer, solicitation, invitation, recommendation, or advice to buy or sell any investment products or make any investment decisions

0

49

0

23

0

No Comments