Hardcore! Important concepts that investment novices must understand

Investing is an art and a science.

For investment novices, understanding some core concepts is crucial.

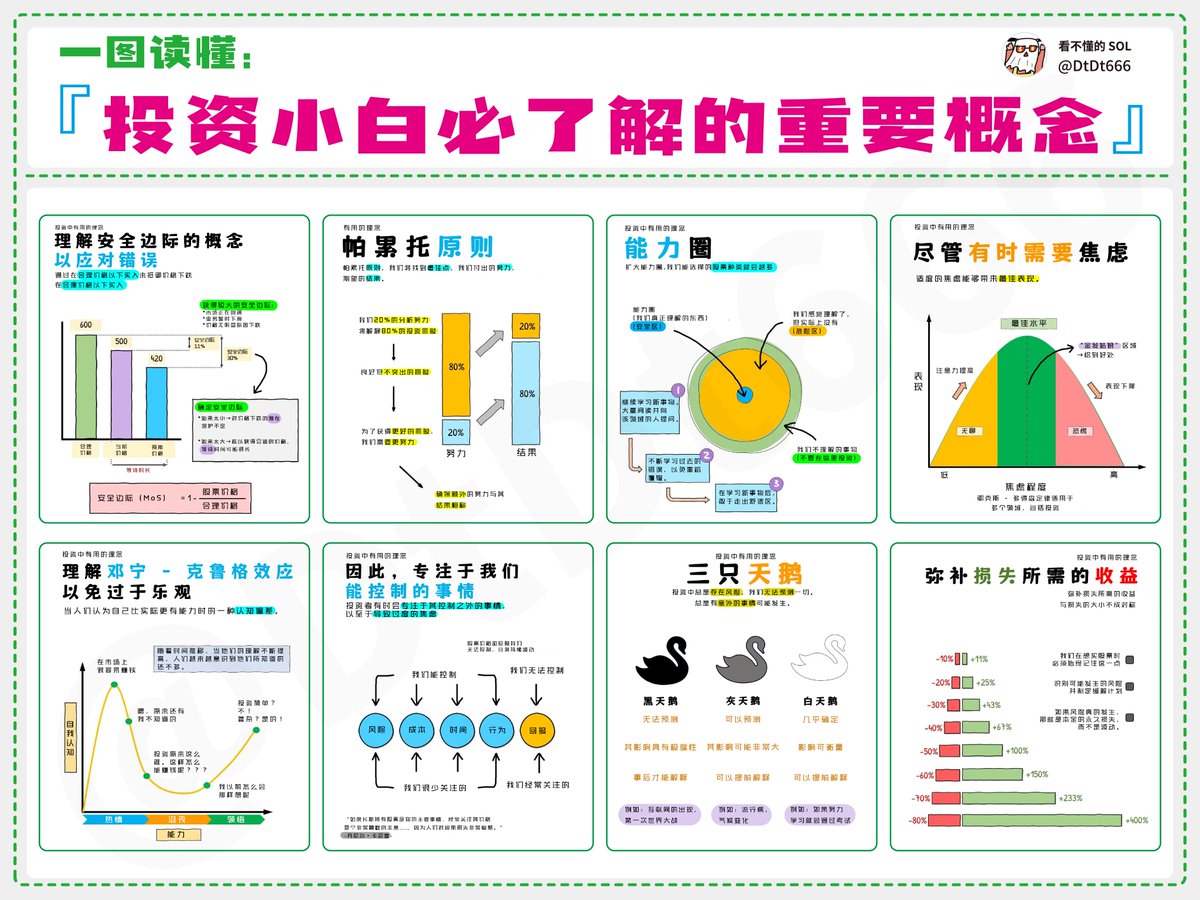

This picture is specially compiled to showcase several key investment concepts:

🔺Three swans: Black swan, gray swan and white swan represent unpredictable events, predictable but neglected events and almost certain events, respectively.

🔺Margin of Safety: In investment, understanding the concept of the margin of safety can help us avoid losses and ensure the robustness of investment.

🔺Pareto Principle: 80% of the results often come from 20% of the reasons, which reminds us to focus on areas that can bring the most benefits when investing.

🔺Ability Circle: Understanding your ability boundaries and focusing on the areas you are good at can improve the success rate of your investment.

🔺Anxiety Management: You will inevitably encounter anxiety in investment. Learning to manage emotions and stay calm is the key to successful investment.

🔺Dunning-Kruger effect: Understanding one's cognitive level and avoiding overconfidence can help us make more rational investment decisions.

🔺The benefits required to make up for losses: Understanding the proportion of benefits required to make up for losses can help us better manage risks.

Investing is not just about making money, but also about understanding and managing risks. Hopefully these concepts will help brothers go further on the road to investment.