帝哥论区块

币圈小白

Follow

The current progress of XRP-related ETFs shows three core contradictions:

The news disturbance continues

Last week, XRP rose by 5% due to the "SEC approved spot ETF" news, but was immediately defeated.

Currently, only 4 XRP leveraged ETFs in the US market (3 times long/short), and spot ETFs are still in a "zero breakthrough" state. This information difference game is exactly the "testing method" commonly used by the main funds.

Global regulatory differentiation intensifies

The Brazilian Securities Regulatory Commission rushed to launch the world's first XRP spot ETF on April 25, and CME also announced the launch of XRP micro futures (contract face value 0.1 coins) on May 19. But it should be noted that the average daily trading volume of Brazilian ETFs is only US$3.2 million, and its liquidity is far less than that of the US market;

The launch of CME futures is more likely to provide hedging tools for institutions rather than spot ETFs. Currently, the SEC still implements a "substantive compliance review" for crypto assets, and XRP needs to first solve the historical problems of "security attributes".

Copyright season hype is heating up

With more than 70 altcoin ETF applications piled up on the SEC desk, the market began to bet on the regulatory shift of new chairman Gensler.

XRP has become a "barometer of policy relaxation" due to litigation, but beware:

Historical data shows that the first Bitcoin spot ETF was approved in three months, and the average retracement of related concept coins was 27% (refer to the GBTC transformation period in 2023). The current concentration of XRP holdings reached 68% (the proportion of the top ten addresses), and there is a risk of market makers controlling the market.

Ecological comparison perspective:

If XRP (market value of 134.5 billion) is benchmarked against SOL (76.9 billion):

SOL Eco TVL has reached 8.2 billion (XRPLedger is only 470 million), and the number of DeFi protocols is 9 times the institutional configuration angle of XRP ecosystem. The SOL circulation market value/FDV ratio is 0.32, which is significantly lower than XRP’s 0.47, which means a smaller risk of selling pressure.

If both related ETFs are passed, SOL may have more outstanding future growth potential due to its relatively low market value and ecological advantages.

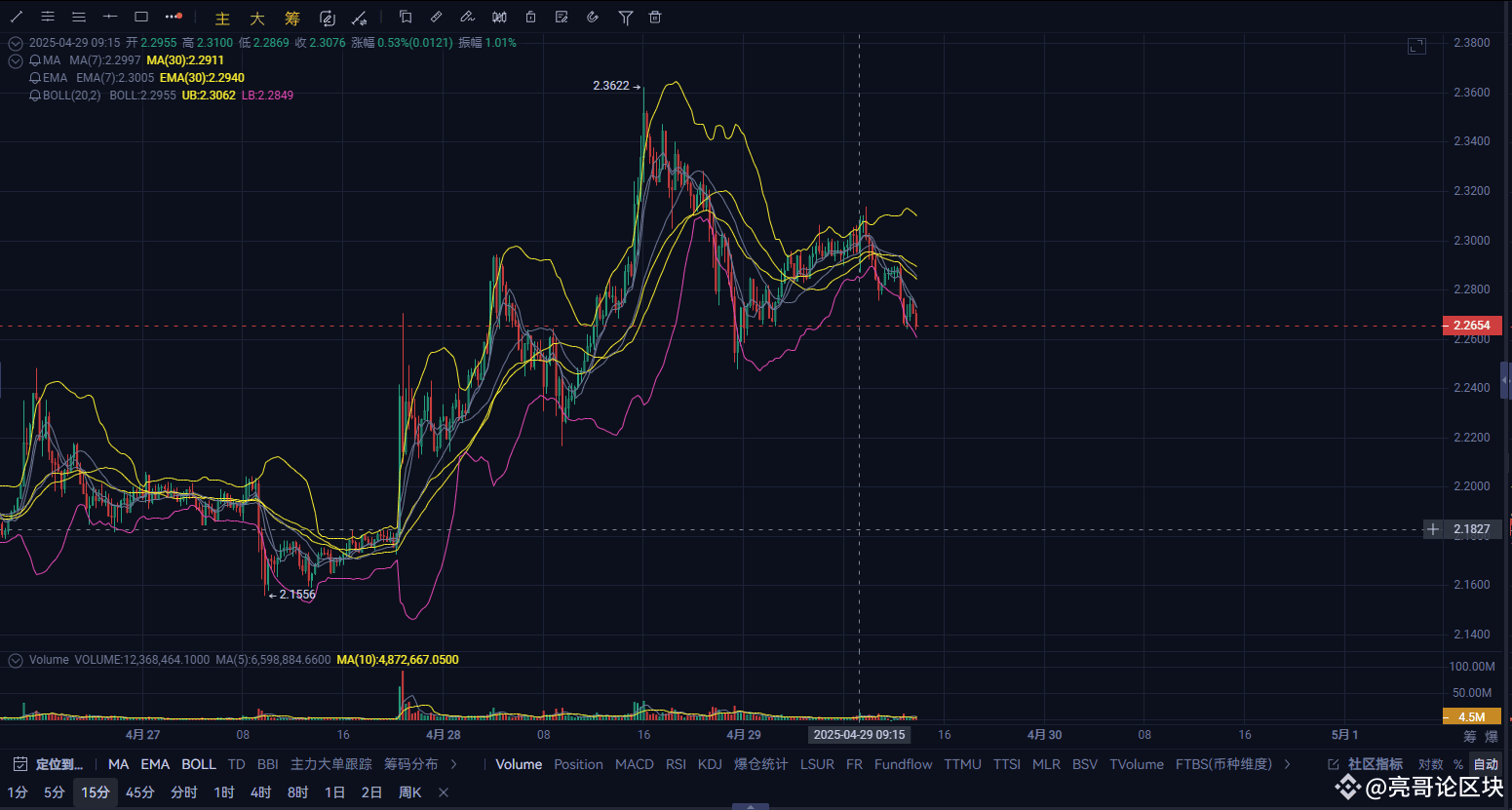

Judging from the current situation, the copycat season is about to usher in signs of explosion. (Focus on the two coins recommended above, $XRP $SOL) spot players can enter the market with a light position. Fans who need suitable points will find Brother Liang to give you accurate entry points, targets and stop losses!

#Trump tax reform #US stock financial report week is coming #AI concept coins lead #Strategy increases Bitcoin #crypto market rebounds

BTC

-1.42%

XRP

-5.97%

SOL

-4.67%

Risk and Disclaimer:The content shared by the author represents only their personal views and does not reflect the position of CoinWorld (币界网). CoinWorld does not guarantee the truthfulness, accuracy, or originality of the content. This article does not constitute an offer, solicitation, invitation, recommendation, or advice to buy or sell any investment products or make any investment decisions

0

32

0

31

0

No Comments