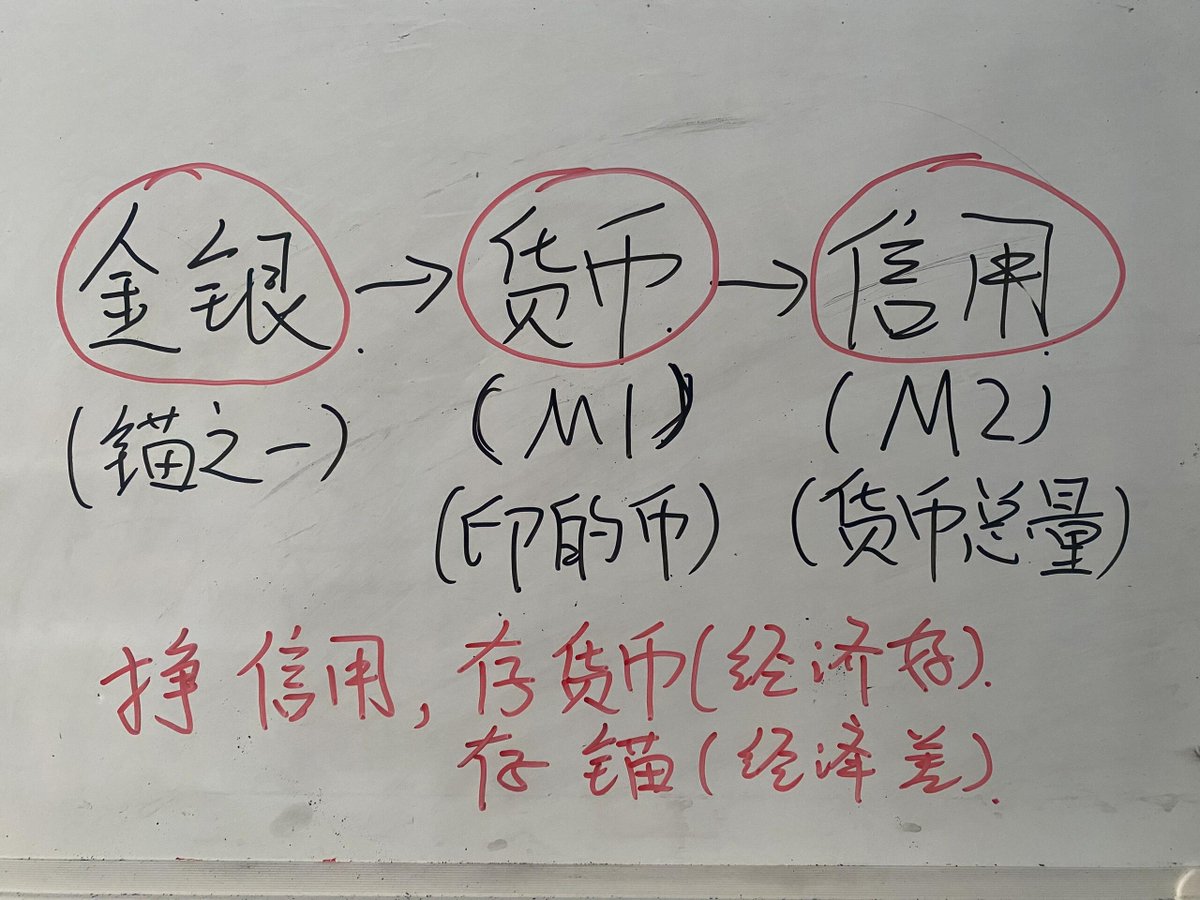

Many brothers asked me, what is the relationship between gold, silver, currency and credit? What are M1 and M2?

First of all, gold and silver: it is one of the anchors of currency, and before it was the only anchor, so in the past, gold and silver = currency, so there is the classic saying "Gold and silver are born with money, and currency is not necessarily gold and silver."

Currency: Also called M1 in China, it is the real printed money.

Credit: In fact, what is really circulating in the market is credit, which is actually debt. What about the currency? All currency exists in banks. The market circulates the liabilities M2 released by banks based on M1. The money you make is actually the liabilities of one party. There is also a classic saying that corresponds to "one party has a surplus, the other party's debt."

In market circulation, you will think that this is a thing, and the purchasing power is the same, but in fact these three are obviously different.

A normal market will ensure that the credit is reasonable and abundant. Since what you earn is credit, if there is a surplus (the general market will try hard not to leave a surplus, high wages, high interest rates, low wages, low prices, low interest rates), then you must deposit upstream, that is, either deposit currency M1 or deposit gold and silver (or other anchors, but ordinary people may only be able to access gold and silver).

Because we were in this economic cycle before, we basically had money in stock, because of the economic growth and the demand for money is large. But if it is a counter-cyclical period, then there will be anchors, because the demand for money is low, so the interest rate will definitely drop. Although the growth rate of M1 is also declining, M2 will not decrease in maintaining normal social circulation, and will even increase, that is, the increase of M2 is greater than M1, or in other words, the debt M2 is greater than the balance M1.

Because of the correspondence between the three, M2 is greater than M1 in the countercyclical situation, and M2 corresponds to indiscriminate labor, which will inevitably lead to the value of M1 and the decline in the value of M1 will be reflected in the nominal price increase of the anchor.

Therefore, money is deposited in procyclical times and gold and silver are deposited in countercyclical times.

If there is still a surplus.