$ETH Intraday technical solution: long-short game strategy in oscillating consolidation

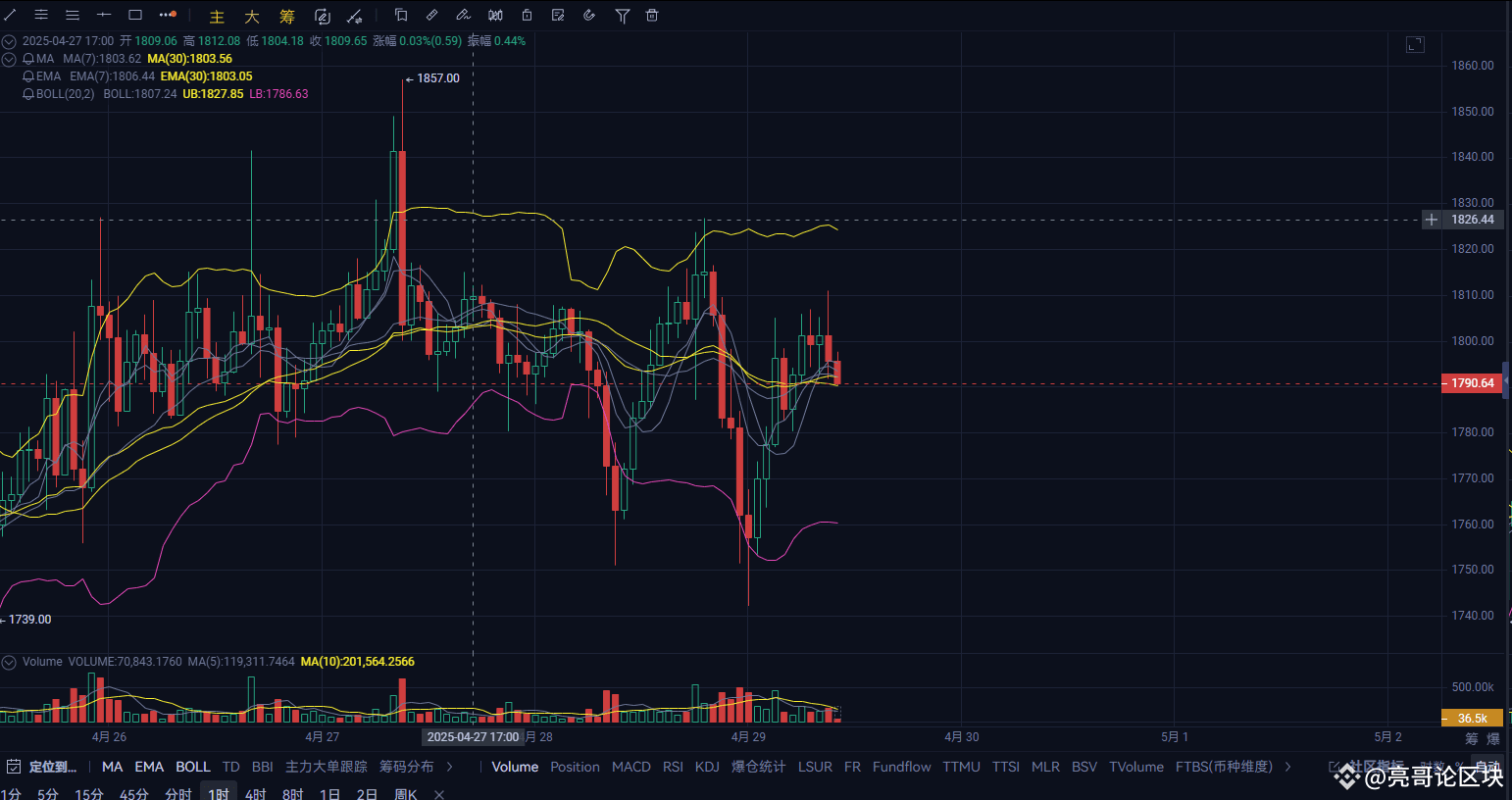

Ether followed market sentiment to $1,800 in the morning and encountered short suppression, with a minimum pullback of $1,740 and closed around $1,790 in the late trading. The current disk shows three major technical characteristics:

Daily level pressure verification

The ether attacked three times in a row at the 1800 integer mark but failed, forming a typical "triple top" pattern, with obvious pressure on the upper trap plate.

However, it should be noted that each time the low point is gradually rising (1720→1740→1760), it shows that the bulls are building a defensive position.

Index divergence signal

The RSI indicator rebounded from the 25-oversell zone to 42, forming a bottom divergence from the price, suggesting that there is a short-term demand for technical corrections.

However, the MACD energy column is still in a shrinking state, and it takes a wait for the trading volume to increase to more than 1.5 times the daily average (currently about US$8.5 billion).

Key forms evolution

The Bollinger Band Channel narrows to the range of 1720-1820 (bandwidth compression 37%), which usually indicates that the price will choose a breakthrough direction.

The hourly chart shows a combination of "five consecutive positives + cross stars", the K-line entity shrinks step by step and the upper shadow line grows, indicating that the bulls' offensive momentum weakens, and there may be a pullback test in the short term to support demand.

Operation strategy:

Radical: try long in the 1760-1770 area, set the stop loss at the bottom of the 1740 and the target is 20 to see the breakthrough situation of 1800

#Trump suspends new tariffs #Trump tax reform #Strategy increases Bitcoin #crypto market rebounds #AI concept coins lead