作者:RomuloNevesOf

Cryptocurrency Hacks in April 2025: $357.11 Million in Losses and Lessons for DeFi Traders

Introduction

In April 2025, the cryptocurrency industry faced a severe security crisis. Blockchain security firm PeckShieldAlert reported a total of 18 major hacking incidents during the month, resulting in losses amounting to $357.11 million.

This figure not only underscores the fragility of the decentralized finance (DeFi) ecosystem but also serves as a wake-up call for cryptocurrency traders and blockchain researchers.

Despite the significant losses, projects such as @zksync, @KiloEx_perp, and @term_labs successfully recovered $14.4 million in stolen funds through swift responses and bounty programs.

Overview of April Hacking Incidents

According to a report released by PeckShieldAlert on May 6, 2025, April saw 18 major hacking incidents, with cumulative losses of $357.11 million.

The largest single attack involved an unauthorized transfer of $352.07 million in Bitcoin, accounting for the vast majority of the month's total losses. Additionally, attacks targeting projects like @KiloEx_perp, Loopscale, @zksync, and MorphoLabs garnered widespread attention. Below is a detailed analysis of the top five hacking incidents of the month:

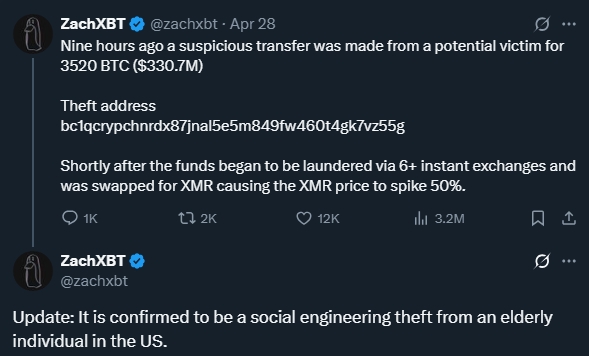

Unauthorized Bitcoin Transfer ($352.07 Million)

l Date: April 28, 2025

l Loss Amount: $352.07 million (3,520 BTC)

l Incident Details: An elderly U.S. citizen lost $352.07 million in Bitcoin due to a social engineering attack, marking it the fifth-largest cryptocurrency hack in history. The attacker gained access to the victim’s wallet private keys through a carefully orchestrated scheme, subsequently laundering the funds via instant exchanges and converting them to Monero, making recovery extremely challenging.

l Impact: This incident exposed vulnerabilities in personal wallet private key management, particularly for investors lacking multi-signature or cold storage measures. Long-term holders must prioritize secure storage solutions.

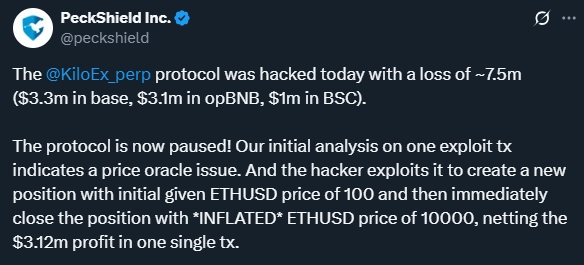

KiloEx_perp Price Oracle Attack ($7.5 Million, Recovered)

l Date: April 14, 2025

l Loss Amount: $7.5 million

l Incident Details: Decentralized perpetual futures exchange KiloEx suffered a $7.5 million loss across the Base, opBNB, and BSC chains due to a price oracle manipulation attack. The attacker drained liquidity pools by manipulating token prices, but the project team successfully recovered all funds through negotiations with the hacker, paying a 10% bounty.

l Impact: This incident highlighted the risks of DeFi platforms relying on single oracles. The security of price oracles is critical to protocol safety, and projects should adopt multi-source oracles or decentralized data validation mechanisms to mitigate similar risks.

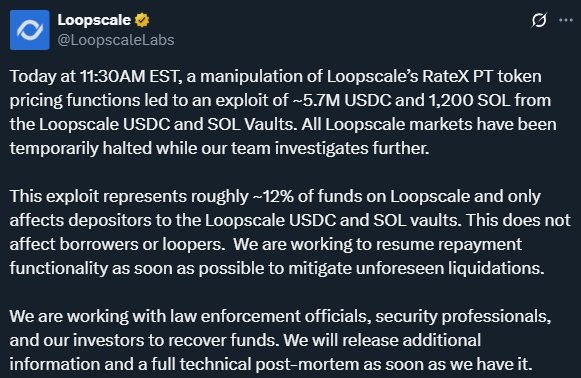

Loopscale Exploit Attack ($5.8 Million)

l Date: April 26, 2025

l Loss Amount: $5.8 million

l Incident Details: Solana-based DeFi lending protocol Loopscale, only weeks after its launch, was attacked, resulting in a $5.8 million loss. The hacker exploited a low-collateral loan vulnerability, draining USDC and SOL liquidity pools and causing a temporary market suspension. Recovery efforts are ongoing.

l Impact: The incident exposed deficiencies in risk management and smart contract audits for newly launched DeFi projects. Loopscale’s case serves as a reminder for developers to conduct comprehensive stress testing and vulnerability scans before launch to ensure protocol robustness.

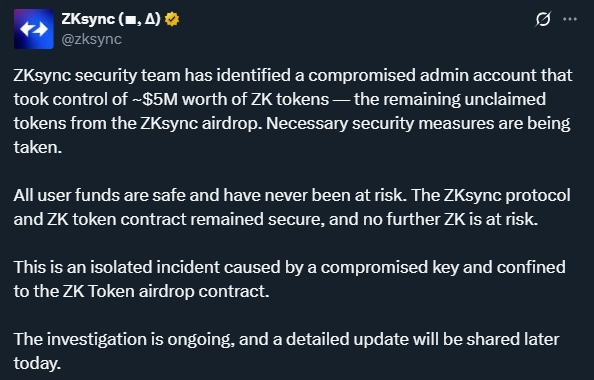

Zksync Token Minting Attack ($5.4 Million, Recovered)

l Date: April 15, 2025

l Loss Amount: $5.4 million

l Incident Details: Ethereum Layer-2 protocol ZKsync suffered a $5.4 million unauthorized ZK token minting attack due to a compromised admin account. The attacker exploited the sweepUnclaimed() function to drain airdrop reserves, but through negotiations, the protocol recovered the funds, paying a 10% bounty.

l Impact: This incident underscored potential vulnerabilities in Layer-2 protocols’ permission management. Admin account security and permission allocation require stricter controls to prevent similar attacks. The successful use of white-hat incentives offers a valuable lesson for the industry.

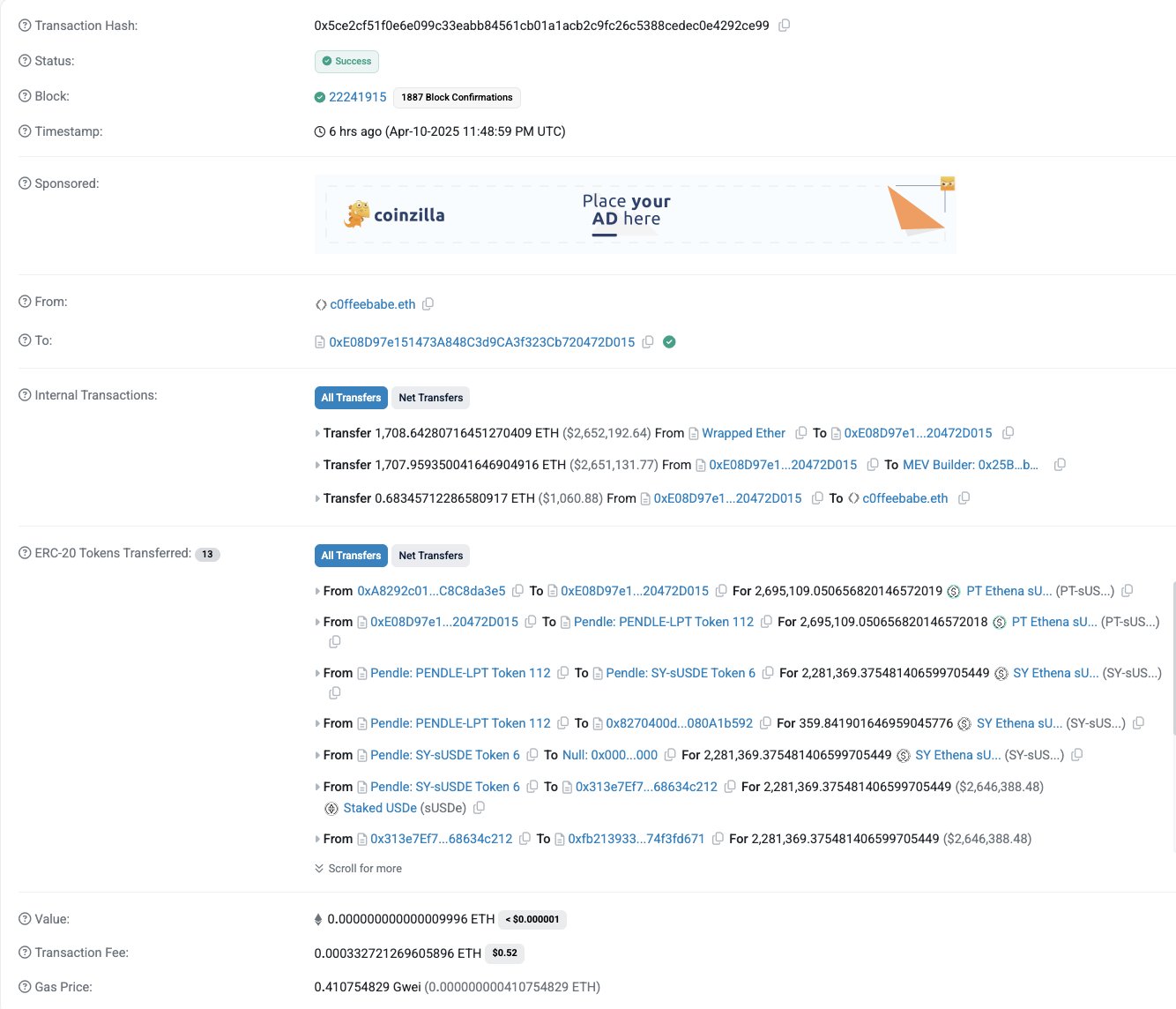

MorphoLabs Frontend Attack ($2.6 Million, Intercepted)

l Date: April 11, 2025

l Loss Amount: $2.6 million (potential loss)

l Incident Details: DeFi lending protocol MorphoLabs faced a potential $2.6 million loss due to a frontend update error. White-hat hacker c0ffeebabe.eth detected the anomaly through real-time monitoring and intercepted the attack, preventing fund losses. The incident benefited from the protocol’s real-time system, averting a larger-scale loss.

l Impact: The complexity of frontend attacks highlights the need for enhanced code reviews and real-time monitoring. As the user interaction entry point, frontend security directly impacts a protocol’s overall defense capabilities.

Recovery Efforts and Industry Response

PeckShieldAlert's report noted that @zksync, @KiloEx_perp, and @term_labs collectively recovered $14.4 million in stolen funds, with KiloEx recovering $7.5 million and ZKsync recovering $5.4 million. These successes relied on the following key measures:

Bounty Programs: By offering hackers a 10% bounty, projects incentivized fund returns, effectively reducing recovery costs. This approach proved highly effective in the cases of KiloEx and ZKsync.

White-Hat Intervention: In MorphoLabs’ case, timely action by a white-hat hacker demonstrated the importance of community collaboration in crisis response. White-hat hackers, through real-time monitoring and rapid response, serve as a critical line of defense for DeFi security.

Swift Response and Negotiation: Projects that quickly responded to attacks and negotiated with hackers prevented further fund laundering. This efficient crisis management played a pivotal role in April’s incidents.

These measures provide valuable lessons for the DeFi industry. The success of bounty programs and white-hat interventions shows that community collaboration and transparent communication can significantly reduce losses during crises.

Lessons for Cryptocurrency Traders

The April hacking incidents offer critical lessons for traders passionate about meme coins, Bitcoin, and Ethereum:

Prioritize Security: Whether for personal wallets or trading platforms, security is paramount. Traders should choose platforms that support multi-signature, real-time monitoring, and decentralized validation to reduce the risk of asset theft.

Recovery Potential: Bounty programs and white-hat interventions demonstrate that losses are not always permanent. Traders should evaluate a project’s crisis response capabilities and community trust, opting for platforms with rapid response mechanisms.

High Risks of Meme Coins: Due to their high volatility and speculative nature, meme coins are prime targets for hackers. Traders engaging in meme coin trading should thoroughly research project backgrounds, on-chain data, and social media dynamics to identify potential risks.

These lessons remind traders to remain vigilant about risks while pursuing high returns. Selecting platforms that are thoroughly audited and transparent is the first step in protecting assets.

Future Trends and Industry Outlook

As the DeFi industry grows rapidly, the complexity and frequency of hacking attacks are likely to increase. Moving forward, the industry must focus on improvements in the following areas:

Smart Contract Security: Comprehensive audits, formal verification, and real-time monitoring can reduce smart contract vulnerabilities. New projects, in particular, should undergo multiple independent audits before launch.

Decentralized Data Validation: Decentralized price oracles and data sources can effectively mitigate manipulation risks. Multi-source oracles and on-chain validation mechanisms will become standard for DeFi protocols.

Community Collaboration and Transparency: The success of white-hat hackers and bounty programs highlights the importance of community collaboration in enhancing industry security. Projects should establish open communication channels and encourage white-hat hackers to participate in security testing.

Additionally, the application of artificial intelligence and big data analytics in risk assessment and trading optimization will become a trend. By automating the analysis of on-chain data and market behavior, traders can more efficiently identify high-risk assets and develop strategies.

Conclusion

The 18 cryptocurrency hacks in April 2025, resulting in $357.11 million in losses, highlight the security challenges facing the rapidly evolving DeFi ecosystem. While @zksync, @KiloEx_perp, and @term_labs successfully recovered $14.4 million, the industry must continue to advance in smart contract security, data validation, and community collaboration.

For investors passionate about cryptocurrency trading, April’s incidents serve as a stark reminder: while pursuing high returns, selecting secure and transparent trading platforms is critical.

Looking ahead, as technology advances and industry standards improve, DeFi is poised to strike a better balance between security and innovation. Traders and practitioners should remain vigilant, continuously learning to navigate the challenges and opportunities of this dynamic industry.

No Comments