Source: Coinbase; compiled by Deng Tong,

summary

Bitcoin appreciated sharply against gold this week, indicating that the token could go its own way in the global financial markets.

The growing popularity of Bitcoin in the corporate finance department is building an important moat for the token, and Twenty One Capital is the latest example of this dynamic.

Market Overview

We rarely witness the market turning point in real time, because we often recognize major institutional changes only after time and reflection. But to put it as a well-known proverb, nothing happened in decades, and decades happened in a few weeks.Bitcoin’s performance this week is decoupled from the performance of traditional macro assets.We have pointed out before,Bitcoin has outperformed U.S. stock markets in recent weeks, but this became even more obvious after President Trump expressed his dissatisfaction with Fed Chairman Jerome Powell on April 17. Affected by this, the stock market fell by nearly 2 standard deviations, while Bitcoin remained firm.

More importantly,This week we saw Bitcoin appreciate sharply against gold – and gold’s trend is usually inversely proportional to the U.S. dollar and U.S. Treasury yields – suggesting that Bitcoin may go its own way in the global financial markets.In fact, as the existing global economic order is eroded, Bitcoin’s return distribution seems to be increasingly consistent with gold rather than risky assets. Of course, it is too early to infer the trend based on performance in a few days or weeks, as the tariff deadlock between the United States and China means that the market is still very driven by headlines. Although President Trump's attitude on trade barriers has eased, he said he is working to reach an agreement with China.

We believe thatThis divergence highlights the mature role of Bitcoin as a store of value asset – an increasing number of institutional and retail investors believe that Bitcoin can withstand the macroeconomic forces that affect risky assets more widely.Unlike multinational stocks, for example, Bitcoin’s value proposition does not rely on supply chain disruptions or tariff negotiations. It has global, liquid, politically neutral and resistant to capital controls – characteristics that resonate in an era of fiscal dominance and geopolitical uncertainty.

at the same time,Bitcoin’s adoption rate in the corporate finance department continues to increase, building an important moat for the token, Twenty One Capital is the latest example of this dynamic. The new company is backed by affiliates of Tether, Bitfinex, SoftBank and Cantor Fitzgerald and is led by Strike’s founder and CEO Jack Mallers. The company initially set to hold 42,000 bitcoins, accounting for about 8% of the amount of bitcoins Strategy currently holds. Recall that Strategy is trading at a higher price than its holdings of 538k Bitcoin, partly because it uses leverage to acquire its holdings. By the way, the same approach has been copied and applied to SOL by real estate financing firm Janover (whose shares were acquired by former Kraken executives) and Nasdaq-listed supply chain management firm Upexi.

On-chain update: Vitalik's RISC-V proposal

Ethereum co-founder Vitalik Buterin recently proposed replacing Ethereum Virtual Machine (EVM) with RISC-V (Leased Instruction Set Computer) architecture—an ambitious and groundbreaking shift aimed at redefining Ethereum’s execution layer while maintaining significant backward efficiency improvements compatibility. RISC-V's modular and register-based design provides performance improvements, such as improved encryption support and reduced overhead of zero-knowledge proofs, addressing key bottlenecks that limit Ethereum scalability, such as sequential processing and high gas costs.

The proposal will introduce RISC-V system calls to replace opcodes and adapt Solidity and Vyper to compile to RISC-V instead of EVM bytecode, representing a long-term vision of simplifying the Ethereum architecture, reducing complexity and improving transaction throughput. While there will be significant technological and ecosystem challenges during implementation, up to 100 times the potential for efficiency improvement (for some applications) makes this reform a strategic priority to maintain Ethereum’s competitive advantage in faster next-generation blockchains, marking a critical moment when Ethereum is under pressure from its evolutionary competitors.

Cryptocurrency and tradition overview

Coinbase Exchange and CES Perspectives

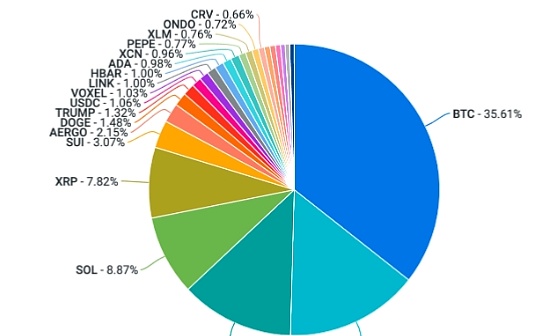

Since April 1, 2025, crypto assets have shown significant resilience and diversification advantages in market volatility. Bitcoin (BTC) returns +9% and COIN50 index returns +6%, outperforming traditional diversified investment vehicles such as gold (+7%) and U.S. 10-year Treasury (-1%). Price movement highlights the emerging role played by cryptocurrencies along with traditional assets and challenges the notion that cryptocurrencies are merely Nasdaq Beta leverage.

No comments yet