South Korea’s SK Hynix on April 24 surpassed quarterly revenue and operating profit estimates, as the company warned that macroeconomic uncertainties, including U.S. tariff policy, have created demand volatility that will impact the second half of this year.

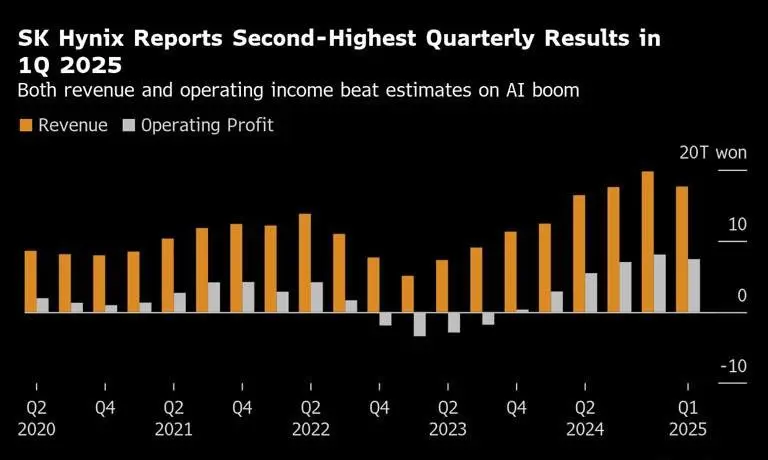

SK Hynix recorded its second-highest quarterly operating profit ever in Q1 with a 158% jump to 7.4 trillion won ($5.2 billion), boosted by strong AI-related demand and stockpiling of smartphone and PC chips ahead of potential increases in U.S. tariffs.

Revenue also rose about 42% to 17.64 trillion won ($12.36 billion) in the March quarter compared with the same period a year earlier. However, revenue dropped 11% on a quarter-on-quarter basis, while operating profit fell 8% from a record high in the December quarter.

SK Hynix records Q1 profit surge despite demand outlook uncertainty

SK Hynix saw a sharp jump in its first-quarter profit on Thursday, as the South Korean Nvidia supplier continued to benefit from increased demand for advanced memory chips from the AI industry. Notably, fears of U.S.-China trade disruptions and increasing Chinese AI development helped spur chip demand through the first quarter for advanced chips and those used in consumer electronics.

The company’s operating profit jumped over 158% to 7.44 trillion won ($5.2 billion) in the three months to March 31st, beating expectations for a 6.6 trillion won print. Revenue also jumped to 17.54 trillion won vs the projected 17.26 trillion won, marking the company’s second-highest quarterly revenue after a record high in the December quarter.

On Thursday, April 24, the South Korea-based company warned that macroeconomic uncertainty would likely create demand volatility in the second half of 2025. However, the company maintained its forecast that high-bandwidth memory (HBM) demand would double this year, citing supply agreements made with customers a year in advance.

“Regarding our HBM business, what we can clearly state is that there has been no change to our sales plans for this year to key customers, which remain in line with the levels set in previously signed contracts.”

– Kim Ki-tae, the head of HBM sales & marketing at SK Hynix

Ryu Young-ho, a senior analyst at NH Investment & Securities, also said that while it was a relief that there were no issues with HBM chip shipments to Nvidia, there were still worries that the advance purchases and stockpiling seen across the industry in recent months may lead to weaker demand in the second half.

Research shows SK Hynix had a 70% market revenue share in Q1 2025

A report from Counterpoint Research earlier in April revealed that SK Hynix had captured 70% of the HBM market by revenue share in the first quarter of 2025. The HBM dominance helped SK Hynix overtake Samsung in the overall DRAM market for the first time, with a 36% global market share compared to Samsung’s 34%.

A representative from SK Hynix said the announcement that the company ranked first in the DRAM market in Q1 2025 suggested that its portfolio strategies focusing on highly profitable AI memory were well executed. The company announced plans on April 24 to build a new fabrication facility in Cheongju, South Korea, to expand its production of next-generation DRAM, including HBM.

Construction of the fabrication facility is expected to begin at the end of April and will be completed for early mass production in November 2025. The company also said its total investment in the new production base would be over 20 trillion won over the long term.

The South Korean government announced earlier this month that it would provide a 33 trillion won support package for its chip industry, which was higher than the 26 trillion won it committed last year, as the industry continued to face the uncertainty posed by Trump’s global trade tariffs.

Cryptopolitan Academy: Coming Soon - A New Way to Earn Passive Income with DeFi in 2025. Learn More

No comments yet