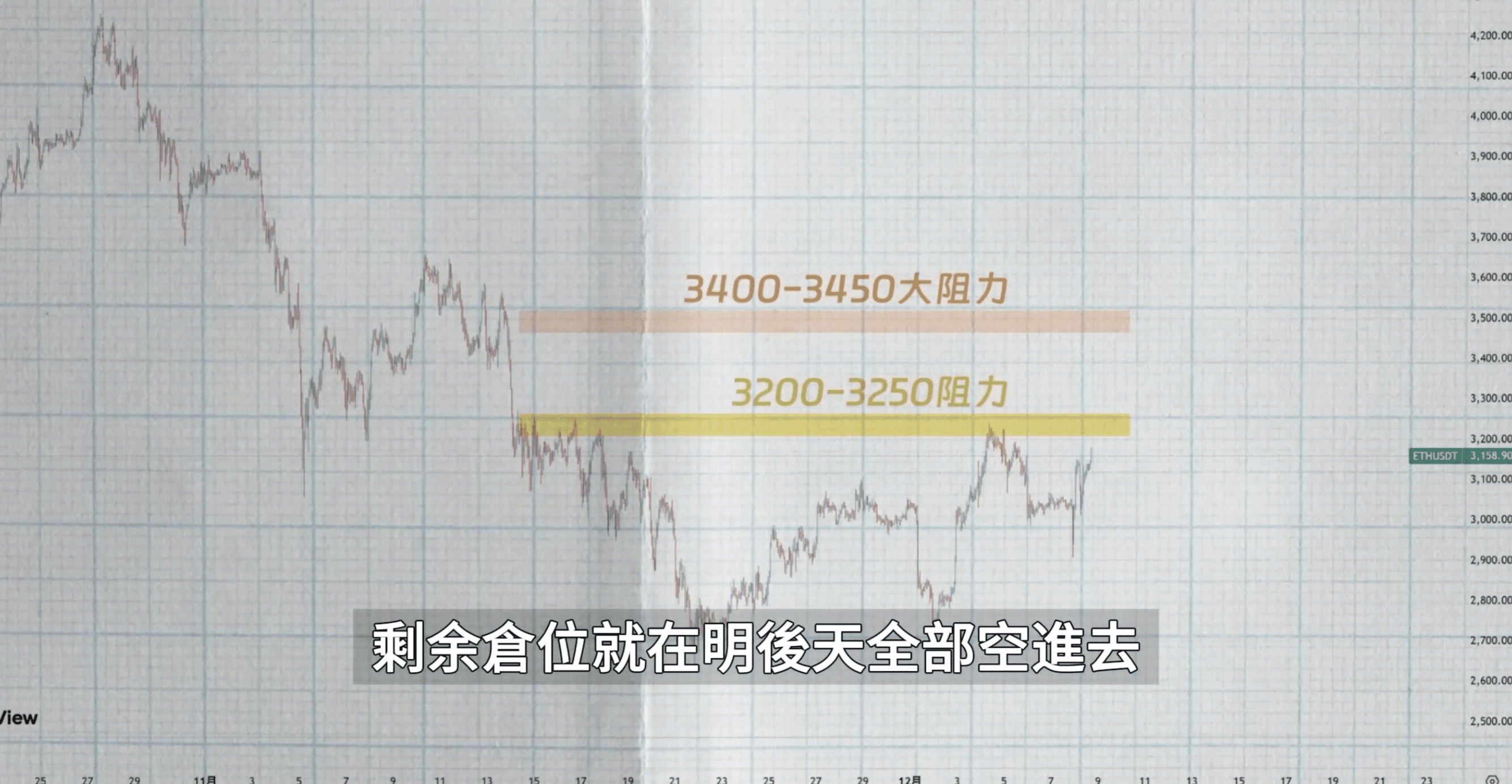

When I looked, I realized the big players were starting to reap the rewards! Ethereum's erratic surge followed by a rapid drop is incomprehensible, but I respect their actions.

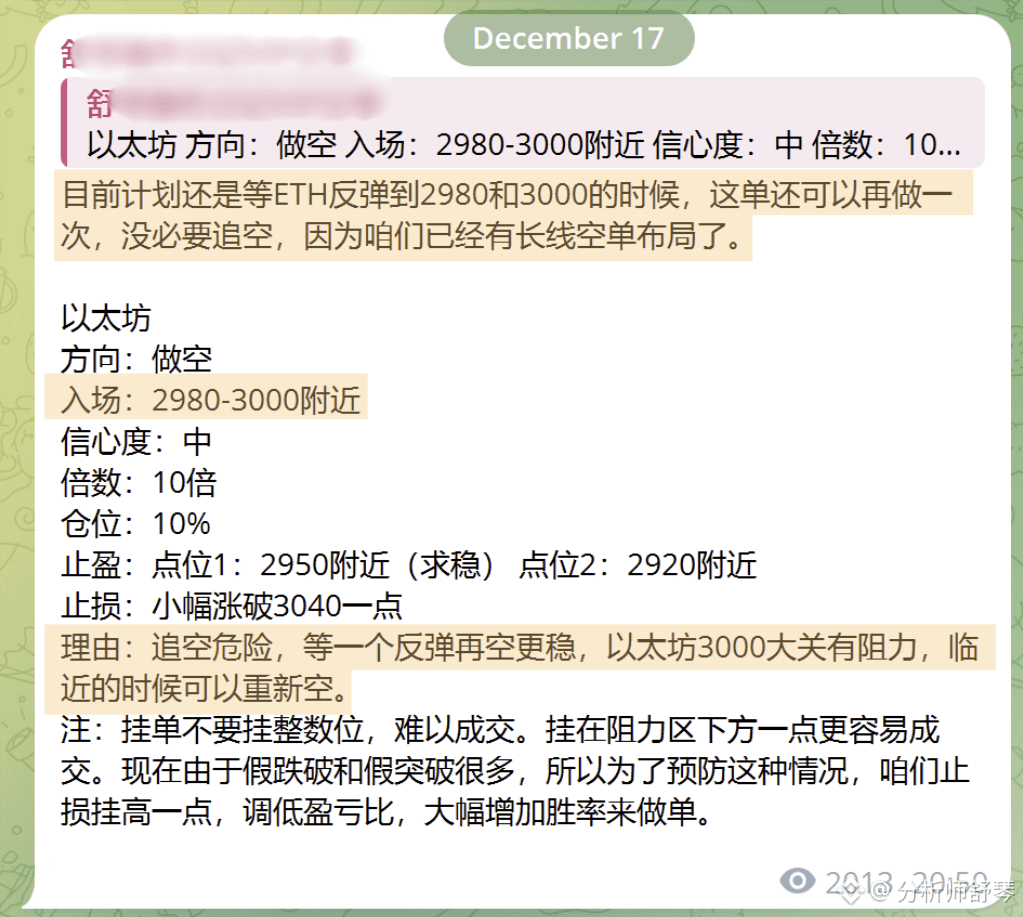

Our strategy was to short near the resistance level of 3000. Shuqin mentioned this trade to everyone this afternoon, saying we could open another one when it reached that level. Tonight, the market dramatically gave us more money; this is our second short position. The first was at 2980, and this time it's at 3000.

The overall market sentiment is still quite bearish. Our strategy is to try shorting on any significant rebound, especially near resistance levels. These two short-term trades were based on this logic, shorting near the 3000 resistance level. This shows that there are truly many opportunities in the market. Be patient; there are plenty of opportunities every day.

Price Converter

- Crypto

- Fiat

USDUnited States Dollar

CNYChinese Yuan

JPYJapanese Yen

HKDHong Kong Dollar

THBThai Baht

GBPBritish Pound

EUREuro

AUDAustralian Dollar

TWDNew Taiwan Dollar

KRWSouth Korean Won

PHPPhilippine Peso

AEDUAE Dirham

CADCanadian Dollar

MYRMalaysian Ringgit

MOPMacanese Pataca

NZDNew Zealand Dollar

CHFSwiss Franc

CZKCzech Koruna

DKKDanish Krone

IDRIndonesian Rupiah

LKRSri Lankan Rupee

NOKNorwegian Krone

QARQatari Riyal

RUBRussian Ruble

SGDSingapore Dollar

SEKSwedish Krona

VNDVietnamese Dong

ZARSouth African Rand

No more data