Technical Breakdown: How Does slisBNB's "Anchoring Magic" Work?

slisBNB claims to be 1:1 pegged to the value of BNB with accompanying returns, which sounds like magic. Today, we'll break it down into its mathematics and code to see if there are any loopholes behind this magic.

Expert Analysis: The core of slisBNB's anchoring lies in "underlying asset ownership + redemption rights." Each slisBNB you hold corresponds to a share of BNB staked in validator nodes and the right to future returns. The key lies in the speed and cost of its redemption mechanism. If redemption takes 7 days and involves attrition, then a discount of slisBNB relative to BNB is inevitable during market panic.

Risk Assessment: Besides technical trust, a greater risk is "liquidity run." If a large number of users simultaneously request to redeem their slisBNB for BNB, the unstaking period for validator nodes will create queues, potentially triggering market panic and a price de-anchoring spiral.

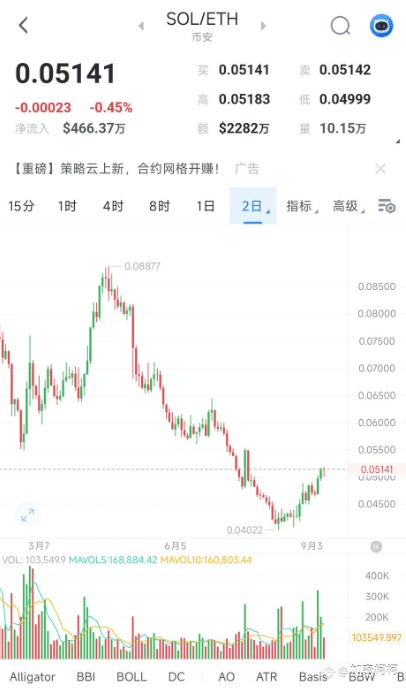

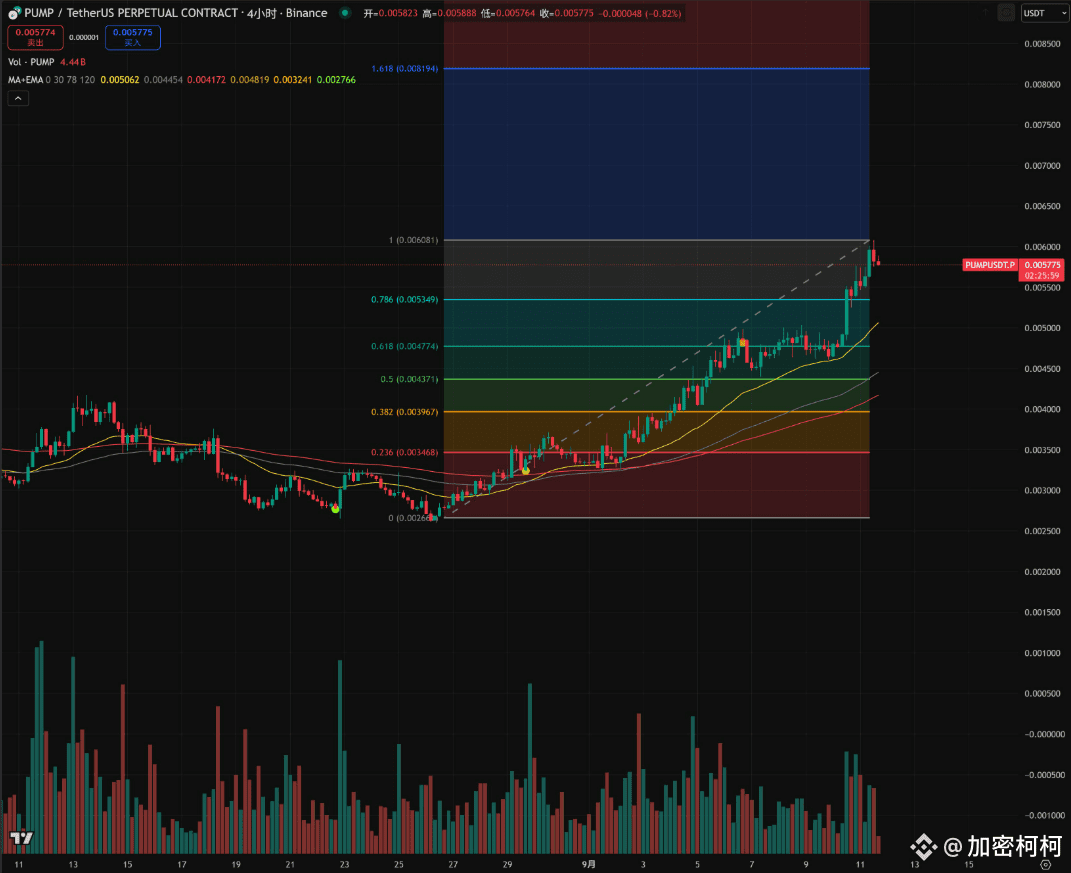

Data Observation: Continuously monitor the trading price of SLIS BNB/BNB on DEXs, especially the deviation during extreme market conditions. This is the golden indicator for testing its "magical" stability.

For LSD assets (such as SLIS BNB), do you trust its on-chain mechanism more, or the issuer's brand reputation?

@lista_dao #BestUSD1InvestmentStrategyListaDAO $LISTA

Price Converter

- Crypto

- Fiat

USDUnited States Dollar

CNYChinese Yuan

JPYJapanese Yen

HKDHong Kong Dollar

THBThai Baht

GBPBritish Pound

EUREuro

AUDAustralian Dollar

TWDNew Taiwan Dollar

KRWSouth Korean Won

PHPPhilippine Peso

AEDUAE Dirham

CADCanadian Dollar

MYRMalaysian Ringgit

MOPMacanese Pataca

NZDNew Zealand Dollar

CHFSwiss Franc

CZKCzech Koruna

DKKDanish Krone

IDRIndonesian Rupiah

LKRSri Lankan Rupee

NOKNorwegian Krone

QARQatari Riyal

RUBRussian Ruble

SGDSingapore Dollar

SEKSwedish Krona

VNDVietnamese Dong

ZARSouth African Rand

No more data